Business

Tariffs Spark Shipping Crisis as U.S. Businesses Brace for Price Hikes

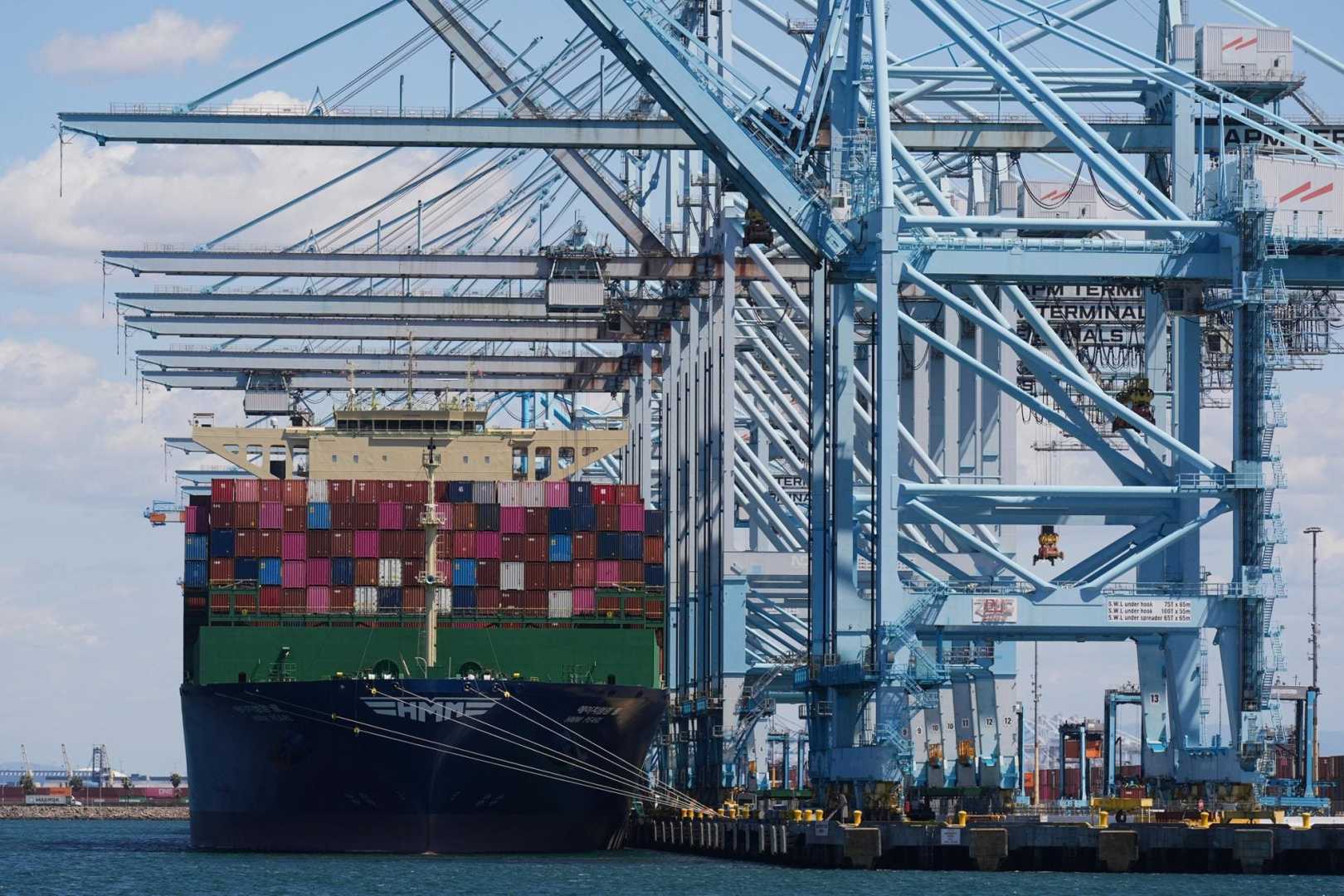

NEW YORK, NY — A surge in tariffs imposed by the U.S. government is causing significant disruptions for businesses across the nation, with many importers facing financial strain that could result in abandoned freight at ports. The new tariffs, which are reaching all-time highs, have left companies agonizing over rising costs and potential price hikes for consumers.

Rick Muskat, president of Deer Stags, a family-owned shoe retailer that imports around two million shoes annually, said the new tariffs have forced his company to confront unprecedented challenges. ‘Our costs have skyrocketed. A pair of men’s shoes that used to sell for $50 is now close to $80 due to multiple rounds of tariffs. We are now facing an overall tariff of 110% on our non-leather shoes and 120% on leather shoes,’ Muskat explained.

The changes are part of a broader trend, as U.S. tariffs on Chinese imports have drawn reactions from businesses struggling to manage their cash flow. Muskat projected that the cost of freight orders affected by new tariffs could escalate from $60,000 to as much as $1 million. ‘We don’t have the capital to grapple with this. Our only option is to pay the duties, but that means budgeting cuts elsewhere,’ he said.

Joseph Esteves, CEO of Maine Pointe, a global supply chain consulting firm, echoed Muskat’s concerns, stating that many businesses simply lack the liquidity needed to absorb these costs. ‘Companies are in precarious positions financially and many are opting not to accept their merchandise,’ he noted. Esteves pointed out that goods that arrive at ports could either be rejected and sent back to manufacturers or auctioned off if tariffs cannot be paid.

The landscape worsened when President Trump announced additional tariffs, pushing rates on some products to as high as 125%. This move has led many retailers to anticipate further cost increases that will ultimately be passed on to consumers. Similarly, Delta Air Lines CEO Ed Bastian criticized the tariffs, deeming them ‘the wrong approach,’ hinting at potential repercussions for both businesses and customers.

Despite fears of immediate price hikes, an ‘on the water clause’ included in U.S. Customs guidelines stipulates that goods currently in transit will not be subject to the new tariffs until May 27, 2025. This clause provides businesses a brief reprieve to negotiate and adapt to the changing trade environment.

Mary Rollman, a strategist at KPMG, stated that companies need sophisticated analytics to effectively manage their supply chains amid these changes. ‘The evaluation of whether to restore supply chains or continue with current manufacturing partnerships will be crucial for businesses as the tariff landscape continues to shift,’ Rollman explained.

In light of the evolving situation, several retail executives are calling for urgent negotiations to alleviate tariff burdens and stabilize the market. Jon Gold, of the National Retail Federation, emphasized that ‘these tariffs are ultimately paid by U.S. importers and retailers, which will inevitably trickle down to consumers.’

As talks escalate, industry leaders remain vigilant, navigating a complex marketplace while keeping an eye on potential resolutions that could mitigate the far-reaching impacts of these tariffs.