Business

Labor Market Shows Major Job Losses, Raising Economic Concerns

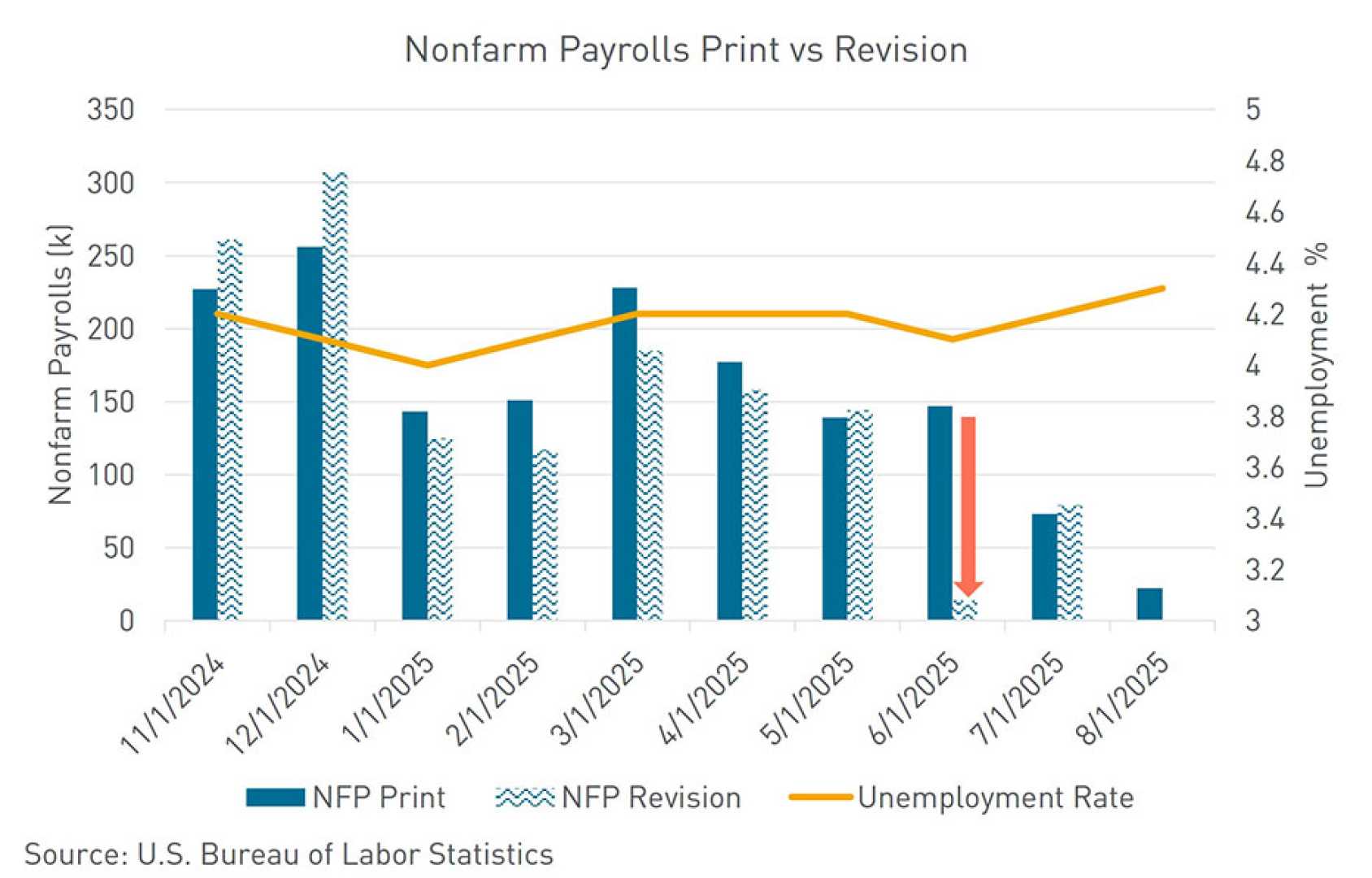

San Francisco, California – The U.S. labor market experienced a significant downturn, with a new report revealing a decrease of 911,000 jobs through March 2025, according to data from the Labor Department. This revision has raised alarms about the health of the economy.

The Bureau of Labor Statistics (BLS) released preliminary figures Tuesday indicating that the annual job count for the year leading up to March has been adjusted down dramatically. The revision surpassed Wall Street expectations, which predicted a decline ranging from 600,000 to 1 million jobs.

Oren Klachkin, a market economist at Nationwide Financial, explained, “The BLS’ preliminary benchmark revisions to nonfarm payrolls show a much weaker labor market over most of 2024 and early 2025 than previously estimated.” He noted that slower job creation also implies income growth was less robust before recent economic challenges.

Much of the data analyzed predates the current administration’s tariffs against trading partners, indicating a deterioration of the job market before these policies were enacted. Recent employment figures also support the idea of a softening job landscape, with average job growth dropping to just 29,000 per month during the summer months of June, July, and August, falling below the break-even point needed to maintain a stable unemployment rate.

Notably, the leisure and hospitality sectors faced the greatest losses, with markdowns around 176,000 jobs. Professional and business services saw a drop of 158,000 jobs, while retail trade lost about 126,200 positions.

In contrast, sectors such as transportation and warehousing saw minor gains. The revisions predominantly affected the private workforce, while government job counts adjusted downward by 31,000.

Despite these troubling revisions, stock markets reacted positively, with Treasury yields recovering losses. However, the BLS is under increased scrutiny from the White House regarding its data collection and reporting methods, particularly following criticisms that arose post a weak jobs report for July.

In light of these developments, the BLS may face significant scrutiny as it prepares for further revisions in February 2026. The implications of these job losses extend beyond just numbers, potentially influencing economic policy and the Federal Reserve’s decisions regarding interest rates.