Business

Gemini Prices IPO at $28, Valuing Company at $3.3 Billion

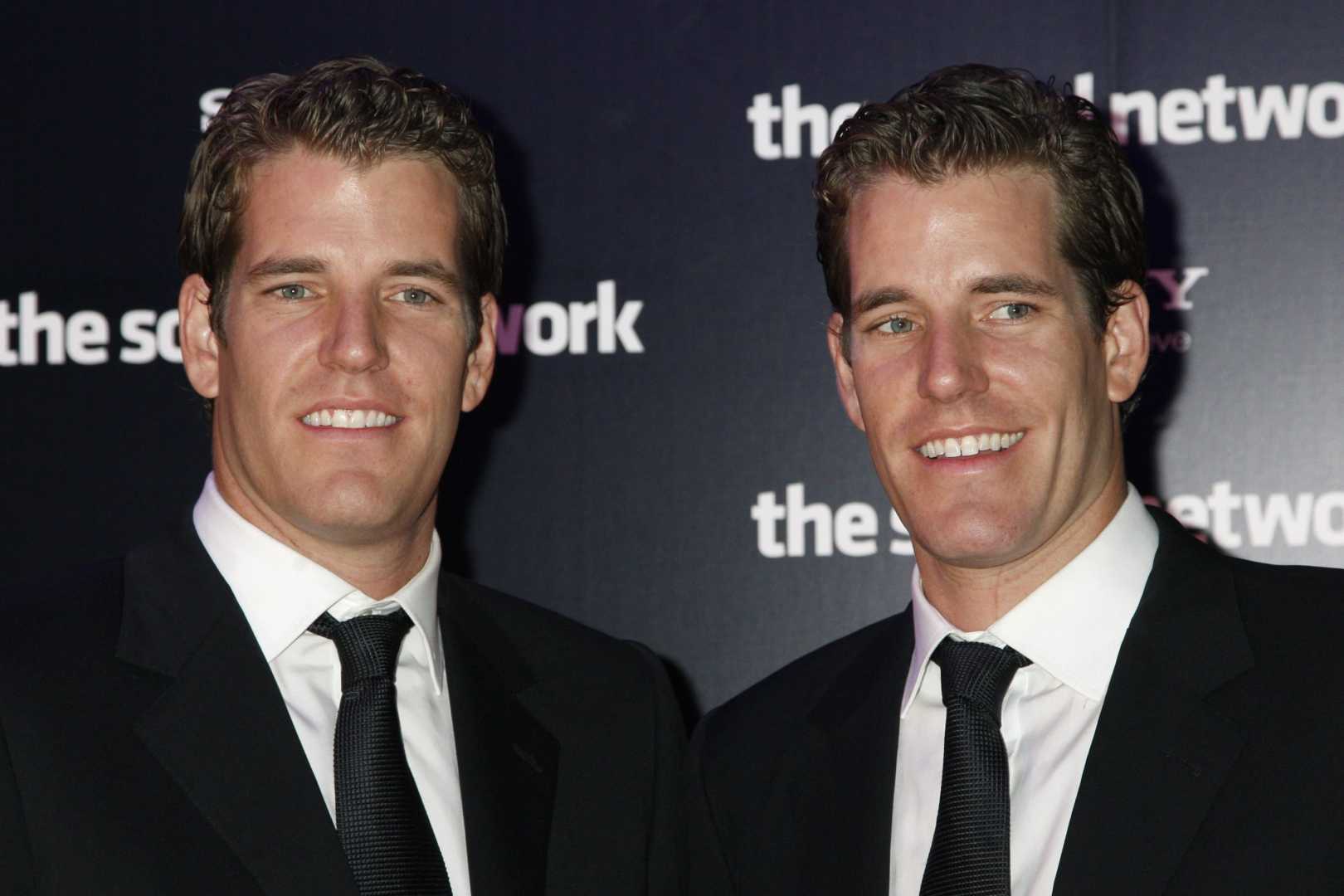

WYNWOOD, Florida — Gemini, the cryptocurrency exchange founded by Tyler and Cameron Winklevoss, priced its initial public offering (IPO) at $28 per share late Thursday, exceeding expectations.

The IPO was initially projected to be between $24 and $26 per share, which would have valued Gemini at roughly $3.3 billion. A source familiar with the offering revealed that the company raised $425 million by selling 15.2 million shares, noting that demand was so high they capped the offering below the previously marketed 16.67 million shares.

Gemini’s stock will trade under the ticker symbol “GEMI” on Nasdaq. The offering appears to have been oversubscribed by more than 20 times, according to Bloomberg. A spokesperson for Gemini did not confirm these details.

The Winklevoss brothers founded the company in 2014 and it currently holds over $21 billion in assets as of July. The company allows users to buy and sell more than 70 cryptocurrencies, along with providing crypto derivatives.

In a recent filing with the Securities and Exchange Commission, Gemini reported substantial losses, including a $159 million net loss for fiscal 2024 and $283 million in the first half of 2025. This has raised concerns among investors regarding the company’s profitability compared to competitors like Circle and Bullish, which had successful IPOs.

However, there is optimism for Gemini’s future. Last week, Nasdaq announced it would make a $50 million investment in the company as part of a strategy to provide access to Gemini’s digital asset custodial services.

To encourage retail investment, up to 30 percent of the shares offered will be reserved for retail investors through platforms like Robinhood and Webull. As the market awaits Gemini’s initial trading, it hopes to gauge current investor interest in the cryptocurrency sector.