Business

Treasury Secretary Addresses Tariff Revenue and National Debt

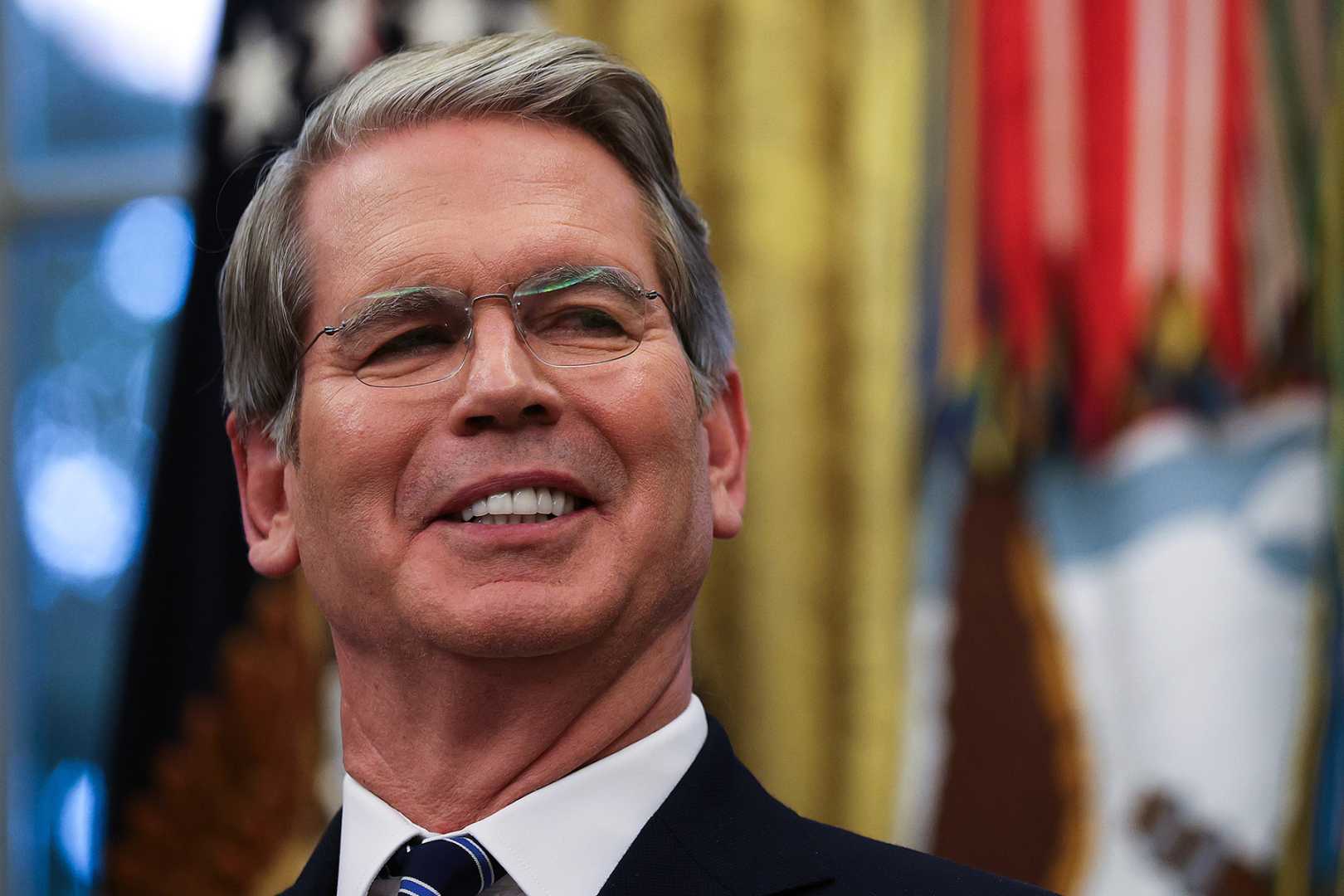

STOCKHOLM, Sweden — Treasury Secretary Scott Bessent discussed the future of import tariff revenues during an interview on CNBC‘s “Squawk Box” on Tuesday. He emphasized that income from these tariffs is planned to go towards reducing the United States’ national debt.

Bessent stated, “I think, at a point, we’re going to be able to do it,” referencing the recent affirmation of the U.S. credit rating by S&P Global. He noted that both he and President Donald Trump are committed to addressing the national debt.

Proposals are being made by some lawmakers to use tariff revenues for direct payments to citizens. These could amount to at least $600 for each adult and dependent child, potentially delivering about $2,400 to a family of four.

According to data from the Treasury Department, the U.S. has collected $100 billion in tariff revenues since April, following the implementation of a variety of tariffs. Trump has previously suggested that these funds could also be used to benefit the American public.

Bessent indicated that tariff revenues are surpassing projections. “I’d been saying that tariff revenue could be $300 billion this year,” he said, implying this figure may increase. He believes the country can reduce its deficit-to-GDP ratio and start paying down the debt, which might eventually allow for additional offsetting to the public.

While Bessent did not elaborate on estimated revenue increases, he expressed hope that Americans may see relief soon in the form of lower interest rates. The Federal Reserve has maintained steady interest rates since December, with expectations of a potential rate cut rising due to recent job and inflation data.

Bessent expressed concerns about the impact of high interest rates, especially on housing and lower-income families with significant credit card debt. He commented, “We’re seeing some distributional aspects to the higher rates, especially in housing.”

He also acknowledged the role of factors like AI and tax reforms in contributing to a rise in capital expenditures, but highlighted ongoing struggles in home construction. Bessent warned that constraining home building could lead to long-term inflation issues.

Recent data from the U.S. Census Bureau indicated that new home constructions rose by 5.2% in July, exceeding expectations. This uptick could allow for more housing availability in the future, potentially reducing prices.