Business

Average Mortgage Rate Drops Slightly but Remains High at 6.808%

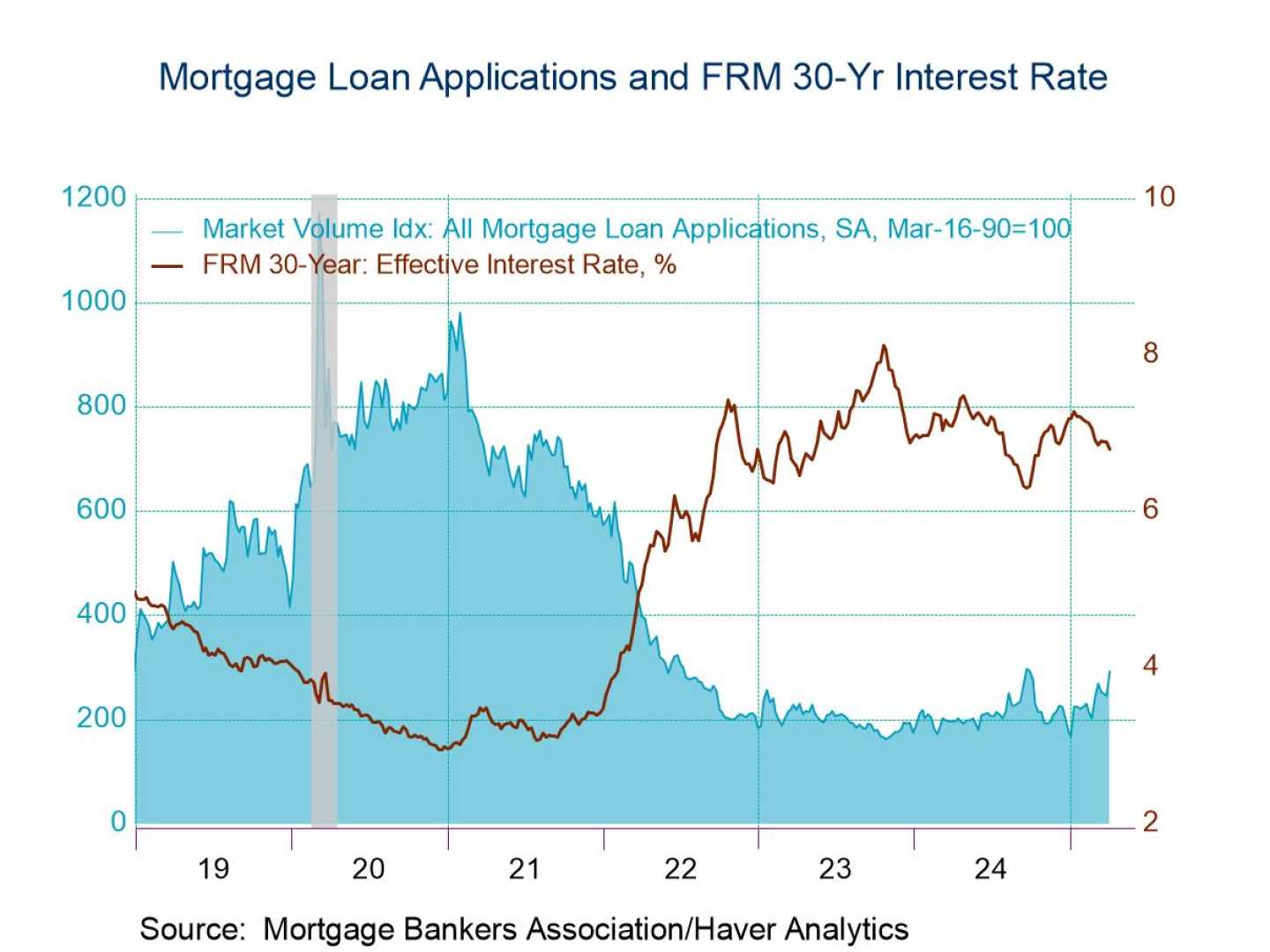

Washington, D.C. – The average interest rate for a 30-year, fixed-rate mortgage loan in the U.S. is currently 6.808%, according to Optimal Blue, a mortgage data company. This represents a small decrease of roughly 1 basis point from the previous week.

Rates have fluctuated significantly over the past year. Many homeowners have experienced a pinch as rates approached 7%, especially after a brief dip when the Federal Reserve began cutting the federal funds rate last September. Despite hopes for further drops, rates surged past 7% again by January 2025, a noticeable increase from the record low of 2.65% seen in January 2021.

Experts indicate that unless there is another major economic crisis, rates in the 2% to 3% range may not be seen again. However, rates around 6% are achievable if inflation is controlled and lenders gain confidence in the economic outlook. There was a momentary dip below 6.5% earlier this year, but rates quickly rebounded.

The lingering concern over U.S. economic policy, particularly from President Donald Trump, has added uncertainty to the housing market. High mortgage rates have left homebuyers feeling trapped, especially as many homeowners are reluctant to sell and lose their pandemic-era low rates, a scenario commonly referred to as the “golden handcuffs.”

While economic variables like inflation and national debt affect interest rates, consumer profiles play a key role. Applicants with strong credit scores may benefit more from conventional loans, while those with lower scores may find FHA loans a better option.

Overall, savvy shoppers are encouraged to compare rate quotes from multiple lenders, as doing so could save them $600 to $1,200 annually. This strategy is especially valuable in a high-interest rate environment.

The mortgage rate landscape remains dynamic, shaped by both macroeconomic factors and individual choices, making it crucial for potential homebuyers to stay informed and proactive.