Business

Tesla Faces Challenges Amid Bold Forecasts for Robotaxi Future

Menlo Park, California — Tesla is navigating tough waters as it faces rising competition in the electric vehicle (EV) market. According to Ark Investment Management, headed by tech investor Cathie Wood, the company must transform to stay competitive. They predict that by 2029, a staggering 86% of Tesla’s earnings will come from self-driving robotaxis, possibly pushing its stock price to $2,600, a 615% increase from current levels.

CEO Elon Musk is trying to steer Tesla towards this future by investing in autonomous vehicles and robotics. However, the company is dealing with significant hurdles. Currently, Tesla’s full self-driving (FSD) software has yet to receive regulatory approval for unsupervised use in the U.S., a crucial step for its upcoming Cybercab robotaxi.

During 2024, Tesla delivered 1.79 million passenger EVs, marking a 1% drop from the previous year—the first annual decline since the Model S was launched in 2011. The situation worsened in 2025, with a 13% reduction in deliveries in the first half of the year, resulting in a 14% drop in revenue and a 31% decline in earnings per share (EPS) for the same timeframe.

The increase in competition is a significant factor in Tesla’s struggles. Low-cost rivals, particularly from China, have gained substantial traction, with Tesla experiencing a 40% sales decrease in Europe in July despite overall EV registrations rising by 33%. In contrast, BYD reported a remarkable 225% sales increase in the region.

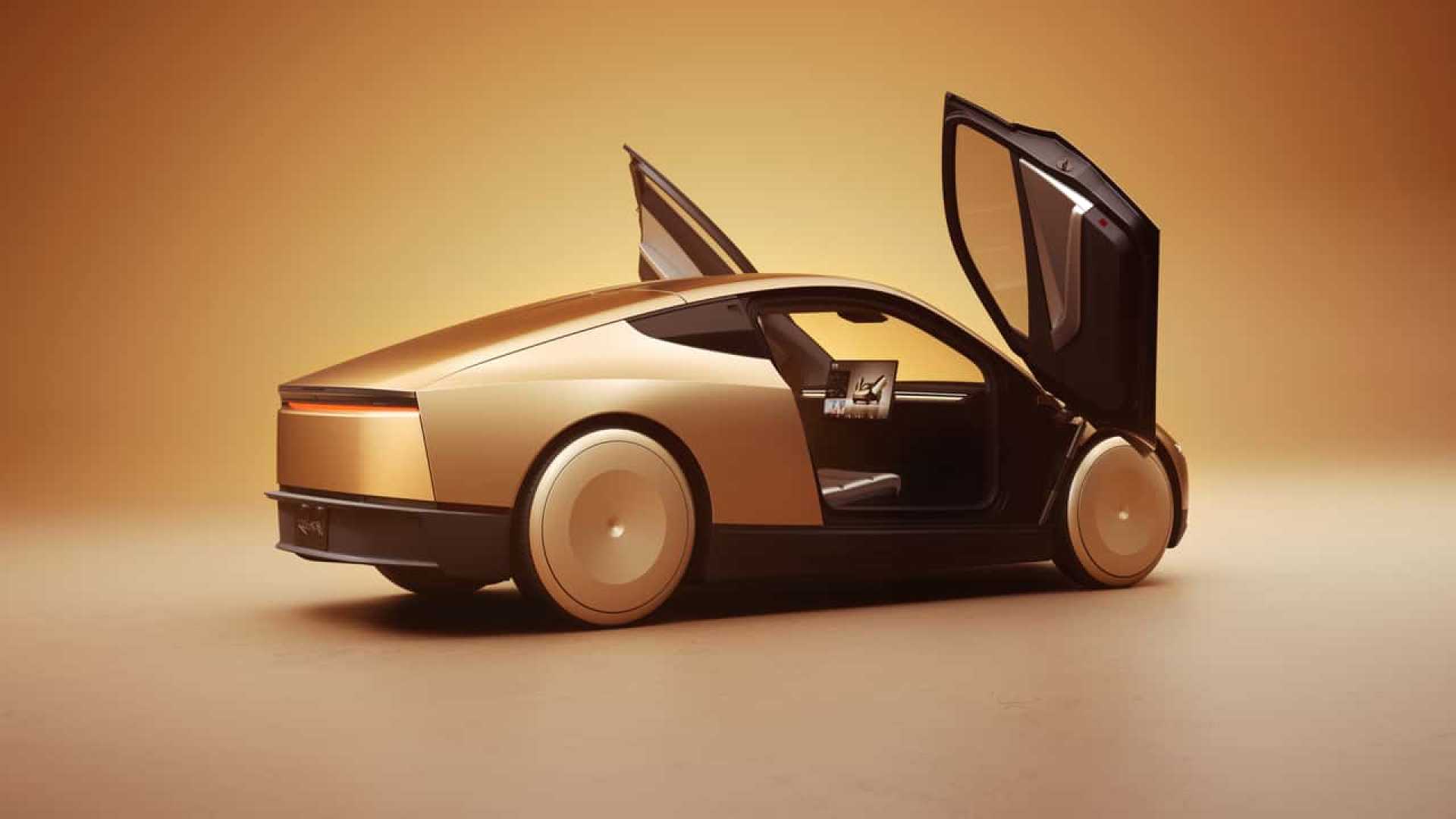

In an effort to reclaim lost market share, Tesla is launching a low-cost EV. However, production has only just begun and is unlikely to impact sales until next year. Meanwhile, Tesla’s Cybercab robotaxi, slated for mass production in 2026, aims to operate solely on the FSD software, enabling it to function without human intervention and potentially create a significant new revenue source.

Nonetheless, several challenges await this ambitious shift. It is unclear how Tesla will compete with established ride-hailing services like Uber, which dominate the market and have extensive partnerships—Uber currently supports over 180 million users monthly.

Ark remains optimistic about Tesla’s future, predicting the company could generate $1.2 trillion in annual revenue by 2029, with a considerable portion—around 63%, or $756 billion—stemming from its robotaxi service. This shift could lead to $440 million in earnings before interest, taxes, depreciation, and amortization (EBITDA), primarily due to the elimination of human drivers in the robotaxi business.

However, skepticism surrounds these forecasts. Wall Street predicts Tesla’s revenue will reach only about $93 billion in 2025, an increase that would require nearly 1,200% growth in four short years—mainly driven by a new product that has not yet been demonstrated on the roads.

Additionally, Tesla’s current valuation poses an issue; its stock trades at a price-to-earnings (P/E) ratio of 209, nearly seven times higher than the Nasdaq-100’s 31.6 P/E ratio, while its earnings are currently declining.

As it stands, the prospect of Tesla’s stock surging 615% to meet Ark’s price target appears doubtful without substantial progress in its robotaxi endeavors. Historically, Elon Musk has promised fully autonomous self-driving vehicles for over a decade without delivering.