Business

UnitedHealth Under Pressure Amid Rising Medical Costs and Stock Volatility

MINNEAPOLIS, Minn. — UnitedHealth Group (NYSE: UNH) has faced -3% returns since the start of 2024, significantly trailing behind the broader S&P 500 index, which is up 28%. The primary factor behind this underperformance is rising medical costs that have impacted the company’s profitability.

Over a longer timeframe, UNH stock has shown limited improvement, declining from approximately $515 in early 2023 to its current value of $500. This trend is attributed to a 25% increase in the company’s adjusted earnings from $22.19 in 2022 to $27.66 in 2024, which has been largely countered by a 22% drop in its trailing price-to-earnings (P/E) ratio, decreasing from 23x to 18x.

Despite being perceived as an underperformer, UnitedHealth’s earnings growth from its OptumHealth business segment provides some positive context. This segment, which offers healthcare services through affiliated medical groups, reported a 48% increase in revenue from 2022 to 2024, significantly outpacing the company’s overall revenue growth of 23%. The robust performance of OptumHealth correlates with an increase in patient volume under value-based care arrangements, including at-home services.

Additionally, the insurance division of UnitedHealth experienced a sales boost exceeding 20% in both Medicaid and Medicare segments during the same period, fueled by higher customer enrollment. However, despite achieving revenue growth, the company’s operating margin slightly declined from 8.8% in 2022 to 8.1% currently, attributed to a 25% rise in medical costs.

The company’s earnings per share saw a 25% increase, climbing from $22.19 to $27.66, slightly surpassing revenue growth. This was partly due to a 3% reduction in the number of outstanding shares, made possible through $24 billion in share repurchases.

Investors have expressed concern regarding the falling valuation multiples of UNH stock. The medical care ratio, which measures the portion of revenue spent on medical services, has risen from 82% in 2022 to 85.5% in 2024. This increase, coupled with recent quarterly sales figures that missed analyst expectations, has added to investor skepticism. UnitedHealth’s 2025 EPS outlook of $30, at the high end, is seen as insufficient to ease these worries given the ongoing high medical costs.

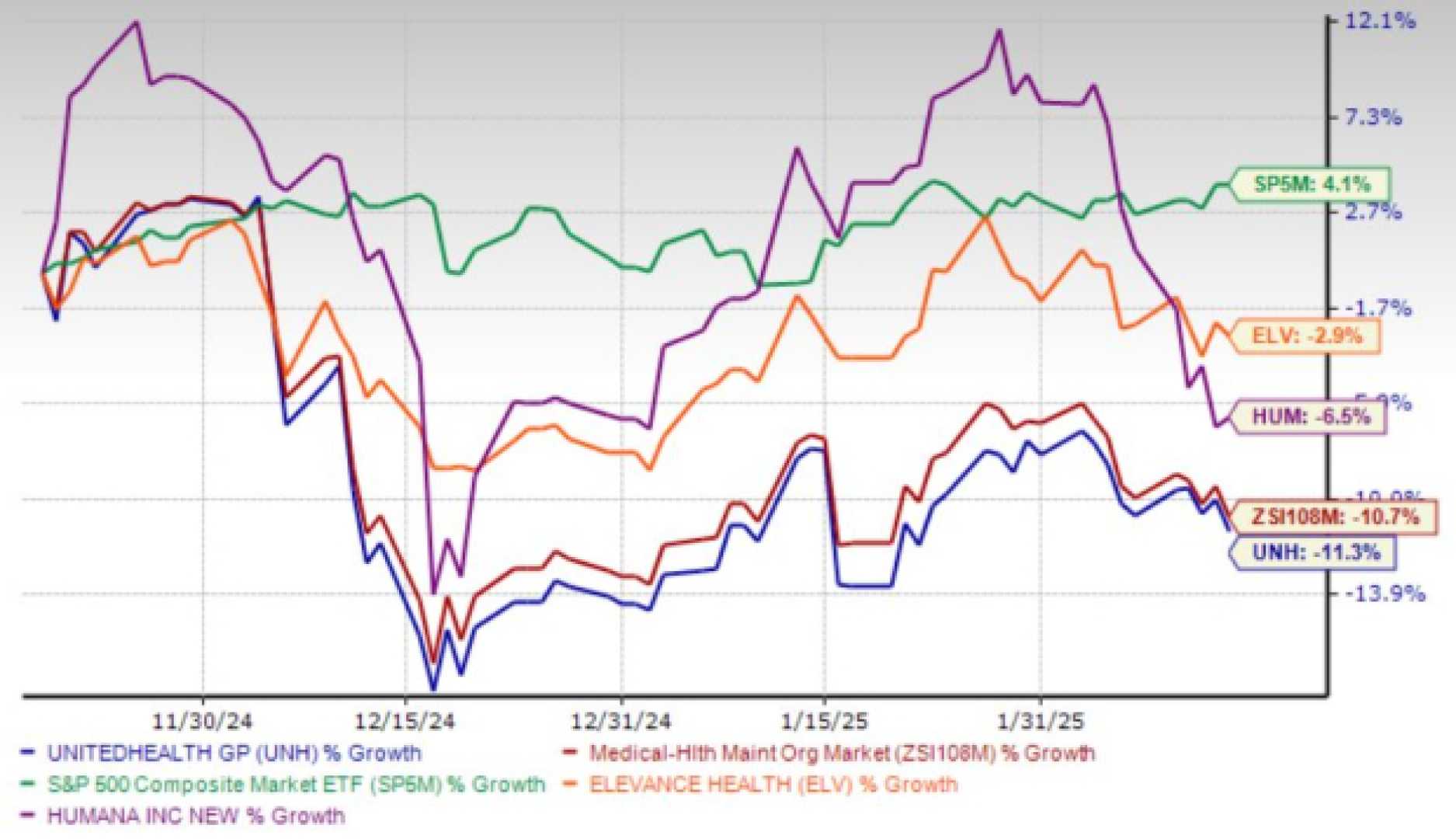

The stock has also exhibited significant volatility over the past four years: it recorded returns of 45% in 2021, 7% in 2022, 1% in 2023, and -2% this year. In contrast, the Trefis collection of 30 stocks has shown more stability and has outperformed the S&P 500 during this period.

The question remains whether UnitedHealth will continue to face challenges similar to those experienced in 2023 and 2024 or if it will rebound strongly in the coming months. From a valuation perspective, analysts suggest that UNH stock has the potential for growth. The share price is estimated to reach $606, indicating about a 20% upside from its current value of $500. The stock is currently trading at a P/E ratio of 18x, down from a four-year average of 22x.

While some adjustments to the valuation multiple may be necessary due to ongoing concerns about high medical costs, the recent price dip is viewed as a favorable entry point for investors looking at long-term growth opportunities.