Business

Mortgage Rates Dip Amid Economic Uncertainties

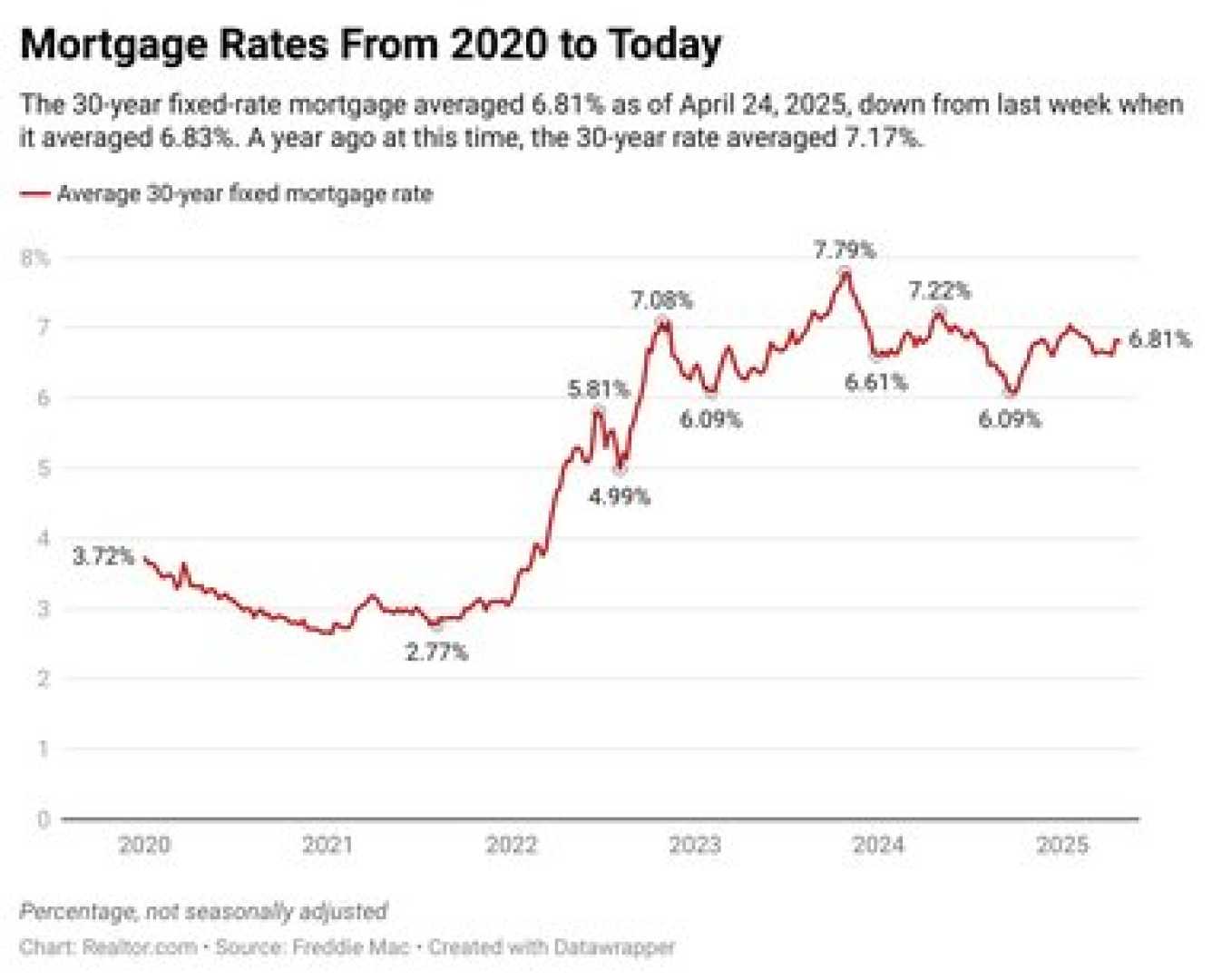

Washington, D.C. – The average rate on a 30-year fixed mortgage has dipped to 6.81% for the week ending May 2, 2025, down from 6.86% the previous week, according to Bankrate‘s latest survey.

As mortgage rates fluctuate, the numbers indicate a continued downward trend. Last year, 30-year fixed rates averaged 7.39%, meaning the current rates present a slight relief for potential homebuyers. Additionally, fixed-rate mortgages, or FRMs, saw an average total of 0.35 discount points.

The 2024 national median family income was reported at $97,800, according to the U.S. Department of Housing and Urban Development. The median price of an existing home sold in March 2025 was $403,700, according to the National Association of Realtors. With a 20% down payment and the current 6.81% mortgage rate, the monthly payment amounts to $2,108, which is approximately 26% of a typical family’s monthly income.

Selma Hepp, chief economist at Cotality, commented on the volatility in the housing market, stating, “The housing market is facing a repeated challenge from recent jumps in mortgage rates, likely remaining elevated.” She emphasizes the significance of investor sentiment affecting mortgage rates, particularly those tied to 10-year Treasury bonds.

Current inflation trends have also contributed to the mortgage rate dynamics. The Labor Department reported an inflation rate of 2.4% in March 2025, which eases pressure on mortgage rates. However, ongoing economic uncertainties, including tariff policies, remain a concern.

Samir Dedhia, CEO of One Real Mortgage, advised homebuyers and homeowners looking to refinance to closely monitor market trends and engage with mortgage professionals to navigate this volatile landscape.

As the year progresses, experts project that mortgage rates may shift slightly lower, contingent upon inflation trends and Federal Reserve activities. Freddie Mac‘s average rate for the 30-year mortgage was reported at 6.76% as of the first week of May 2025, with expectations for a gradual decrease.