Business

New Federal Tax Rules Impact Overtime and Tips for Workers

Las Vegas, Nevada – On July 4, 2025, President Donald Trump signed the “One Big Beautiful Bill Act” into law, introducing significant tax changes for employees. The bill eliminates federal income taxes on overtime and tips, aiming to support workers in service-heavy economies like Nevada.

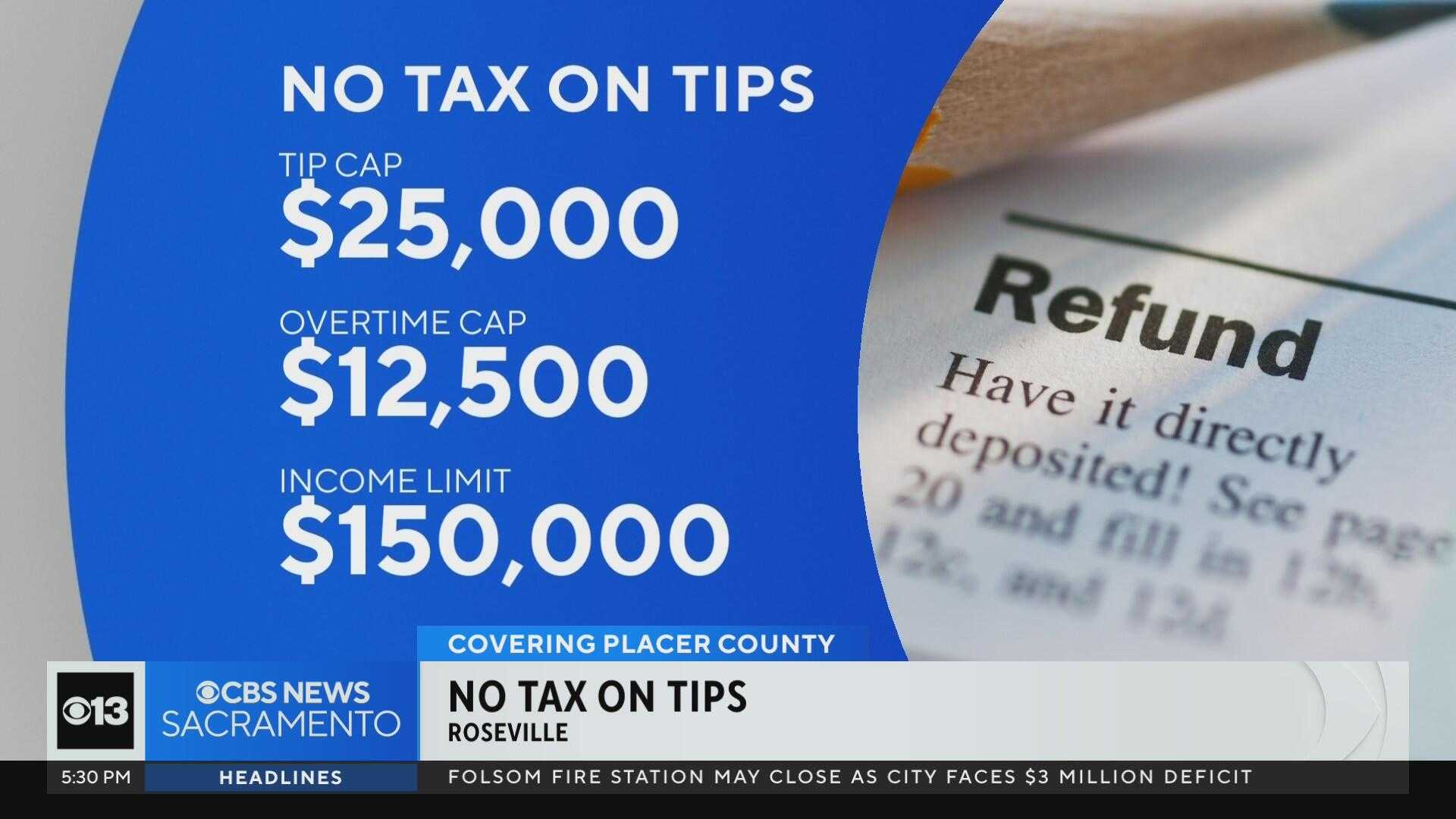

Retroactive to January 1, 2025, the legislation offers an above-the-line tax deduction for eligible overtime pay for individual taxpayers up to $12,500, or $25,000 for joint filers. This deduction, which expires after 2028, only applies to wages that are paid above an employee’s normal rate.

Todd Cox, a certified public accountant based in Las Vegas, emphasized the importance of understanding that while tip and overtime income may be exempt from federal income tax, it is still subject to payroll taxes like Social Security and Medicare.

The deduction for tips also provides relief, allowing workers who regularly receive tips to deduct up to $25,000. To qualify, individuals must meet income thresholds, and the deduction phases out for those earning more than $150,000, or $300,000 for joint filers.

“These tax breaks are crucial for many workers in our state, where tipped employment is common,” Cox said. “For some, that $25,000 deduction could represent a significant portion of their income, providing real savings at tax time.”

However, only tips given voluntarily are eligible. Mandatory charges or automatic gratuities do not qualify for the deduction.

Moreover, the bill includes specific requirements for employers. They must track qualified overtime and tips accurately and report them on employees’ W-2 forms. Changes to payroll systems might be necessary to accommodate these new tracking requirements.

The Department of the Treasury is expected to issue additional guidance and a list of qualified occupations within 90 days of the law’s enactment. Employers are encouraged to prepare their systems and avoid providing tax advice to employees.

The Culinary Workers Union Local 226 supports the new provisions but remains cautious, noting that the tax breaks are temporary. Secretary-Treasurer Ted Pappageorge acknowledged the bill’s potential benefits, while also advocating for long-term solutions for workers’ tax burdens.

“We’ve fought for tax relief for tipped workers for decades, but it’s concerning that these benefits will expire in just a few years,” Pappageorge said.

Business owners and employees alike will need to stay informed as more details emerge about the implications of these new tax rules.