Business

Palantir Technologies Sees Stock Fluctuations Amid AI Market Dynamics

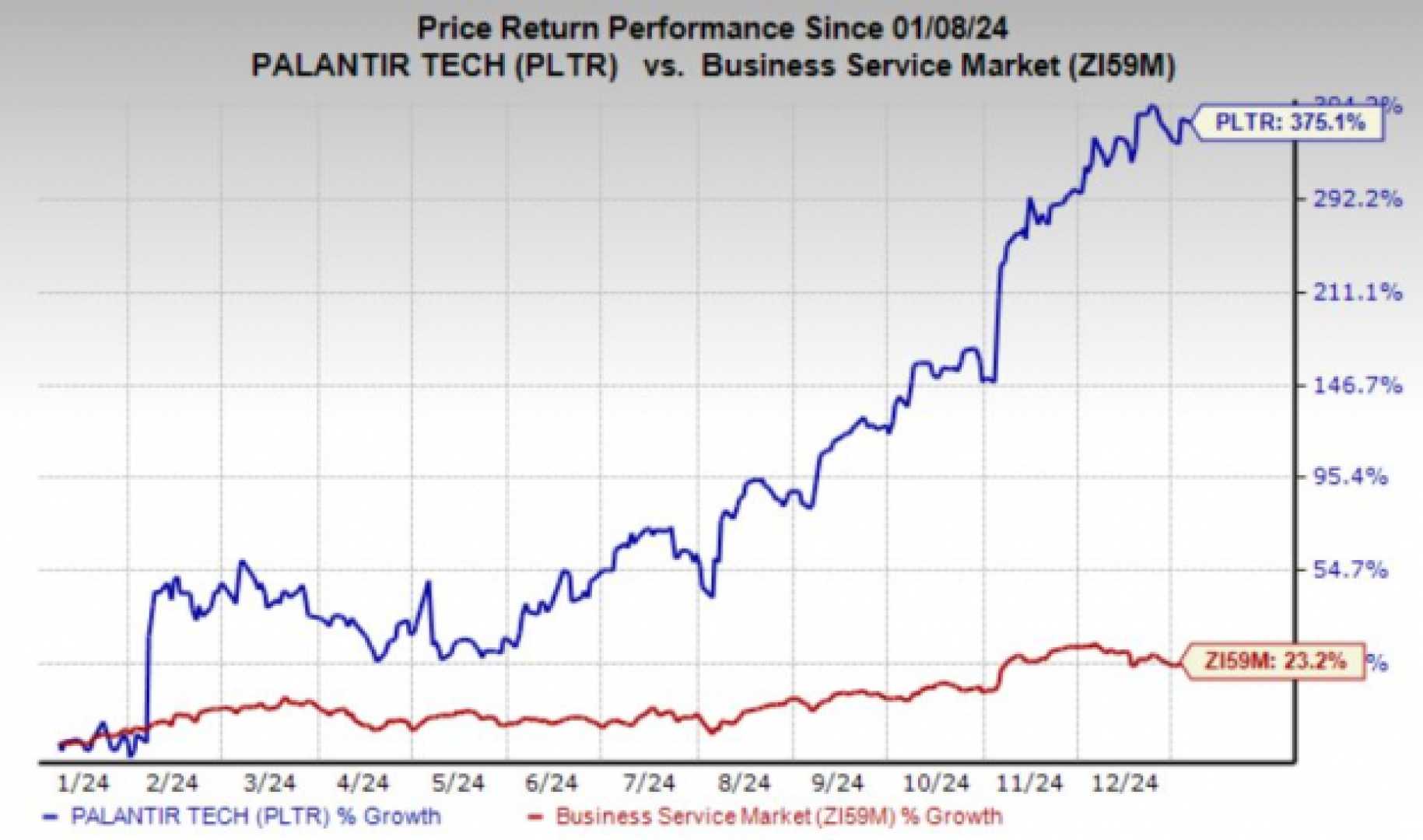

New York, NY – Palantir Technologies Inc. experienced significant stock movement recently, underscoring the volatility in the AI sector. As of July 1, 2025, the company’s market cap stands at $322 billion, with shares dropping by 4.14%, closing at $130.68.

Palantir, which focuses on providing data analytics solutions primarily for government and commercial clients, has been recognized as a crucial player in artificial intelligence. It has reported an impressive 39% revenue increase in the first quarter, marking its seventh consecutive quarter of accelerating growth. U.S. commercial revenue alone surged by 71% in the last quarter, indicating strong market demand.

The company’s AI Platform (AIP) is distinct in its approach, organizing and analyzing data to create actionable insights for businesses ranging from healthcare to energy. Recently, Palantir began deploying AI agents capable of executing tasks, suggesting a strategic shift towards enhanced automation.

Despite concerns about high valuation, with a forward price-to-sales ratio of 85, Palantir is viewed as a potential mega-cap company in the tech sector. Analysts project that if the company maintains a robust annual growth rate of 40%, it could achieve $15 billion in revenue by 2029, allowing it to justify its current stock price.

On the government contract front, Palantir’s revenue from U.S. agencies grew by 45% last quarter. The company is expanding its relationship with agencies like the Department of Defense, while also securing a significant contract with NATO. These developments could bolster its international presence.

Palantir’s strategic partnership with Accenture Federal Services, which aims to train employees on its platforms, exemplifies the growing emphasis on modernizing U.S. governmental operations through AI solutions. However, despite the growth outlook, analysts remain cautious, with a consensus rating of Hold due to potential market risks.

In summary, while Palantir’s stock may appear volatile and expensive, the company’s integration of AI across various sectors holds potential for long-term investment, depending on its ability to sustain growth and execute its strategy effectively.