Health

2025 Medicare Premiums and Deductibles See Significant Increases

The Centers for Medicare & Medicaid Services (CMS) has announced significant increases in Medicare premiums and deductibles for 2025. The standard monthly premium for Medicare Part B, which covers doctor visits, outpatient care, routine cancer screenings, and other services, will rise to $185 in 2025, an increase of $10.30 from the 2024 premium of $174.70.

In addition to the premium increase, the annual deductible for Medicare Part B will also go up, from $240 in 2024 to $257 in 2025. This change reflects projected increases in healthcare spending and utilization trends consistent with historical experience.

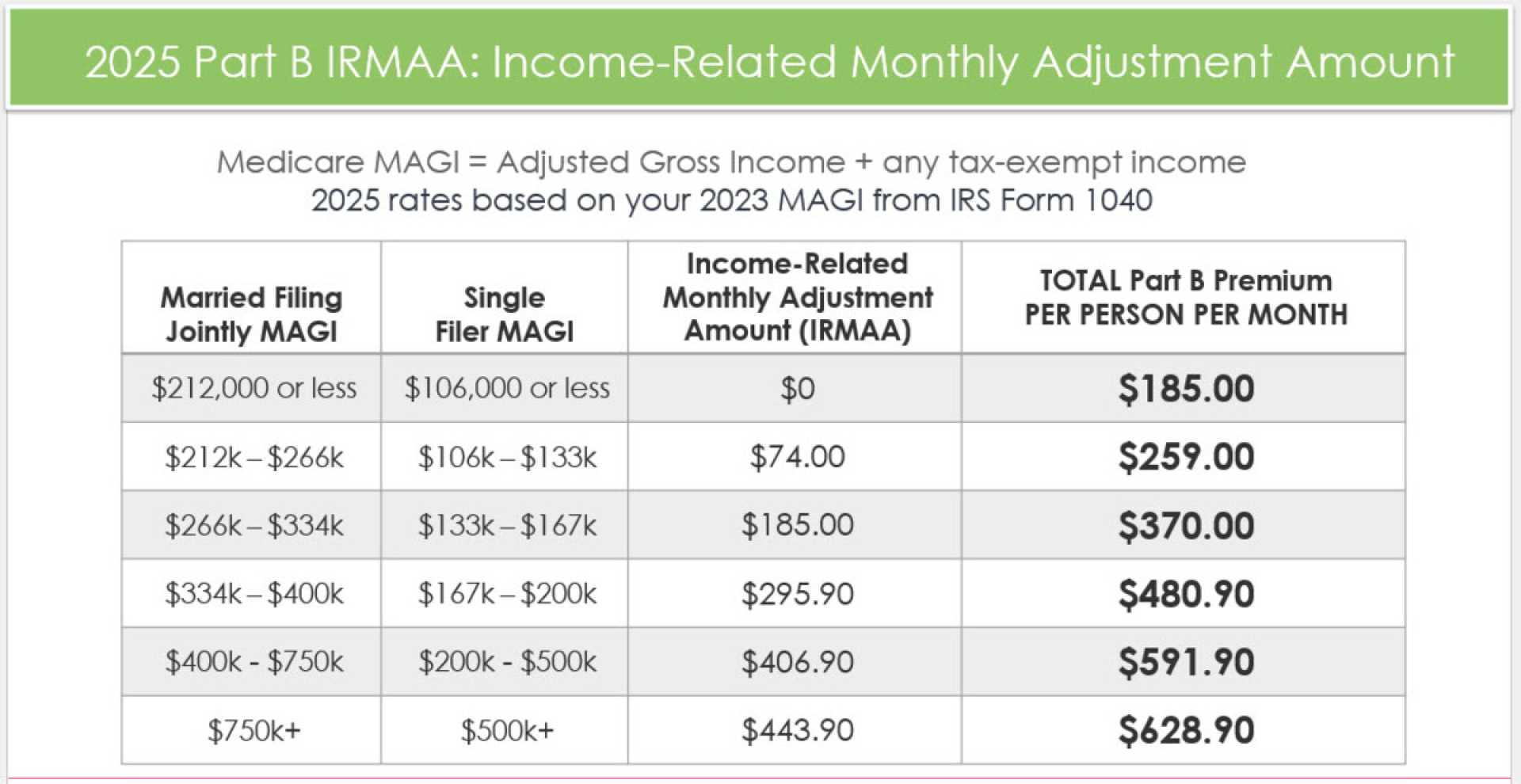

Higher-income beneficiaries will face additional costs due to the Income-Related Monthly Adjustment Amount (IRMAA). For example, individuals with incomes above $106,000 but below $133,000 will pay an additional $13.70 on top of the standard premium, while those with incomes above $394,000 will pay an additional $443.90.

Medicare Part A, which covers inpatient care, hospice care, and stays at skilled nursing facilities, will also see increases. The inpatient hospital deductible will rise to $1,676 in 2025, up from $1,632 in 2024. The full Part A premium for those with less than 30 quarters of coverage will increase to $518 per month, a $13 increase from 2024.

For Medicare Part D, which covers prescription drugs, the average monthly premium is expected to decrease from $41.63 in 2024 to $40 in 2025. However, some high-income beneficiaries will still pay more based on their income. A significant change for Part D is the introduction of a $2,000 out-of-pocket cap on prescription drugs, which is expected to benefit nearly 3.2 million Americans.

These changes will impact Social Security benefit payments, as the increased Part B premiums will be automatically deducted from Social Security checks starting in January 2025. This comes at a time when Social Security benefits are also increasing by 2.5% due to the cost-of-living adjustment (COLA), but the Medicare premium increase will offset some of this gain.