Business

Experts Predict a Stabilizing Housing Market: What Lies Ahead?

Laguna Niguel, CA – As the housing market trends shift, experts are weighing in on what to expect in the coming years. Predictions from major organizations suggest a softening market, but not a collapse. According to Berkshire Hathaway, the consensus points to stable interest rates around the mid-6% range, with increasing inventory pressing down on prices.

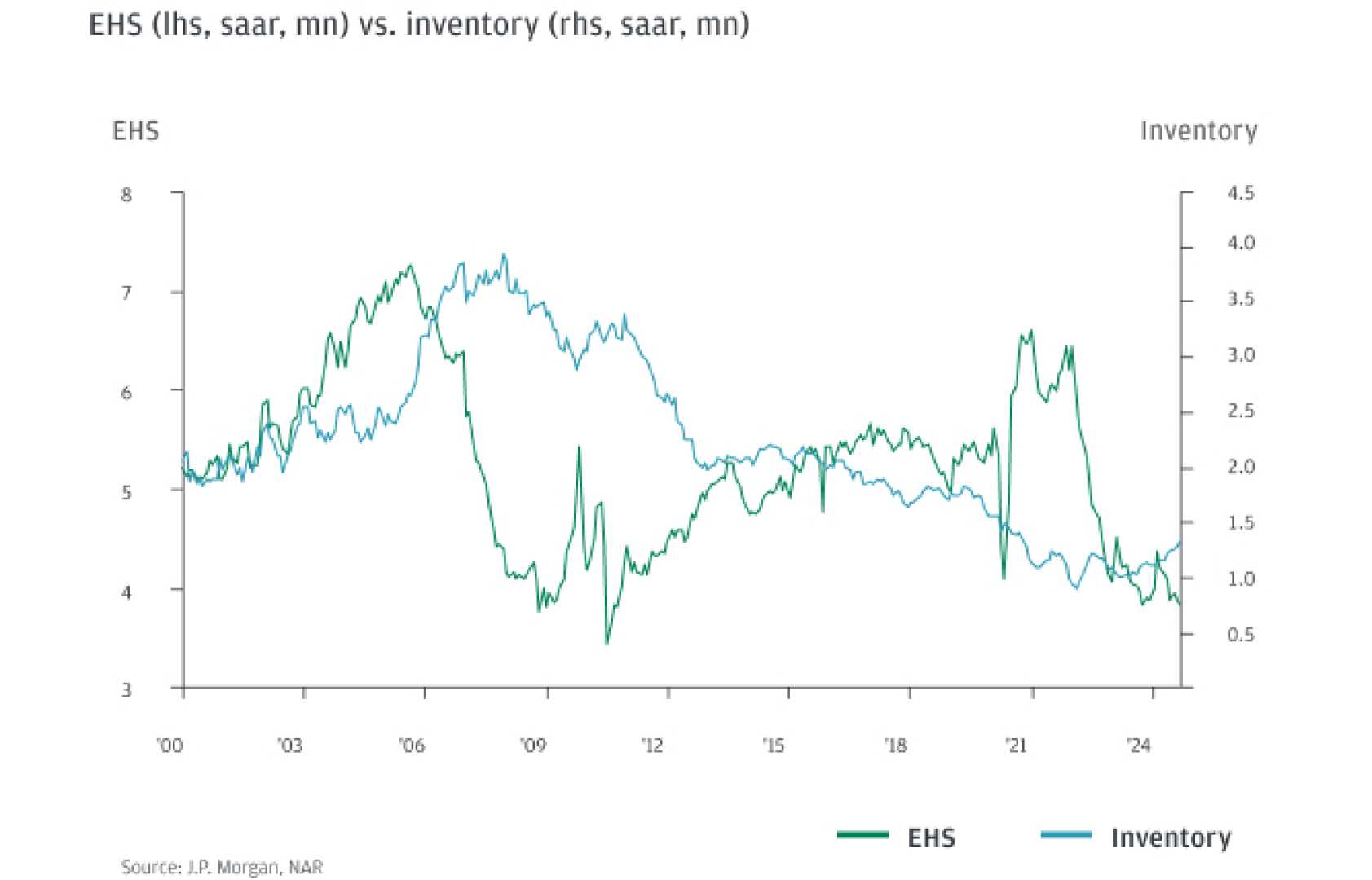

The National Association of Home Builders (NAHB) predicts new home sales will decline, while the National Association of REALTORS® (NAR) reports a slowdown in sales with inventory on the rise. The Mortgage Bankers Association (MBA) expects rates to hover above 6.5%, providing little relief for potential buyers.

“Understanding local markets is crucial,” said an industry expert. “While some areas may see a recovery with price increases, others will face challenges.” In regions like the Northeast, lack of construction is influencing price stability.

Key predictions from various organizations for Q4 2025 include the Federal Reserve anticipating slower GDP growth and higher unemployment. For homebuyers, it’s essential to grasp how these broader economic factors will impact local markets.

Experts agree that although there may be short-term fluctuations, mortgage rates are likely to stay elevated. NAR reports that as of early 2025, only 1 in 5 homes listed are affordable for households earning $75,000.

“Affordability will remain a significant challenge moving forward,” noted a realtor. “Buyers should think long-term when making decisions.”

In summary, while the market is stabilizing, it’s imperative for buyers and sellers to stay informed and collaborate with experienced professionals to navigate the changing landscape successfully.