Business

Inflation Data Raises Questions Amid Changes at Bureau of Labor Statistics

Washington, D.C. — This week, investors are focusing on inflation data that could have significant implications for the market. The Bureau of Labor Statistics (BLS) is set to release its consumer price index on Tuesday and producer price index on Thursday, but the integrity of the data has come under scrutiny.

Concerns about the reliability of BLS reports have intensified, particularly following budget cuts that have altered how the agency collects data. President Donald Trump‘s recent decision to fire BLS Commissioner Erika McEntarfer has also raised fears of political influence on agency data.

“I feel like this data that is coming out is getting much less reliable,” said Jeffery Gundlach, CEO of DoubleLine, in an interview on CNBC. “This has been building for a long time.” Analysts worry that these challenges could affect important government policies and economic decisions.

According to Michael Gapen, an economist at Morgan Stanley, the firing of McEntarfer raises essential questions about the data’s quality. He noted, “Official U.S. data has never been perfect but has been of high quality and useful in setting policy.”

Wall Street has echoed Gapen’s concerns, emphasizing potential issues with budget cuts that have led to changes in data collection methods. The BLS has faced criticism for revisions in its monthly payroll counts, with Trump accusing the agency of manipulating data for political gain.

While few on Wall Street suspect wrongdoing, the BLS’s traditional methods of surveying employment—primarily through phone and written surveys—have sparked doubts about pre-revision data reliability. Responses to surveys have declined, resulting in larger revisions.

Aditya Bhave, a senior U.S. economist at Bank of America, stated, “Significant downward revisions to job growth have raised questions about official statistics’ reliability.” He added that while the data remains generally trustworthy, caution is advisable when interpreting initial job figures.

This week, the BLS will also contend with challenges in its consumer price index collection due to staffing shortages. The agency plans to stop gathering data from several cities, increasing reliance on imputed data to estimate prices where specific information is lacking.

Economists warn that using different-cell imputation could generate larger variances in the data. Estimates suggest that approximately 35% of BLS data for its price reports is influenced by some form of imputing.

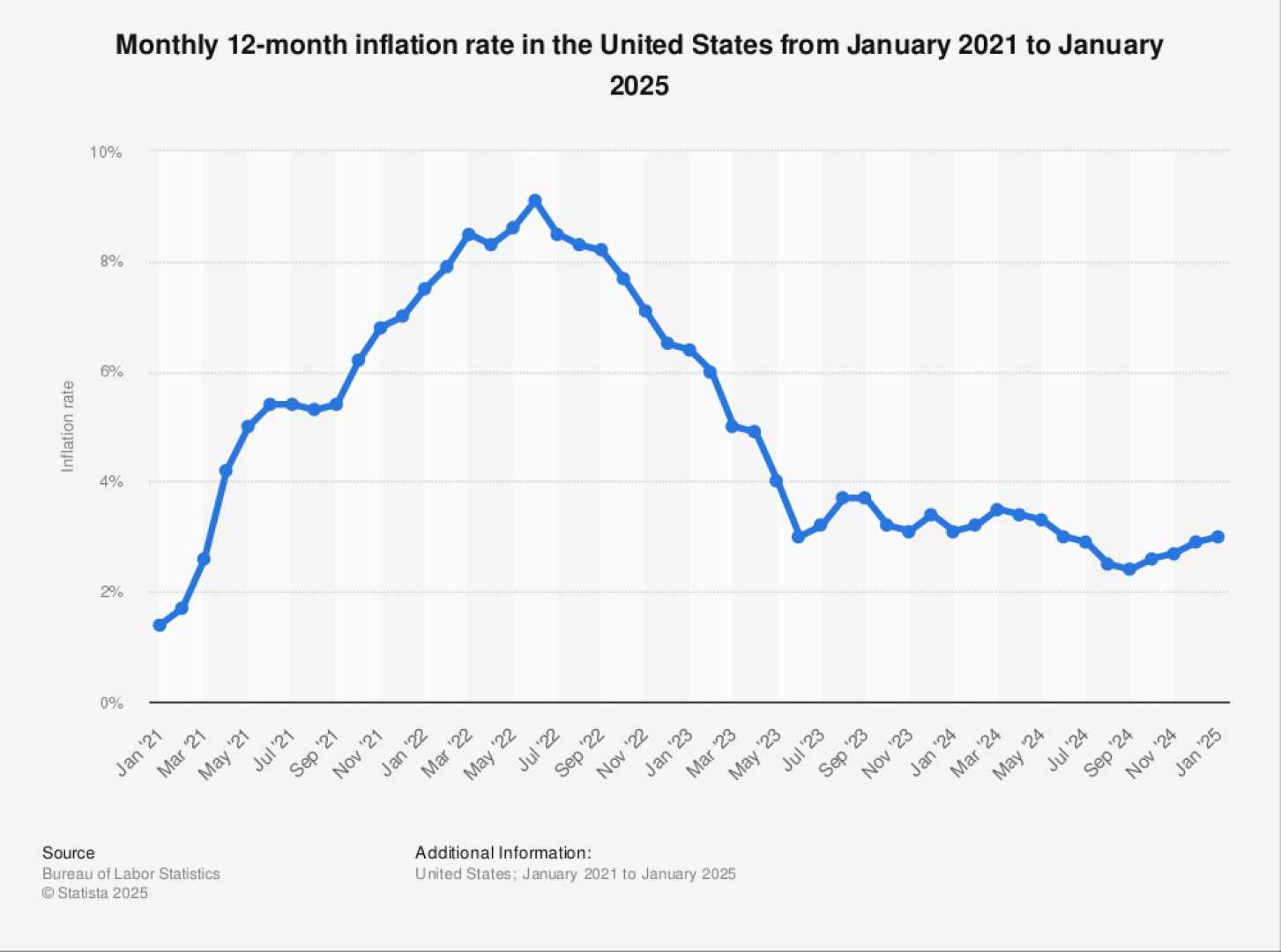

The Federal Reserve closely monitors these inflation indicators to shape monetary policy. A Dow Jones survey anticipates that the overall CPI will show a 0.2% rise for July, leading to a 12-month inflation rate of 2.8%. Core inflation, excluding food and energy, is expected to increase by 0.3% for the month.

Market reactions to the inflation data will also determine whether the Fed will make rate cuts in September. Currently, Wall Street economists are divided on future rate adjustments, with firms like Morgan Stanley and Bank of America predicting no cuts this year, while others, such as JPMorgan Chase, forecast multiple cuts.

As Gapen reflected on the BLS’s new procedures, he concluded, “While these changes should not introduce systematic bias into CPI inflation estimates, volatility in CPI prints is likely to increase.” Precise interpretations of this week’s data will be crucial for economic forecasts moving forward.