Business

Could Cardano Regain Ground Amid Declining Interest?

NEW YORK, NY — Cardano, the cryptocurrency co-founded by Charles Hoskinson, faces a challenging period as it trades at approximately $0.73, down significantly from its all-time high of $3.10 in September 2021.

Launched in October 2017, Cardano attracted attention for its peer-reviewed development process and ambition to be a more scalable and sustainable alternative to Ethereum. Its price surged shortly after launch, but the asset has since lost more than 75% of its value due to various market pressures, including rising interest rates and slow adoption of its smart contracts.

This year alone, Cardano’s value has dipped around 20%, even as Bitcoin has increased by about 27%. Analysts are pondering whether now could be a good time for investors to accumulate Cardano while interest wanes.

Recently, Cardano has made strides toward scalability with the partial implementation of its Hydra Layer 2 solution, which aims to process transactions off-chain to alleviate congestion. The company has also introduced the Mithril protocol, which enhances accessibility for developers.

Additionally, a new smart contract bridge named Cardinal allows for Bitcoin assets to be utilized on Cardano’s blockchain, potentially enriching its decentralized finance (DeFi) ecosystem.

Despite not attracting the same level of institutional interest as Bitcoin or Ethereum, major funds are beginning to invest in Cardano, and it has even launched Cardano nodes through Franklin Templeton. Moreover, applications for Cardano exchange-traded funds (ETFs) have been submitted by Grayscale and Tuttle Capital Management.

Looking ahead, Cardano’s governance upgrade, known as Voltaire, is expected to decentralize control further and may encourage more decentralized app development. These changes, coupled with anticipated cuts in Federal Reserve interest rates, could revitalize the crypto market.

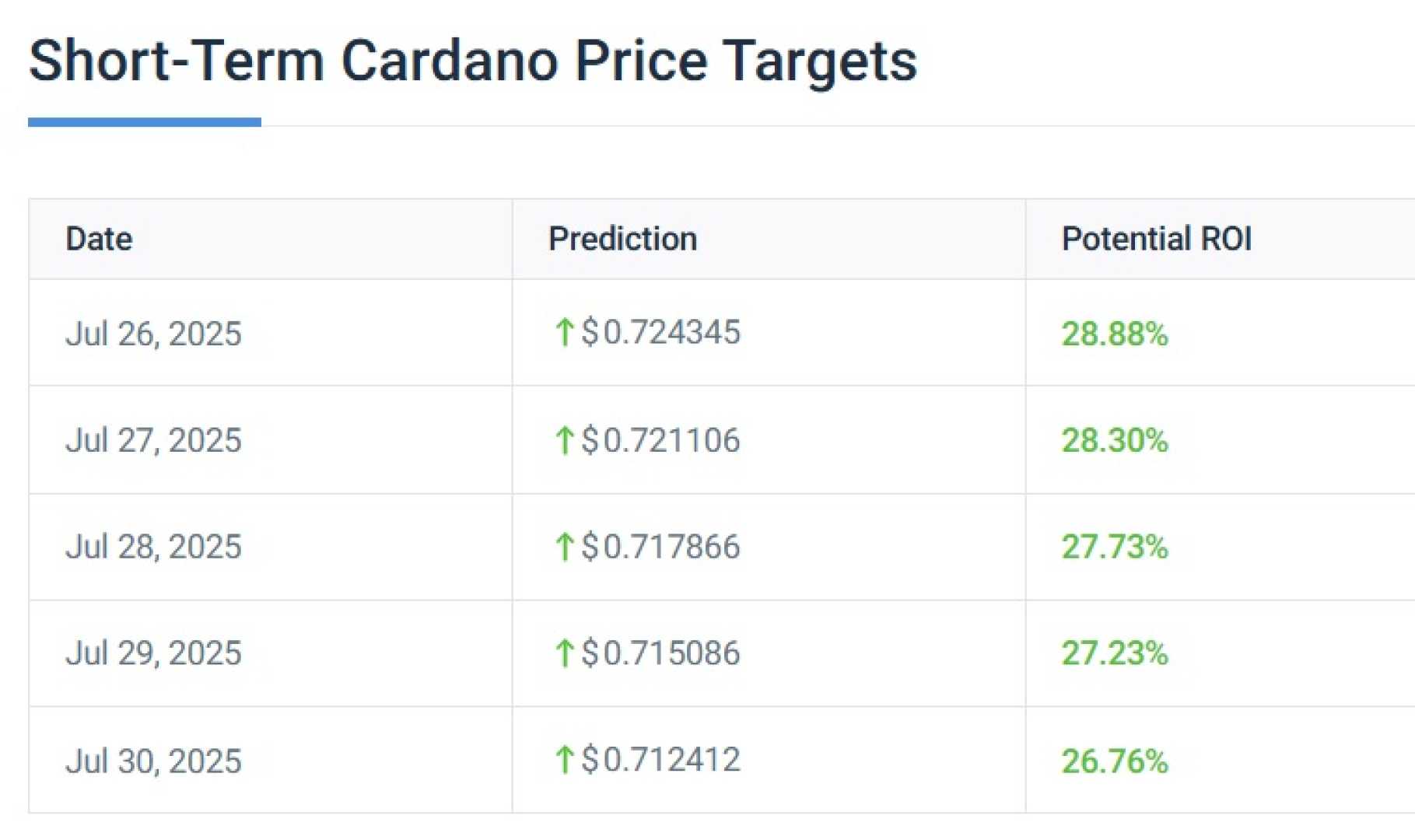

Some investors forecast that Cardano could trade between $1 and $2 by the end of the year, equating to potential gains of 37% to 174% from its current level, though others warn that returns may be underwhelming compared to past performances.

As Cardano navigates through these transformations, it faces tough competition and a changing market landscape. Its future relies on how effectively it can capture developer interest and expand its ecosystem.