Business

Mortgage Rates Drop to Lowest Level in Over a Year

North Miami, Florida — Americans concerned about high home borrowing rates received positive news this week. The average 30-year fixed mortgage rate fell to 6.19% for the week ending October 23, a decrease from 6.27% the previous week, according to data released by Freddie Mac.

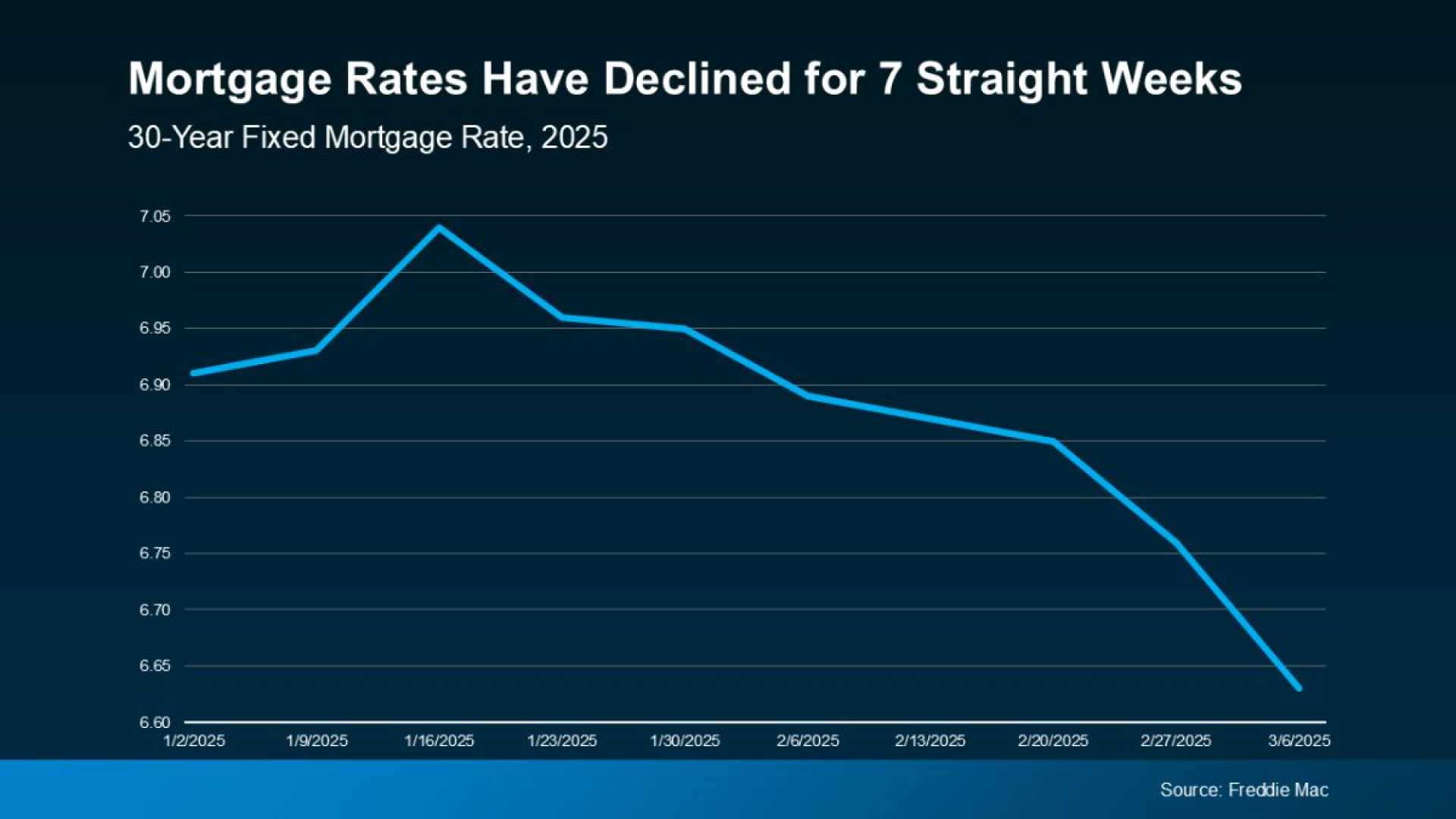

The drop in mortgage rates comes after years of sluggish home-buying activity. Sam Khater, Freddie Mac’s chief economist, stated, “At the start of 2025, the 30-year fixed-rate mortgage surpassed 7%, while today it hovers nearly a full percentage point lower.” The decline in rates may finally encourage sidelined homebuyers to re-enter the market.

This week marks the third consecutive decline in mortgage rates, reaching the lowest level since October 2024 when it was 6.12%. Meanwhile, the average rate on 15-year fixed-rate mortgages decreased to 5.44% from 5.52% last week.

According to Kara Ng, a senior economist at Zillow Home Loans, “With signs of softer economic momentum and a deteriorating labor market, mortgage rates may drift slightly lower through 2026.” While the Federal Reserve does not directly control mortgage rates, its monetary policy influences them by affecting the 10-year Treasury yield.

In September, the typical home sold for 1.4% below asking price, the largest September discount since 2019, according to a report from Redfin. This shift signals that homebuyers may now have more negotiating power.

Sales of existing homes rose at the fastest pace in seven months, reflecting the improved affordability. Lawrence Yun, chief economist for the National Association of Realtors, stated, “As anticipated, falling mortgage rates are lifting home sales.”

Despite recent improvements, Lisa Sturtevant, chief economist at Bright MLS, cautioned, “While lower rates will bring some buyers and sellers into the market… we will need to see further drops in mortgage rates and much slower home price growth to make a dent in affordability.”