Tech

Microsoft’s AI Ambitions and Market Performance: A Closer Look

Microsoft Corporation (NASDAQ: MSFT) has been at the forefront of technological innovation, particularly in the realms of artificial intelligence (AI), cloud computing, and software development. Recently, the company has been highlighted as one of Goldman Sachs‘ top selections in Phase 2 AI stocks, underscoring its significant investments and advancements in AI technology.

Microsoft’s collaboration with OpenAI has been a key factor in its AI endeavors. The company’s multi-billion dollar investment in OpenAI grants it a share of OpenAI’s revenues, and its Azure cloud computing platform is a primary beneficiary of this new technology. Azure facilitates customers in storing, analyzing, and managing their data, with cloud revenue reaching $28.5 billion in the fourth quarter of FY2024.

The company’s AI tools, such as GitHub Copilot and Azure OpenAI Service, have seen extensive adoption. GitHub Copilot, an AI coding assistant, has significantly enhanced productivity for developers, with reports indicating over 40% improvements in efficiency. Additionally, 65% of the Fortune 100 companies are leveraging Azure OpenAI Service.

Despite the positive outlook, Microsoft’s stock has experienced some volatility. The stock is currently trading down 12% from its 52-week high, and a recent downgrade by D.A. Davidson to a “neutral” rating has raised some concerns among investors. However, analysts remain bullish, with a consensus price target of $500.87.

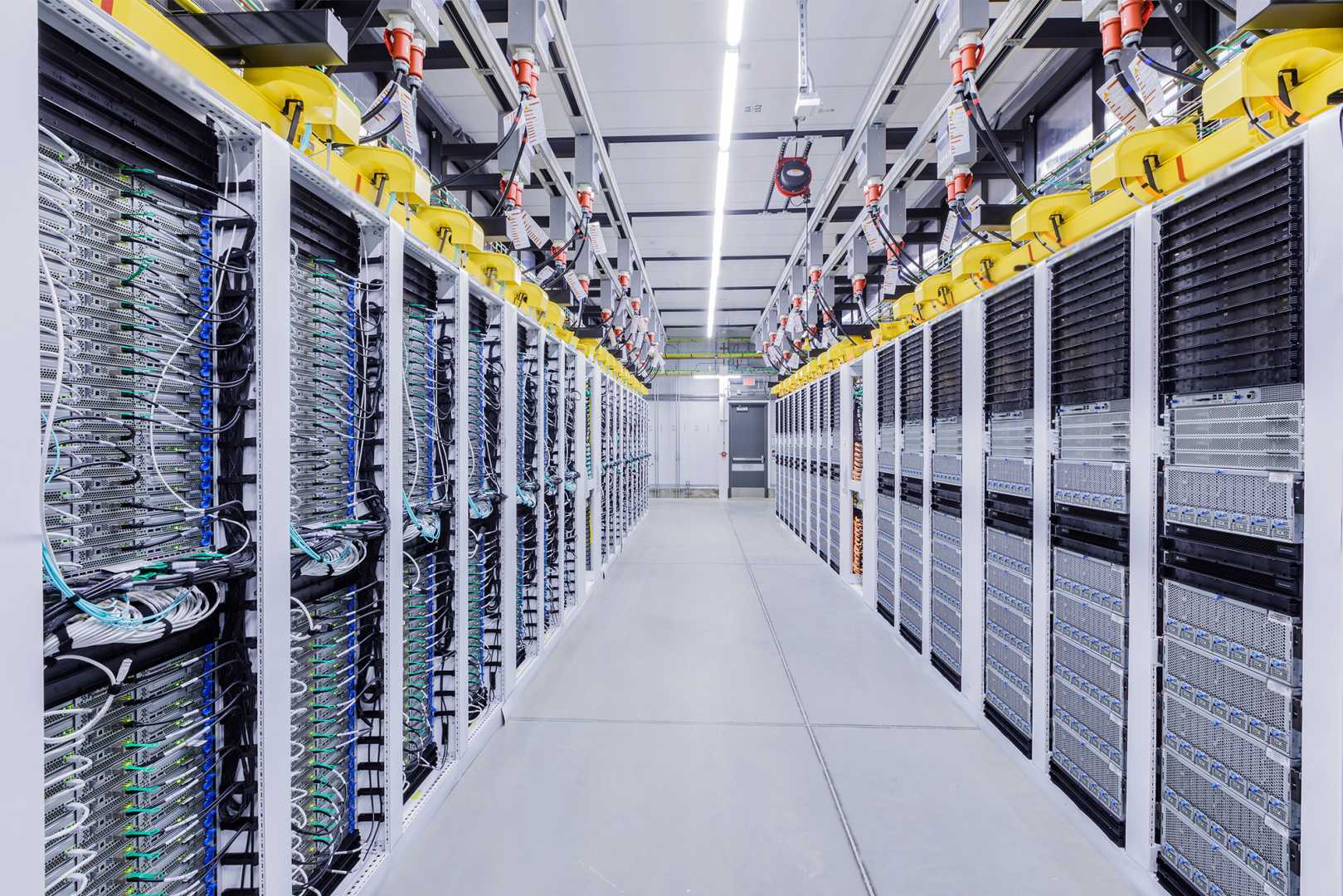

Microsoft’s commitment to expanding its data center capacity to meet the surging demand for AI services is also noteworthy. The company has ramped up its AI data center investments by 50% in 2023 and plans to double its data center capacity this year. This expansion is part of a broader strategy to establish Microsoft as a leader in the AI data center market.

In terms of financial performance, Microsoft continues to demonstrate robust growth. The company reported a 23% year-over-year growth in commercial bookings, with Azure revenue accelerating by 31% in constant currency. This growth aligns with the company’s optimistic outlook for its Intelligent Cloud segment.