Business

Social Security Benefits: How Long They Last in Different States

As Americans approach retirement age, the longevity of their Social Security benefits becomes a critical consideration. A recent study has revealed significant variations in how long these benefits can sustain retirees based on their location in the United States.

States like West Virginia, Oklahoma, Kansas, Alabama, and Mississippi emerged as optimal locales where Social Security benefits can endure for extended periods. According to the analysis, retirees in these states can expect their Social Security benefits combined with retirement savings to last anywhere between 26.19 to 28.8 years.

Conversely, the study illustrated that retirees in high-cost-of-living states such as Hawaii, California, Massachusetts, Alaska, and New York may find their benefits depleted much more quickly. Here, the longevity of combined Social Security and retirement savings is estimated to range from 8.8 to 15.38 years.

The analysis considered a scenario where retirees have $750,000 in retirement savings in addition to the average Social Security payment. It is important to note that this retirement savings figure significantly exceeds the current average savings for Americans aged 65 to 74, which stands at $609,230, and a median of $200,000 according to a Federal Reserve survey.

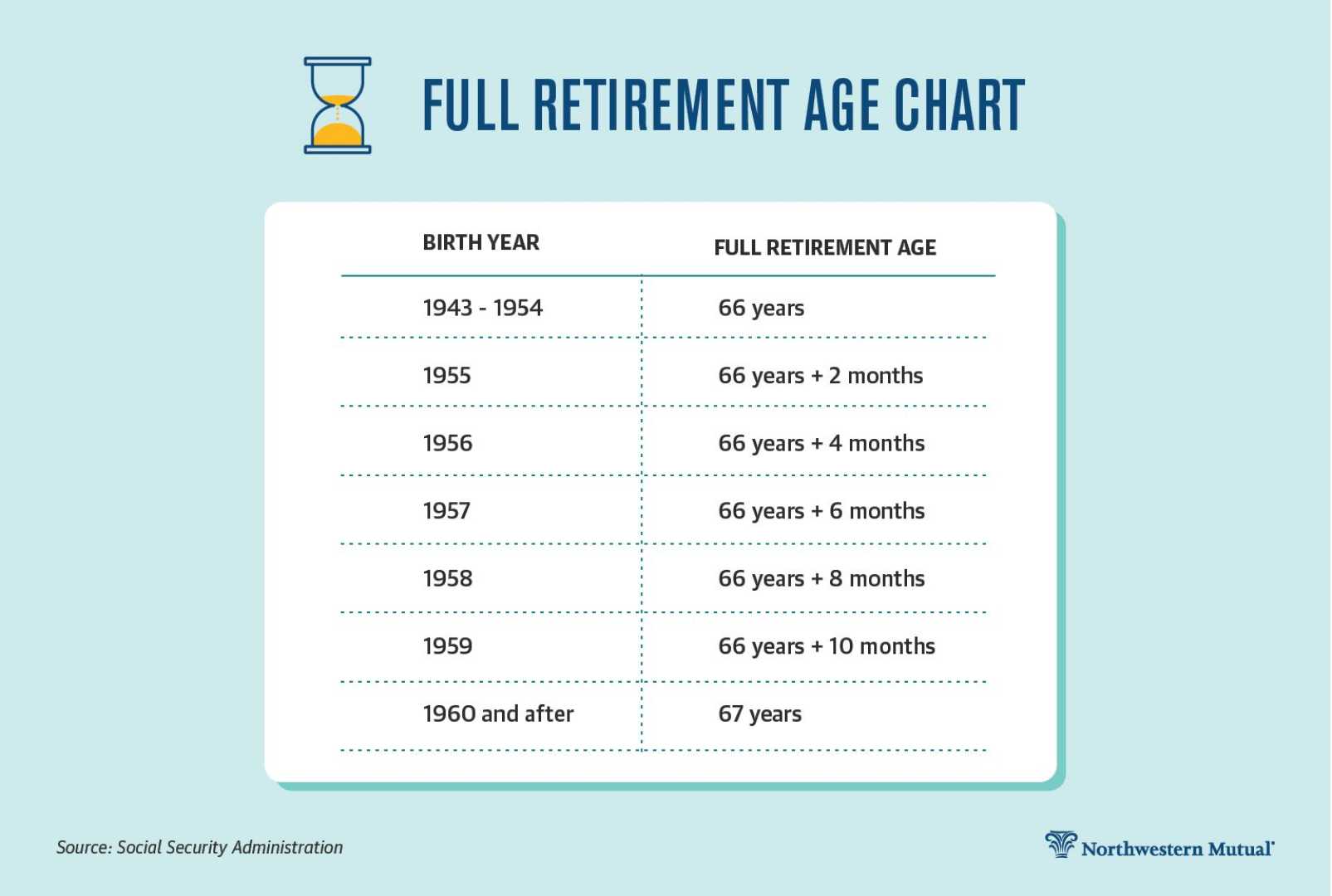

Individuals have the option to increase their Social Security benefits by delaying their claims until age 70. However, this decision varies based on personal financial situations and health factors. For instance, waiting until 70 can boost benefits by up to 24 percent, while claiming early at 62 may reduce those benefits by 35 percent.

Financial experts point out that other factors may substantially influence how far Social Security benefits stretch. Alex Beene, a financial literacy instructor, emphasized that owning a home and vehicle without a mortgage and managing healthcare expenses play more crucial roles in retirement finances than Social Security benefits alone.

Drew Powers, founder of Powers Financial Group, highlighted the significance of proximity to family in managing retirement costs. Having relatives nearby to assist with daily tasks can save retirees thousands of dollars annually.