Business

AMD’s Struggles Signal Possible Turnaround Amid Market Challenges

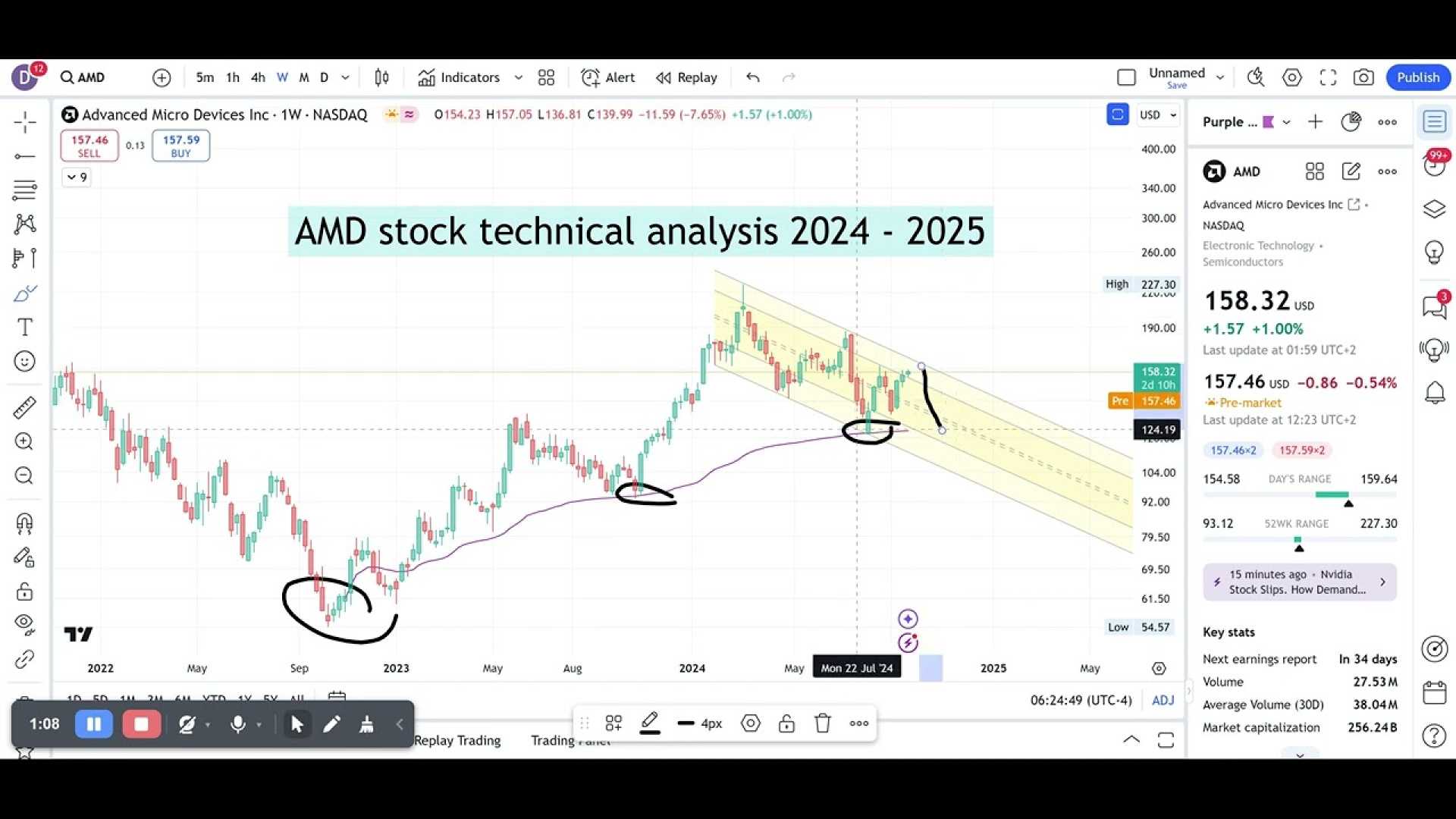

NEW YORK, March 8, 2025 — Advanced Micro Devices (AMD) is experiencing a significant decline in stock prices, plummeting 1.48% on March 7, 2025, to close at $100.31. Despite initial excitement about its potential growth in the artificial intelligence (AI) sector, the company has struggled to capture substantial market share, particularly against competitor Nvidia.

Over the last year, AMD’s stock has suffered a staggering decrease of over 50%, in stark contrast to Nvidia’s performance, which has seen gains exceeding 50%. This disparity raises concerns about AMD’s competitive positioning in the growing data center market.

AMD’s most recent fiscal reports reveal a complicated financial landscape. In the fourth quarter ending December 28, 2024, data center revenue increased by 69% year-over-year to $3.86 billion; however, Nvidia’s comparable revenue surged by 93% to $35.6 billion, underscoring AMD’s ongoing struggles in this critical segment. Partnering with AI applications, Nvidia continues to dominate the sector, leading analysts to question AMD’s growth strategy.

“The thesis last year suggested that AMD could take market share from Nvidia,” said an industry analyst. “However, that has not materialized, and AMD must address its lagging performance factors.”

Client revenue, which represents sales of CPUs and GPUs for consumers and enterprises, did rise by 58% year-over-year. Yet, this increase may not be sufficient to bolster the company’s overall financial health in what has become an ever-competitive commodity market, where performance upgrades are erratic.

In additional segments, AMD reported a 59% year-over-year decline in gaming revenue—a category vital for the company’s growth trajectory—as well as a 13% drop in embedded processor revenue. Overall, AMD’s revenue growth stood at a modest 24%, significantly below Wall Street expectations, contributing to the negative sentiment surrounding the stock.

Given these complexities, investors are urged to consider AMD’s current valuation. With a forward price-to-earnings (P/E) ratio of 21.2, the company appears to be relatively inexpensive. This pricing is comparable to the S&P 500’s average forward P/E ratio of 21.6, suggesting that AMD may offer opportunities for growth moving forward.

“While AMD may never fully catch up to Nvidia,” noted another financial expert, “its underlying business is solid enough to warrant investor consideration, especially given the anticipated revenue growth of 23% in 2025 and 21% in 2026.”

As AMD navigates these challenges, many analysts are watching closely to see if the company can leverage its assets to achieve a more favorable valuation as the year progresses.