Business

Stocks Plunge Sharply Amid Tariff Fears and Economic Uncertainty

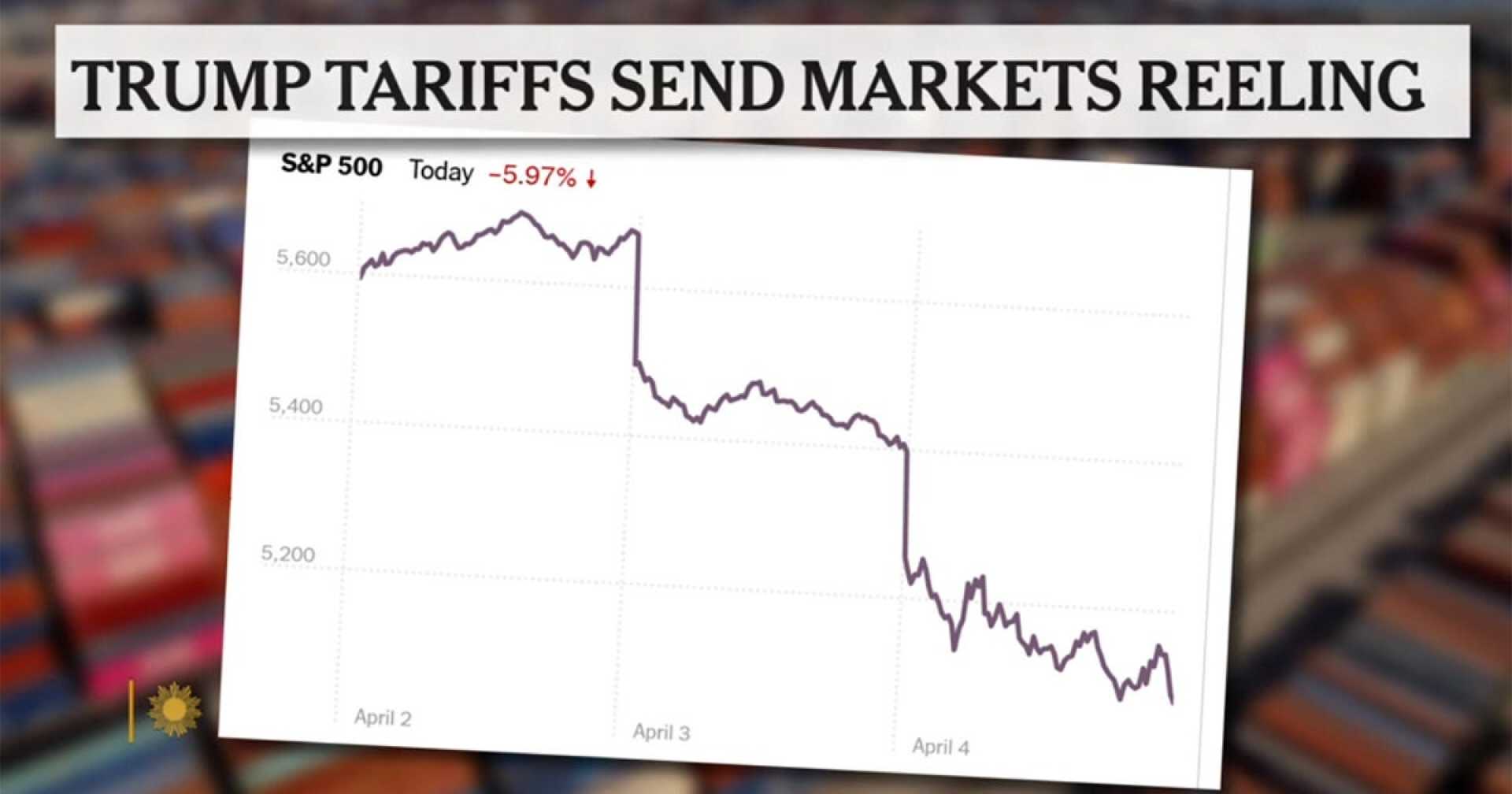

NEW YORK, April 4, 2025 — Major U.S. stock indices fell sharply today, marking a turbulent week for the markets. The Dow Jones Industrial Average dropped approximately 5.5%, losing over 2,200 points, while the S&P 500 sank 6% and the Nasdaq Composite tumbled 5.8%. This decline signals investor concerns about a potential global trade war stemming from newly announced tariffs by President Donald Trump.

The selloff was exacerbated by China’s announcement of reciprocal tariffs on all U.S. imports, a move that analysts warn could severely impact corporate profits and stifle economic growth. The week ended as the worst for major indices since the early COVID-19 pandemic in March 2020, with declines exceeding 9% for the S&P 500 and 10% for the Nasdaq.

President Trump’s announcement earlier this week to impose tariffs on select trading partners sparked the initial market rally, but fears built rapidly as the reality of escalating trade tensions sank in. White House officials argue that the tariffs are necessary to restore competitive balance and bring manufacturing jobs back to the U.S. However, economists predict these measures may lead to higher inflation and recessionary pressures.

“The risks for slower growth and higher inflation have increased,” Federal Reserve Chair Jerome Powell stated. During a recent conference, Powell acknowledged the significant impacts of tariff increases, stating that they are more extensive than anticipated. The yield on the 10-year Treasury note fell to 4.00%, its lowest since early October.

All major indices reported steep losses this week, with the Dow down 7.9%, S&P 500 sliding 9.1%, and the Nasdaq Composite plunging 10%, marking a second consecutive week of declines. The cumulative losses since the start of 2025 reached nearly 10% for the Dow, 14% for the S&P 500, and 19% for the Nasdaq.

Technology stocks bore the brunt of the downturn, with AI chipmaker Nvidia falling over 7%, while electric vehicle maker Tesla dropped 10%. Apple, which has significant manufacturing ties in China, saw its shares decline 7% following a 9% decrease earlier this week. Financial institutions like Bank of America, JPMorgan Chase, Citigroup, and Goldman Sachs each saw their values drop over 7%.

In the energy sector, shares of Exxon Mobil and Chevron were off 7% and 8%, respectively, as concerns about decreasing oil prices and production pressure weighed heavily on the market.

Gold futures, which had reached record highs earlier this week, fell 2.1% to $3,055 an ounce as market volatility continued. Bitcoin showed some resilience, trading at $84,200 after hitting a low of $81,600.

The implications of these tariffs extend beyond just immediate market reactions. Anticipation mounts regarding how they will impact various sectors, particularly consumer goods. Nike shares dropped amidst fears of profit shrinkage due to higher production costs in countries impacted by the new tariffs.

As investors await first-quarter earnings reports next week, many are reshaping their GDP forecasts due to the evolving economic landscape influenced by the tariffs. Economists note that the likelihood of a recession in the near future is now 60%, leading to increased caution in trading strategies.