Politics

Georgia Congresswoman Faces Scrutiny Over Stock Purchases Before Market Rebound

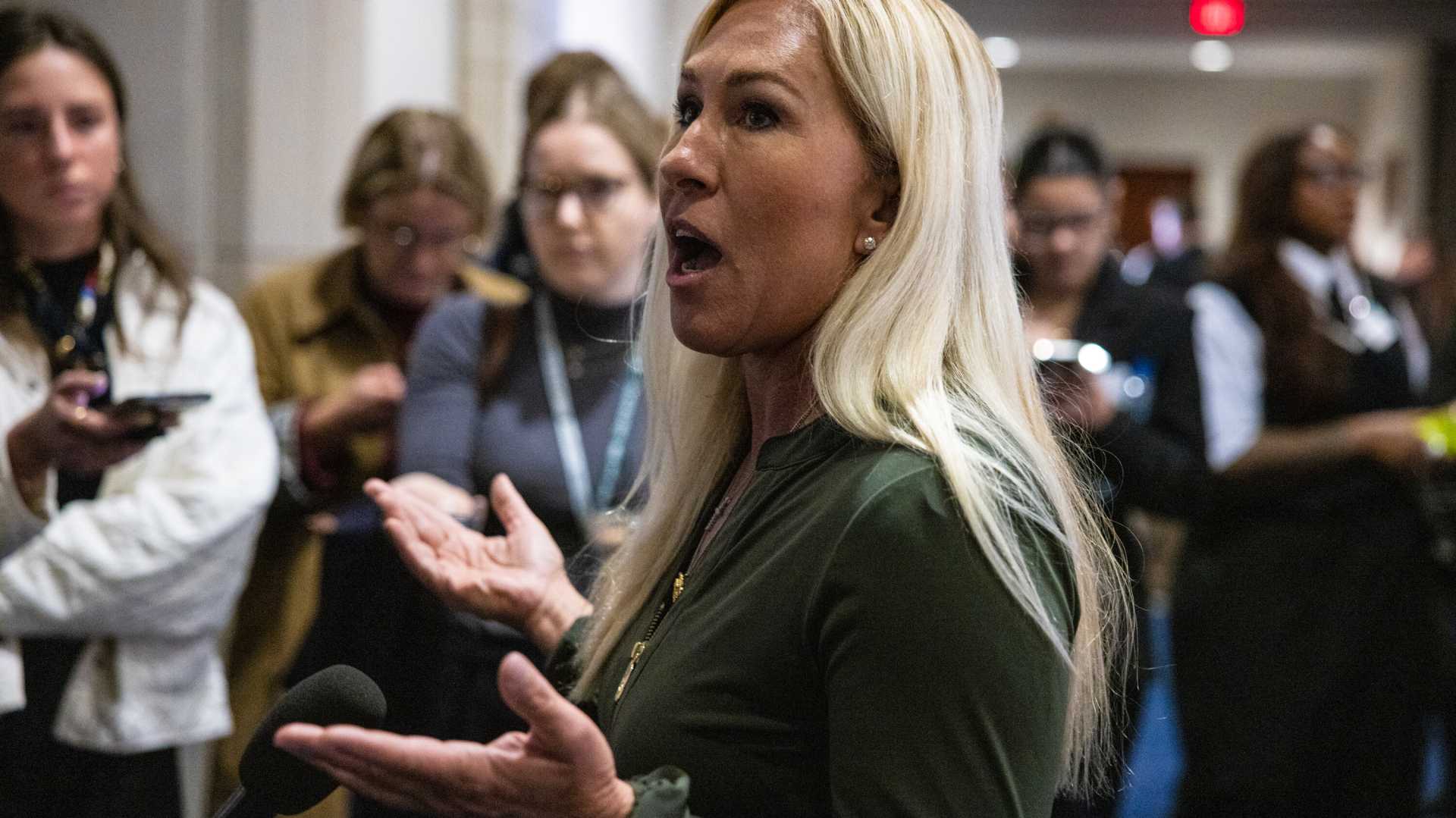

ATLANTA, Ga. — Congresswoman Marjorie Taylor Greene is facing scrutiny after making significant stock purchases just before President Donald Trump announced a pause on international tariffs, which subsequently caused a spike in the stock market. On April 8 and 9, Greene invested between $21,000 and $315,000 in major companies like Apple, Amazon, FedEx, and Nike ahead of the market rebound.

The timing of Greene’s stock buying has raised questions about potential conflicts of interest, particularly following Trump’s April 2 “Liberation Day” speech which resulted in a rapid decline in markets. After Trump hinted on April 9 that it was a “great time to buy,” he announced a 90-day pause on tariffs, leading the S&P 500 to rise 9.5% and the Nasdaq to jump 12.2%, marking historic gains.

Greene defended her actions in a statement, asserting, “I have signed a fiduciary agreement to allow my financial advisor to control my investments. All of my investments are reported with full transparency.” Yet, critics have pointed out that members of Congress are allowed up to 45 days to disclose stock purchases, leaving room for speculation regarding profits made from potential insider knowledge.

Trump, when addressing his tariff announcements, indicated that he believed people were overreacting to economic conditions. “I thought that people were jumping a little bit out of line… They were getting a little bit yippy, a little bit afraid,” he stated. “We’ve got a big job to do.”

The issue has reignited discussions around legislation that would ban stock trading by Congress members and their families, aimed at mitigating conflicts of interest. Rep. Tim Burchett, R-Tenn., recently proposed the latest iteration of such a bill. In support of a ban, House Democratic Leader Hakeem Jeffries remarked, “So many of these people are crooks, liars and frauds. And Marjorie Taylor Greene is, of course, exhibit A. We are seeing corruption unfold before us in real time.”

In the wake of these events, Senator Adam Schiff, D-Calif., has announced plans to investigate Trump’s timing of market-moving announcements, questioning whether the president or his associates engaged in insider trading. Schiff emphasized the need for transparency, calling for anyone with information about the stock trades to come forward.

Green’s stock purchases coincide with a broader pattern that has drawn the attention of both lawmakers and the public. Concerns have been raised about the legality and ethics of these trades, particularly as notable figures like Greene and other members of Congress are scrutinized for potentially profiting from their positions.

As the investigation continues, the implications of these financial transactions underscore the ongoing debate surrounding the intersection of Congress and private financial interests, with many advocates calling for reform to prevent conflicts of interest and promote transparency.