Business

Verona Pharma Shares Receive Positive Analyst Ratings and Predictions

NEW YORK, NY — Shares of Verona Pharma PLC American Depositary Share (VRNA) have received an average recommendation of “Buy” from twelve analysts currently covering the company. Recent reports indicate that these analysts have set a 12-month target price of $107.36 for the stock.

On April 28, Cowen initiated coverage on Verona Pharma, issuing a “buy” rating. Shortly after, Wolfe Research rated the stock as “outperform” and targeted a price of $170.00. Roth Capital maintained a “buy” rating while increasing their target price to $116.00, up from $92.00, on June 18. Meanwhile, Piper Sandler also set a $160.00 target price and gave an “overweight” rating on June 23. Most recently, Wells Fargo increased their target price from $107.00 to $138.00 and provided an “overweight” rating on June 20.

As of Friday, VRNA opened at $91.18. The stock has a 50-day simple moving average of $81.23 and a 200-day moving average of $65.74. Its market capitalization stands at $7.76 billion, with a negative price-to-earnings ratio of -45.59, and it experiences low volatility with a beta of 0.24. VRNA has fluctuated between a 52-week low of $15.56 and a high of $99.01.

Verona Pharma recently reported its quarterly earnings on April 29, revealing earnings per share of $0.27, surpassing consensus estimates of -$0.22. The company’s revenue for the quarter amounted to $98.65 million, significantly exceeding the expected $41.47 million. Analysts forecast that Verona Pharma will post earnings of -$1.95 per share for the current fiscal year.

In insider trading news, the General Counsel sold 80,000 shares on June 16 at an average price of $11.53, totaling $922,400. Following this transaction, they own 359,999 shares valued at $4.15 million. The CFO, Mark W. Hahn, sold 400,000 shares on June 11 for $4.56 million, resulting in a 3.15% decrease in their ownership.

Hedge funds continue to increase their positions in Verona Pharma. NBC Securities Inc. purchased a stake valued at around $34,000 recently. Additionally, Geneos Wealth Management raised its stake by 44.2%. As of now, institutional and hedge fund investors control 85.88% of the company’s stock.

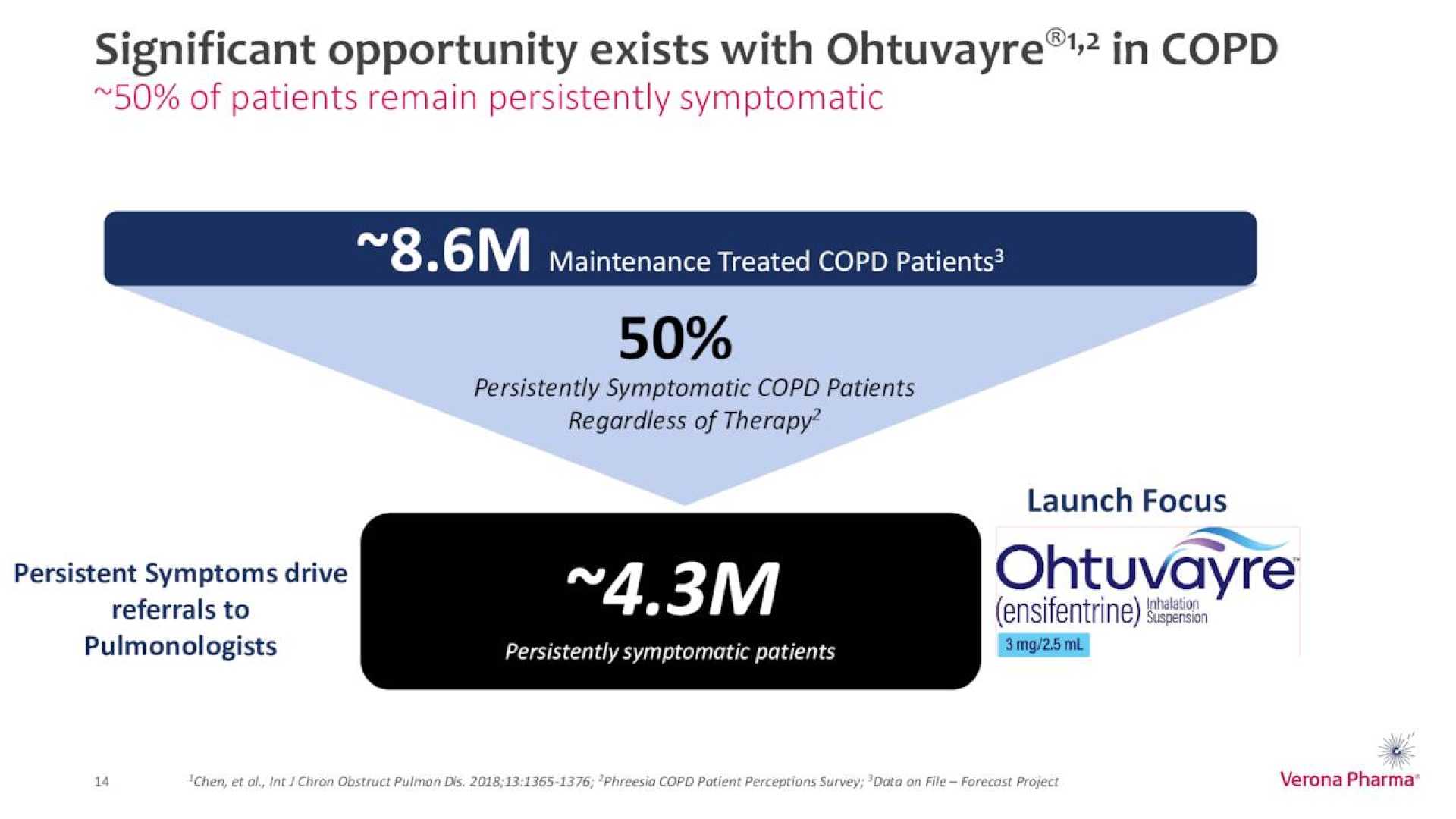

Verona Pharma is a clinical-stage biopharmaceutical firm dedicated to developing treatments for respiratory diseases. Its primary product candidate, ensifentrine, is a dual inhibitor of phosphodiesterase (PDE) 3 and PDE4. It is currently undergoing Phase 3 clinical trials to treat chronic obstructive pulmonary disease, asthma, and cystic fibrosis.