Business

Mortgage Applications Surge Amid Declining Rates

ARLINGTON, Virginia — Mortgage applications increased by 10.9% last week, driven by rising refinance demand and a growing interest in adjustable-rate mortgages (ARMs), according to data from the Mortgage Bankers Association.

The average contract interest rate for 30-year fixed-rate mortgages dropped to 6.67%, down from 6.77% the previous week. The current rate is still higher than it was a year ago, when it stood at 6.54%. Points increased to 0.64 from 0.59, including the origination fee for loans with a 20% down payment.

ARMs also saw a decrease in rates, dropping to an average of 5.80% from 6.06%. ARMs offer a fixed interest rate for a set term before adjusting to market rates, which can create risk for borrowers.

The most significant rise was in refinancing applications, which surged by 23% from the previous week and were up 8% compared to the same week last year. This marked the most robust refinancing activity since last April. The refinance share of total mortgage applications climbed to 46.5%, up from 41.5%.

Joel Kan, an economist at the MBA, remarked, “As seen in other recent refinance bursts, the average loan size grew significantly to $366,400. Borrowers with larger loan sizes continue to be more sensitive to rate movements.” He noted that with ARM rates looking attractive compared to fixed-rate loans, ARM applications increased by 25%, reaching their highest levels since 2022.

Meanwhile, applications for purchasing a home experienced a slight rise of 1%, although they remain 17% higher than a year ago. Despite some regions witnessing falling prices, home prices overall continue to be high in relation to average incomes.

In the current week, mortgage rates remain stable despite a mixed consumer price index report, indicating some inflation aspects influenced by tariffs alongside price declines in large categories.

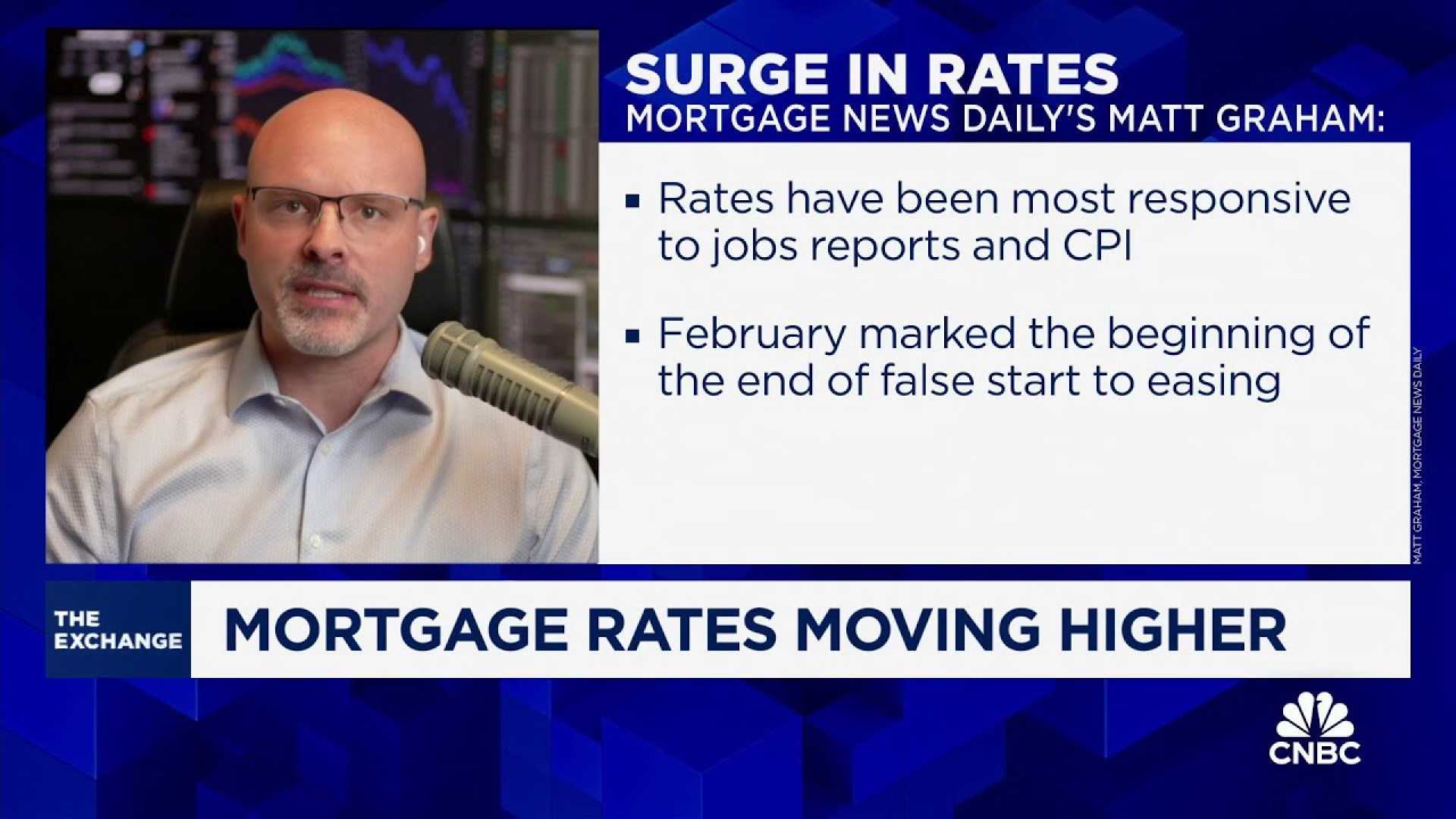

Matthew Graham, COO of Mortgage News Daily, pointed out that the likelihood of a Federal Reserve rate cut improved for September, noting, “Shorter-term bonds also improved, which is expected as they correlate with Fed rate expectations.” Nevertheless, longer-term bonds, including those determining mortgage rates, have remained steady.