Tech

Cryptocurrency Surges to New Heights: Understanding the Digital Currency Boom

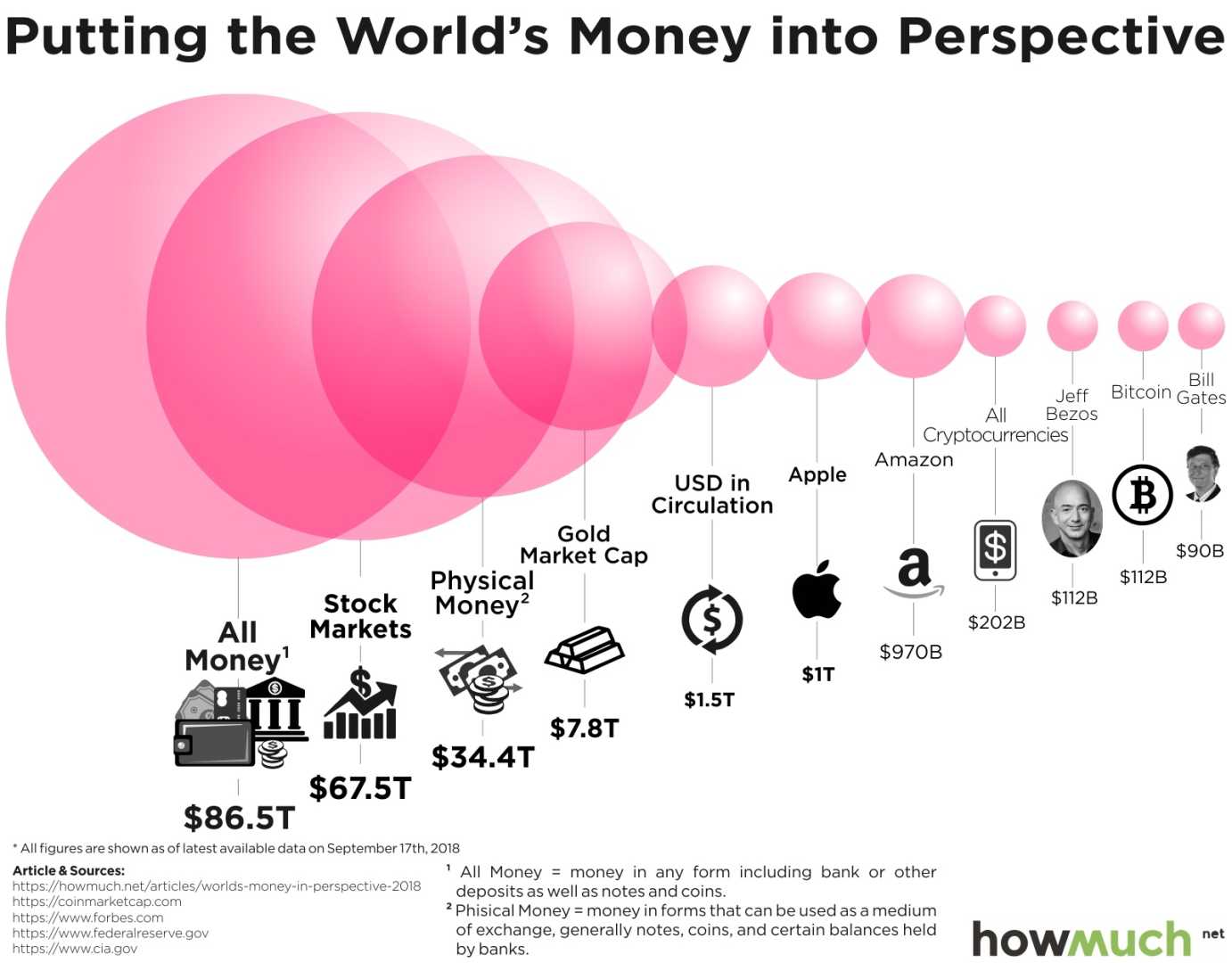

Cryptocurrency, often referred to as digital money, has been gaining significant attention in recent years, particularly following the latest surge in its value. At its core, cryptocurrency is a digital or virtual currency that uses cryptography for security and is decentralized, meaning it operates without a central authority such as a government or bank.

The transactions of cryptocurrencies are recorded on a public digital ledger called a blockchain. This technology ensures the integrity and transparency of the transactions, as it is maintained by a network of computers rather than a single central authority.

Bitcoin is the oldest and largest cryptocurrency, but other notable assets include Ethereum, Tether, and Dogecoin. These digital currencies are not recognized as legal tender but can be used for buying and selling digital assets. They are often seen as a digital alternative to traditional money, although they are known for their volatility and reliance on larger market conditions.

The recent rally in cryptocurrency prices, particularly Bitcoin, has been fueled by the outcome of the U.S. presidential election. Donald Trump‘s victory and his pledges to create a more crypto-friendly regulatory environment have boosted investor confidence. Trump has promised to make the U.S. the “crypto capital of the planet” and to create a “strategic reserve” of Bitcoin, which has led to significant speculation and investment in the crypto market.

In India, for example, cryptocurrencies are legal to trade and hold but are not recognized as legal tender. They are taxed at a flat rate of 30% along with a 1% Tax Deducted at Source (TDS) on transactions exceeding Rs 50,000 annually. The regulatory framework in India is complex and evolving, with key bodies like the Reserve Bank of India (RBI), the Ministry of Finance, and the Securities and Exchange Board of India (Sebi) overseeing crypto activities.

Despite the optimism, there are significant risks associated with investing in cryptocurrencies. The value of these assets can fluctuate drastically and unpredictably, leading to potential significant losses. Historical examples include the crash during the COVID-19 pandemic and the collapse of FTX in 2022, which underscore the volatility and risks involved in crypto investments).