Business

Opportunity Zones Transform Communities Amid Tax Cuts Expiration Threat

Erie, Pennsylvania – In 2017, Congress enacted the Tax Cuts and Jobs Act (TCJA), a significant change that aimed to boost the U.S. economy. Under this law, many Americans saw wage increases and lower unemployment rates. However, as the most impactful provisions of the TCJA approach renewal, discussions regarding the future of Opportunity Zones (OZs) are becoming increasingly crucial.

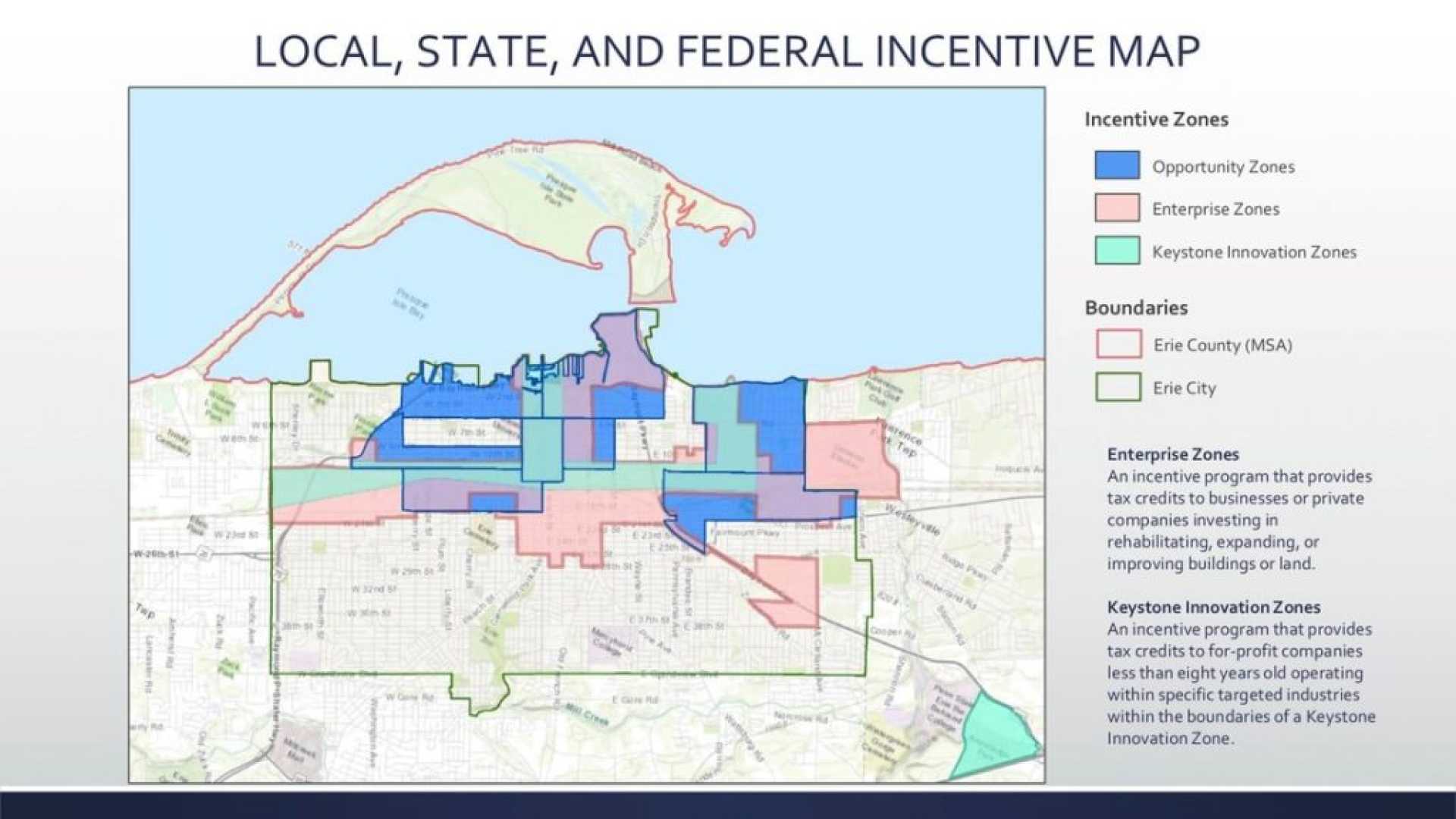

Opportunity Zones are designed to attract investors to underserved communities across the country, allowing for preferential tax treatment on investments. This initiative has mobilized funds that would have otherwise remained idle, channeling over $115 million into downtown Erie, where revitalization efforts are now underway.

Originally, Erie’s downtown area held the title of the poorest ZIP code in Pennsylvania in 2018. However, local residents, seeing potential in the Opportunity Zone model, collaborated with major employers and institutions to establish the Erie Downtown Development Corporation (EDDC). Since its formation, the EDDC has facilitated the construction of new residences and commercial spaces, signifying a turnaround for the once-overlooked region.

“This tax policy has incentivized investments that don’t cost taxpayers anything while providing underserved communities with the resources they desperately need,” said a local official. The impact is evident; $400 million in long-term investments are reshaping Erie’s future.

Not only in Pennsylvania, but Opportunity Zones have also fostered economic growth in places like South Carolina. There, the South Carolina Technology & Aviation Center has generated over $6.1 billion in investments and created 18,000 jobs, demonstrating that these zones can lead to significant advancements in local economies.

According to a report by the Economic Innovation Group (EIG), Opportunity Zones have generated over $75 billion in private investments across the U.S., leading to the creation of more than 500,000 jobs in just the first two years. Approximately one in 10 Americans lives in an Opportunity Zone, showcasing the program’s vast reach.

The EIG’s report also revealed a 3.4% increase in home values within these areas, translating into billions of dollars in wealth for homeowners. As communities like Erie and Oconee County in South Carolina witness such transformations, there is renewed focus on the need to make the benefits of the TCJA permanent.

As discussions continue in Congress about the future of these tax cuts, there is growing concern that if they are not renewed, projects could come to a standstill, risking economic stability for countless families and businesses. Local leaders are urging Congress to act swiftly to ensure the revitalization momentum continues.