Tech

Starlink Faces Intensifying Competition as New Rivals Emerge

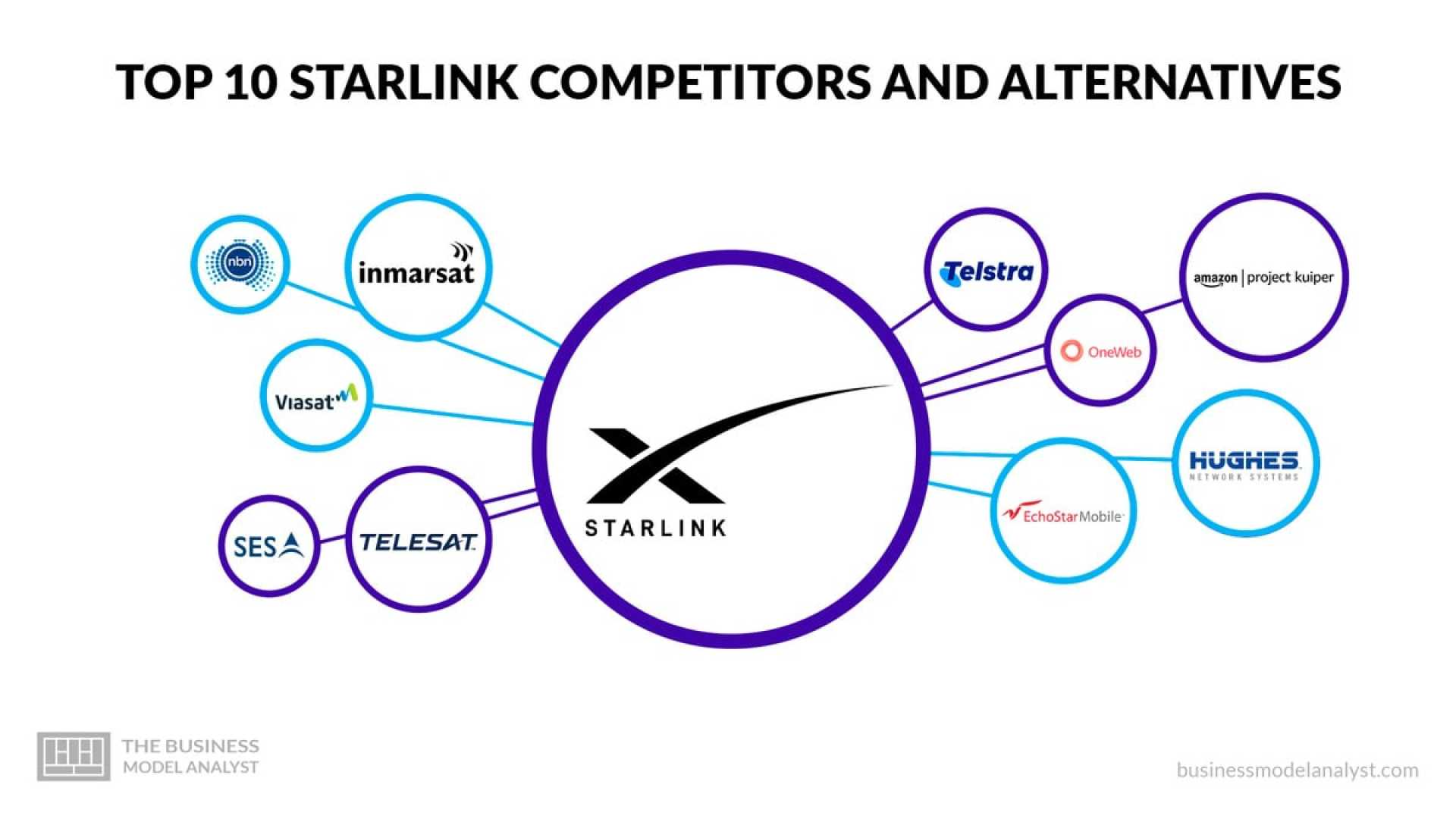

BENGALURU, India, Feb 24 (Reuters) – Elon Musk‘s Starlink communications network is encountering escalating competition from new global rivals, notably China’s state-backed SpaceSail and Amazon’s Project Kuiper. This shift in the satellite internet landscape signals a growing geopolitical rivalry as these companies vie for control of this crucial connectivity space.

Since its debut in 2020, Starlink has launched more low-Earth orbit (LEO) satellites than all its competitors combined, providing high-speed internet to remote areas worldwide. However, in November, Shanghai-based SpaceSail signed an agreement to enter the Brazilian market and began operations in Kazakhstan shortly thereafter, indicating significant ambitions to expand its reach. Currently, SpaceSail is negotiating with over 30 countries, marking a strong entry into the global satellite internet space.

The Brazilian government is actively exploring partnerships with both Bezos’s Project Kuiper and Canada’s Telesat as it seeks to enhance internet access for isolated communities. A Brazilian official involved in the negotiations revealed these discussions for the first time, emphasizing their importance to the country’s connectivity strategy.

China has been notably aggressive in its space endeavors, launching a staggering 263 LEO satellites in 2023 alone, according to astrophysicist Jonathan McDowell’s data. This push underscores Beijing’s goal to deploy 43,000 LEO satellites as part of its broader strategy to assert dominance in global communications, a move viewed critically by Western policymakers concerned about the implications for internet freedom.

Chaitanya Giri, a space technology expert at the Observer Research Foundation in India, noted the importance of occupying orbital slots: “The endgame is to occupy as many orbital slots as possible.” There are concerns internationally that China’s growing satellite network could extend its model of internet censorship, posing additional challenges to the global balance of digital power.

In the competitive landscape, SpaceSail aims to deploy 648 satellites by 2025 and an ambitious 15,000 by 2030, a scale that could rival Starlink’s current operations, which involve approximately 7,000 satellites. A Chinese telecommunications newspaper has extolled SpaceSail’s capabilities, emphasizing its potential to transcend national boundaries and enhance a strategic military and economic presence.

Experts warn that the satellite boom comes with inherent risks, including the potential for orbital congestion, which could endanger not only satellite integrity but also the safety of future space missions. Anticipating these challenges, researchers in China are developing monitoring tools to track foreign satellite systems like Starlink, which they consider essential for national security.

China’s tech companies have turned their focus to innovating low-latency communication systems and efficient satellite networks, significantly increasing the number of patents filed in LEO satellite technology. According to research data, China published 2,449 patents related to LEO technology in 2023, up from 162 in 2019, showcasing a substantial commitment to closing technological gaps.

As satellite technologies evolve rapidly, Musk and his competitors must navigate an increasingly complex field where both commercial interests and strategic national goals collide. This contest for dominance over satellite internet not only shapes the future of connectivity but also the geopolitical landscape of the 21st century.

The stakes are high, and the implications extend beyond internet speeds to strategic power plays, economic influence, and the very architecture of global digital infrastructure.