Business

Nvidia’s AI Futures: Stock Dips Present Investment Opportunity Amid GPU Demand Surge

SAN FRANCISCO, CA — Nvidia Corporation’s stock has fallen 27% from its recent high, trading at $94.64 after a 7.03% decline on April 4, 2025. This drop, occurring amidst a turbulent market, presents potential buying opportunities for investors as demand for its advanced graphics processing units (GPUs) continues to surge.

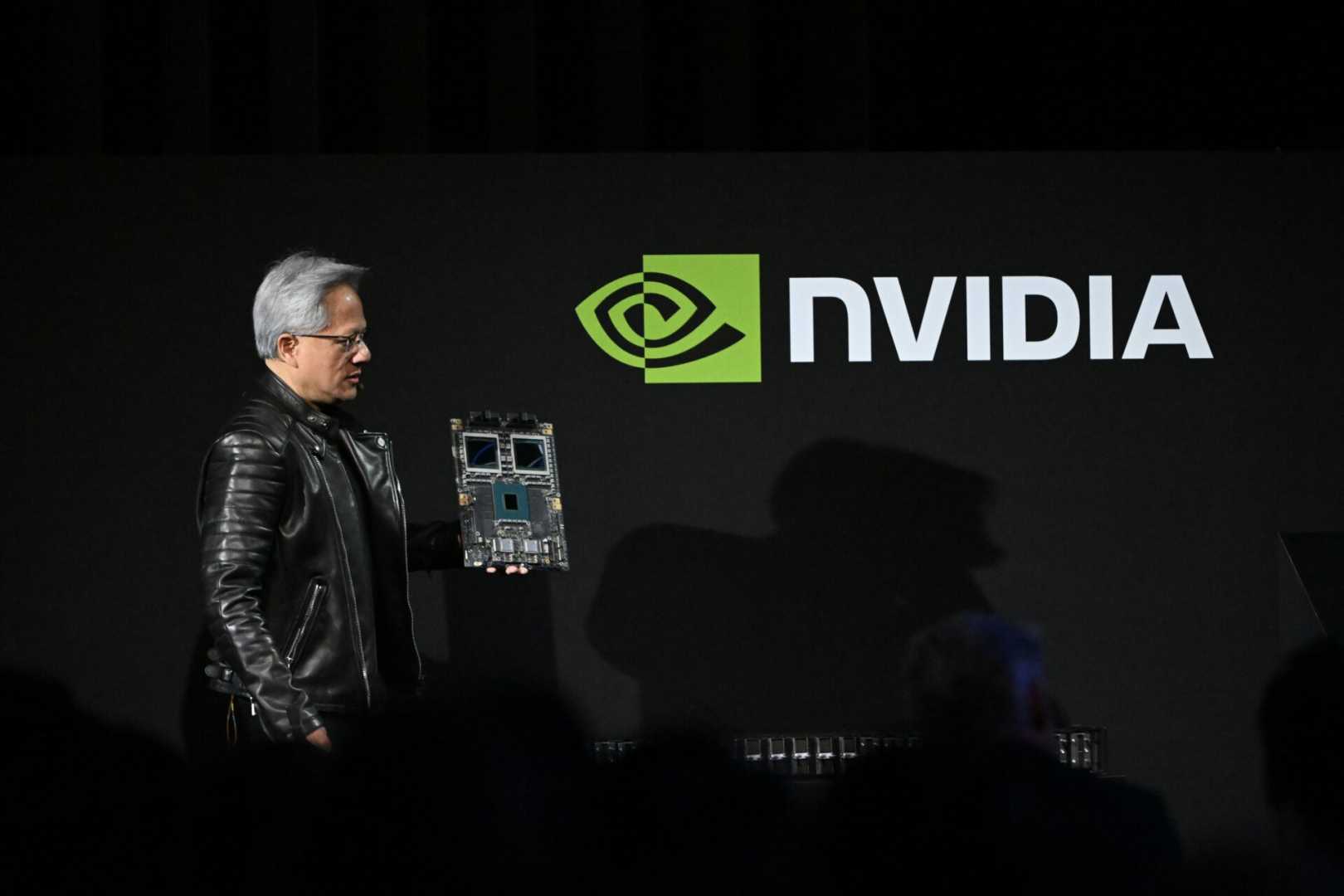

With a market capitalization exceeding $2.3 trillion, Nvidia plays a pivotal role in the artificial intelligence (AI) industry. CEO Jensen Huang highlighted key growth catalysts during the company’s annual GPU Technology Conference (GTC) last month, emphasizing the increasing need for cutting-edge GPUs capable of supporting sophisticated AI applications.

Nvidia’s momentum is driven largely by the rising demand for large language models (LLMs), foundational to numerous AI tools. However, the deployment of these models has shifted to a more complex methodology known as “testing-time scaling” or “reasoning,” necessitating much higher computing power. Huang noted that the new reasoning models will demand GPUs that are ten times faster and a staggering increase of 100 times more computing power to render satisfactory user experiences.

To address this need, Nvidia introduced its Blackwell GPU architecture at GTC, boasting performance capabilities 30 times faster than the previous Hopper architecture. The latest Blackwell Ultra is projected to deliver up to 50 times the performance needed for reasoning models.

These innovations are expected to significantly boost Nvidia’s GPU sales, with major cloud service providers—Amazon Web Services, Microsoft Azure, Google Cloud, and Oracle Cloud—having already ordered 3.6 million Blackwell GPUs. This figure marks nearly triple the orders made for Hopper chips last year, presenting a compelling indicator of anticipated growth in data center infrastructure.

Nvidia’s data center business reportedly generated $115.2 billion in revenue during fiscal 2025, reflecting a 142% increase year-over-year. Huang predicts that annual AI infrastructure spending could surpass $1 trillion by 2028, indicating substantial potential for Nvidia’s growth as AI technology proliferates.

Despite price fluctuations, analysts regard the current valuation attractive. Nvidia’s share price places it at a price-to-earnings (P/E) ratio of 36.9, a significant reduction from its 10-year average of 59.5 and marking its lowest point in three years. Furthermore, Wall Street estimates for fiscal 2026 project an earnings per share (EPS) of $4.53, which would position Nvidia for a favorable upside if past performance remains indicative.

“Investors should look beyond the immediate market dips,” Huang advised, suggesting that strong growth potentials may yield significant returns over the next three to five years rather than the coming year alone.

As Nvidia advances its GPU technologies and captures a larger share of the AI market, the recent drop in stock price may represent a strategic entry point for investors eager to engage with one of the leading innovators in technology today.