News

Gen Z Learns Financial Independence Amid Rising Costs

CHARLOTTE, NC – A new study found that nearly three-quarters of Gen Z, aged 18-28, are taking action to improve their financial health as they face rising living costs. The Bank of America’s 2025 financial education study was published today.

Coinciding with this challenge, the study highlights that 51% of Gen Z surveyed believe the high cost of living is a barrier to their financial success. Another 35% reported their monthly spending is higher than expected, particularly in areas like groceries (63%), rent and utilities (47%), and dining out (42%).

“Gen Z is challenging the stereotype when it comes to young people and their finances,” said a Bank of America official. “Even though they’re facing economic barriers and high everyday costs, they are working hard to become financially independent and take control of their money.”

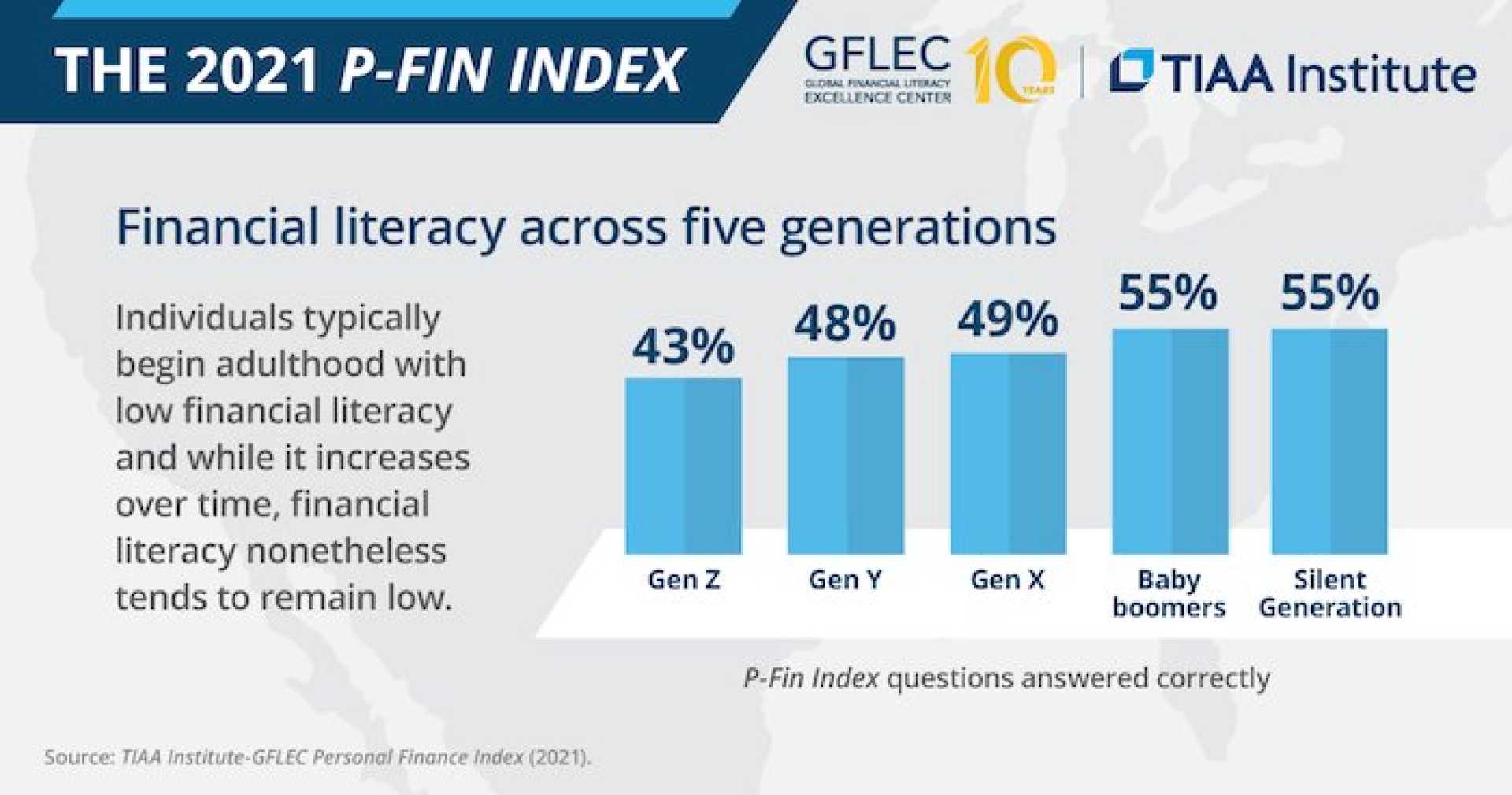

The report indicates that more than half of Gen Z (53%) don’t feel they earn enough to live the lifestyle they desire. Additionally, 55% lack sufficient emergency savings to cover three months of expenses. Despite recognizing the importance of future savings, 43% aren’t on track to save for retirement within the next five years.

Investing is also a concern; only 25% contributed to a retirement account last year, and 21% invested in the stock market. Nonetheless, there has been a slight uptick in these activities compared to previous years.

Gen Z finds joy in small indulgences, with 57% treating themselves weekly, yet this leads to 59% overspending, highlighting a financial struggle. Economic instability has caused financial stress for 33% of Gen Z, 52% of whom attribute this stress to broader economic factors.

In response to financial stress, 90% of Gen Z take proactive measures, such as checking bank balances (69%) or budgeting (64%). Yet, for some, pressure leads to avoidance or impulsive purchases.

Despite economic strains, the survey reveals that financial health is crucial in relationships, with 78% of Gen Z citing financial responsibility as an important quality in a partner. The survey conducted online from April 4 to 25, 2025, included 1,069 adults aged 18 or older, with a margin of error of +/- 3.1 percentage points.

Bank of America continues to support individuals in achieving financial wellness through its Better Money Habits platform, offering tools for managing finances and making informed financial choices.