Business

U.S. Government Considers 10% Stake in Intel Amid Market Volatility

WASHINGTON, D.C. — The Trump administration is exploring the possibility of acquiring a 10% equity stake in Intel, valued at around $10.5 billion, by converting portions of the company’s $10.9 billion in federal grants from the 2022 CHIPS Act into ownership shares. This plan, if finalized, would position the U.S. government as Intel’s largest shareholder.

The proposed plan underscores a growing interest in strengthening domestic semiconductor production and reducing reliance on foreign chip manufacturers, especially those in Asia. A government stake could provide Intel with much-needed capital, potentially stabilizing its finances amidst increasing competition.

Market reactions have been mixed, with Intel shares initially surging by nearly 9% following news of the potential investment before dropping 4% on subsequent reports. The uncertainty around the stake reflects investor concerns about governance risks and the potential for increased political oversight.

Citing unnamed White House sources on August 11, Bloomberg reported that discussions on the stake are ongoing. However, it remains unclear if the administration has finalized plans or discussed them with Intel and other stakeholders.

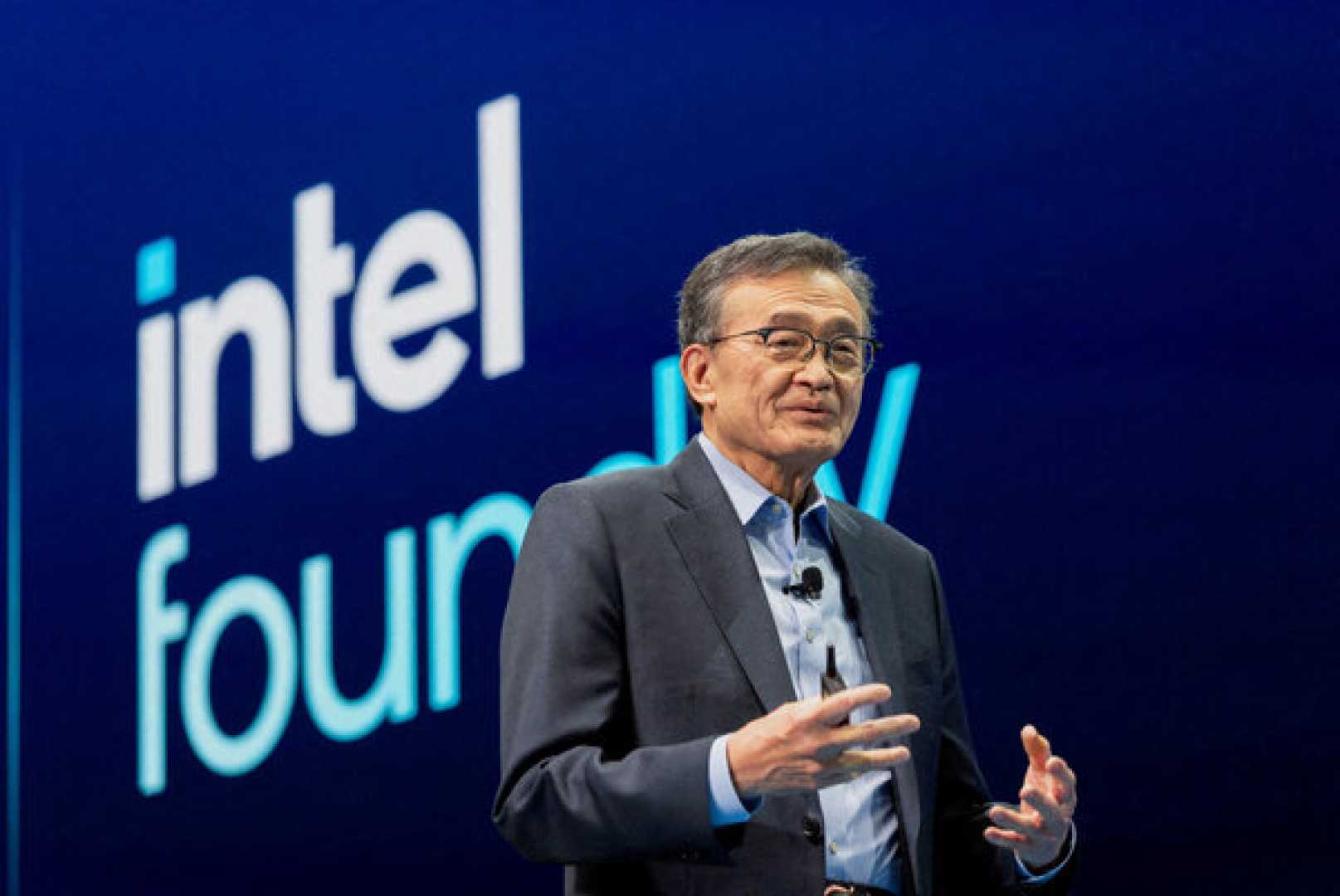

Intel’s CEO Lip-Bu Tan met with President Trump last week, shortly after Trump called for changes in the company’s leadership due to Tan’s past ties to China. Following their discussion, Trump seemed to shift his stance, praising Tan’s leadership.

Intel has historically been a leader in the U.S. semiconductor industry but has faced challenges in advanced chip manufacturing in recent years. The company is currently working on several projects linked to the CHIPS Act, which aims to revitalize U.S. manufacturing.

The CHIPS and Science Act has allocated $39 billion to support semiconductor manufacturing projects across multiple American companies, including GlobalFoundries and Nvidia. However, implementation has faced scrutiny, especially regarding Intel’s delayed expansions, such as its Ohio fabrication plant.

Some analysts argue that government intervention could help reinvigorate Intel, especially as the U.S. seeks to bolster its technological capabilities amidst rising competition from China. Others caution that deeper systemic issues may require more than just funding to address effectively.

With the proposed stake possibly redefining corporate governance at Intel, how it unfolds could have broader implications for the semiconductor industry and government-private sector relations.