Business

Mortgage Rates Drop as April Ends, Leaving Homebuyers Searching for Deals

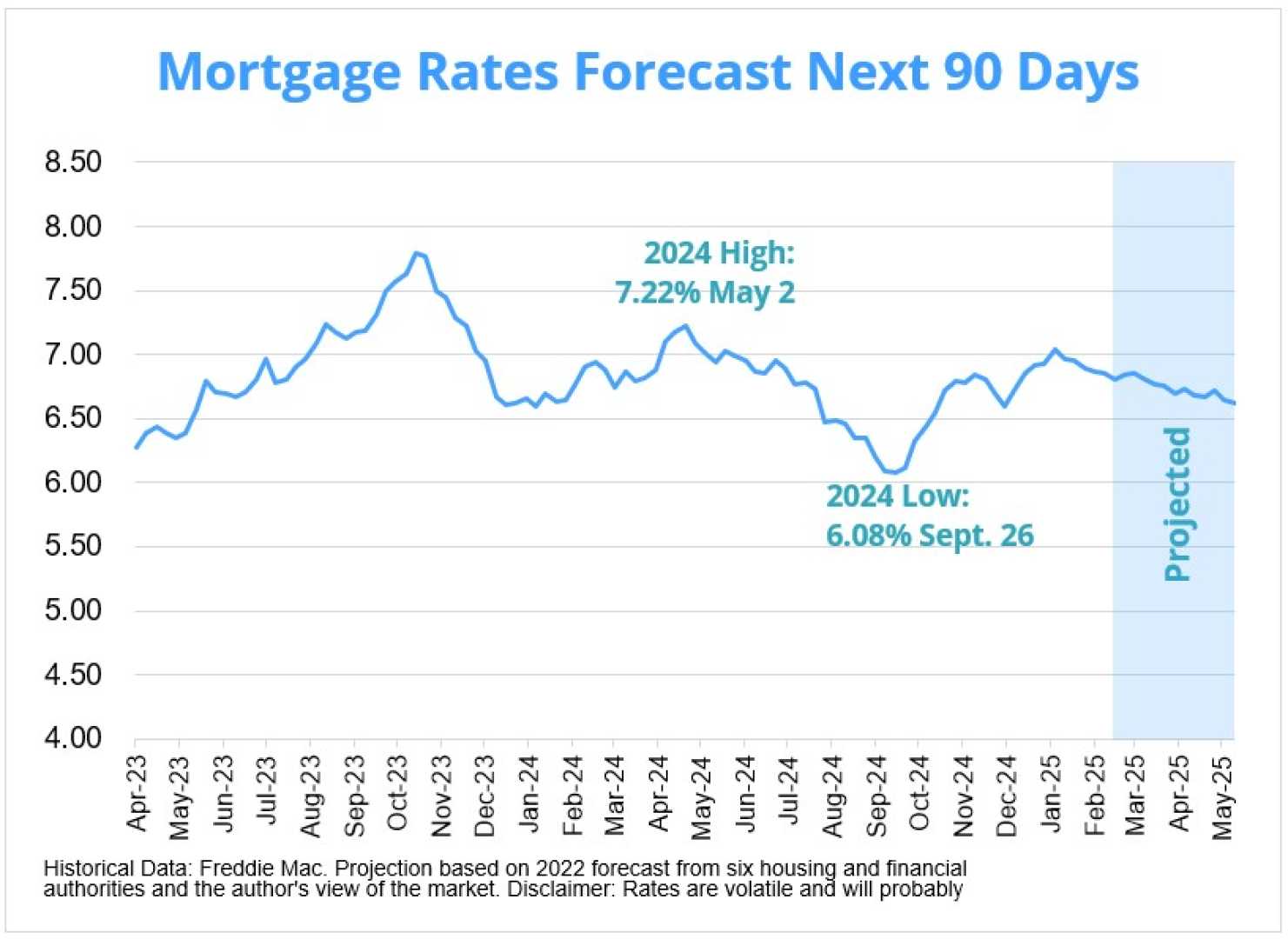

WASHINGTON, D.C. — Mortgage rates have fluctuated dramatically this month, with a notable decline in the latest week. As of last Friday, the average rate for a 30-year fixed mortgage has decreased to 6.92%, following a recent trend of volatility.

This decline comes after average rates peaked at 7.14% on April 11, the highest since May 2024. Since then, rates have dipped 44 basis points over the course of two weeks, prompting homebuyers to explore their refinancing options or new purchases.

Freddie Mac, a government-sponsored enterprise that aggregates mortgage statistics, noted that rates often differ between lenders, making it crucial for consumers to shop around for the best deals. Despite the recent decline, the average rate remains nearly a full percentage point higher than last September’s two-year low of 5.89%.

Additionally, 15-year mortgage rates have also experienced a decrease, currently averaging 6.00%, down from 6.31% on April 11. This drop in rates presents an opportunity for homeowners looking to refinance or new buyers seeking affordable mortgages.

“The housing market is currently volatile due to various economic factors, including recent tariff discussions and inflation fears,” said Selma Hepp, chief economist at Cotality. “Buyers need to remain adaptable and informed to navigate these fluctuations.”

The Federal Reserve’s actions over the past couple of years also play a significant role in shaping mortgage rates. After a series of interest rate hikes throughout 2022 and 2023 to combat inflation, the Fed has since been cautious about making further adjustments.

As of now, experts predict that while current averages are higher than in previous months, potential buyers should stay engaged with ongoing market shifts. They are advised to consult with mortgage professionals regularly to secure the best rates as conditions evolve.

The journey to obtaining a mortgage remains complex, impacted by numerous factors including credit score, down payment, and current economic policies. As homebuyers navigate this tricky environment, market momentum in the coming months will be essential to track.