Business

Market Woes: Pharma Stocks Merck, Novo Nordisk, and Pfizer Struggle

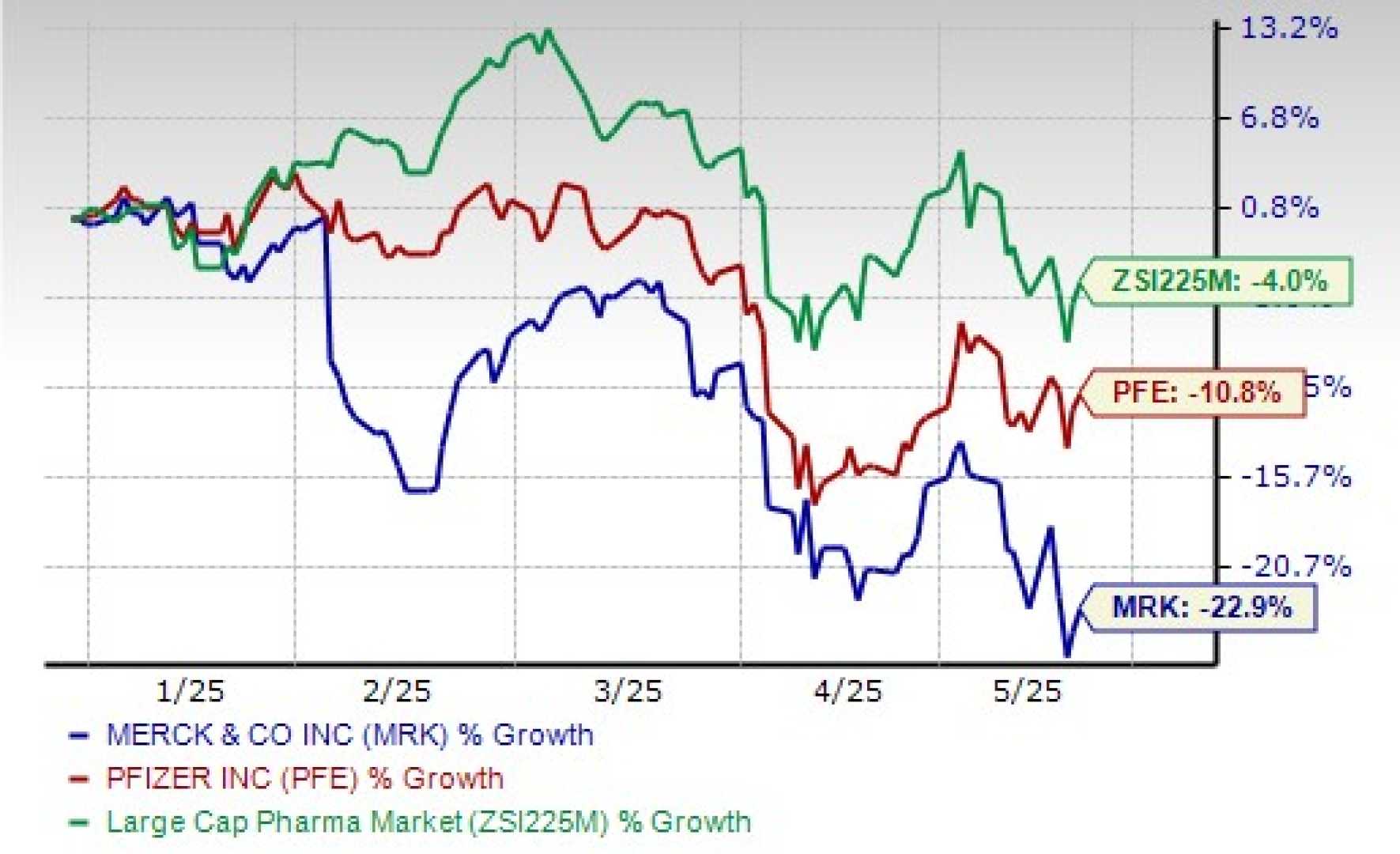

NEW YORK, NY — Major pharmaceutical companies are facing significant challenges as they navigate the stock market’s shifting landscape. As of July 29, 2025, Merck, Novo Nordisk, and Pfizer have all seen declines in their stock prices, prompting investors to reevaluate their potential.

Merck’s market cap stands at $211 billion, with shares dropping 5.12% to $79.76. The company is bracing for the loss of patent exclusivity for its leading cancer drug, Keytruda, by 2028. This impending challenge, coupled with the emergence of competitors, has caused Merck’s shares to lag. Despite these issues, analysts argue that Merck’s forward price-to-earnings ratio of 9.4 is a bargain compared to the healthcare sector’s average of 16.5. The company is working on a new subcutaneous formulation of Keytruda and aims to introduce additional products like Winrevair, which targets pulmonary arterial hypertension, to sustain its growth.

Similarly, Novo Nordisk has struggled, with its shares falling over 50% in the past year, now valued at less than $300 billion. Investors were disappointed by phase 3 trial results for its weight loss drug, CagriSema, which helped patients lose an average of 22.7% of their body weight, falling short of previous expectations. However, the company continues to expand its successful weight loss drug Wegovy and is developing a promising next-gen treatment called amycretin. Although shares have dipped, Novo’s trading at under 18 times its trailing earnings may present an opportunity for long-term investors.

Pfizer, while perceived as underappreciated by some, still faces its own hurdles. Despite a favorable 12-month price target that suggests nearly 20% upside, Pfizer’s share price has remained below its 52-week high. The company has faced setbacks, including discontinuing its oral obesity candidate, danuglipron, and looming patent expirations for key products like Eliquis and Ibrance. Nevertheless, Pfizer’s sales are strong for drugs such as Nurtec ODT and Padcev. CEO Albert Bourla reassured shareholders of a growing dividend, which currently stands at a 6.79% yield.

Investors are advised to keep an eye on these companies as they adapt to market conditions and strive for growth. The evolving landscape may open up new opportunities for those willing to take calculated risks in a fluctuating market.