Business

Cava Group Offers Growth but Not Millionaire Returns

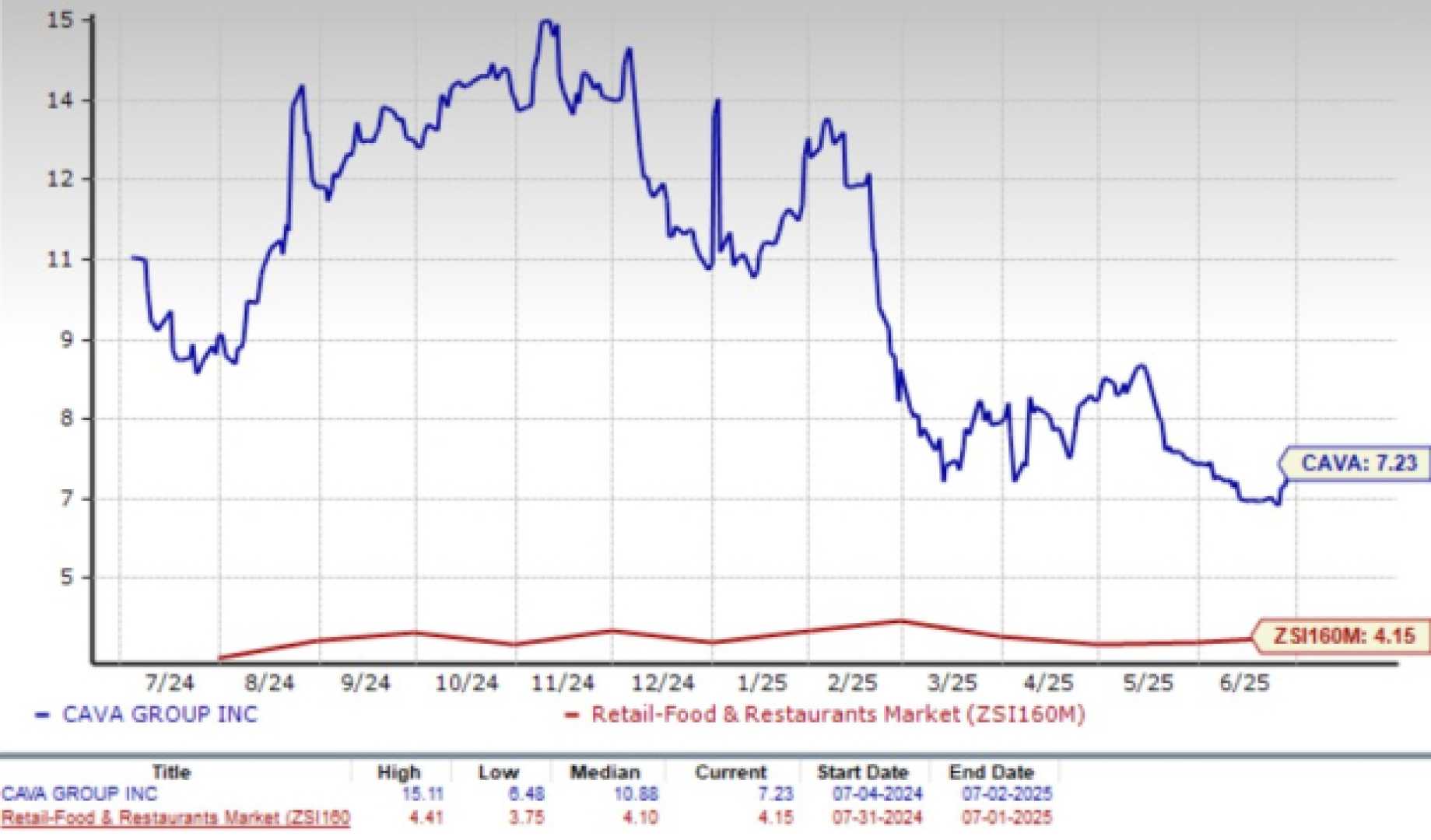

New York, NY – As of July 24, 2025, Cava Group‘s stock is trading at $86.65, reflecting a 5.50% decrease on the day. This decline follows discussions regarding its growth potential and market position relative to established players like Chipotle Mexican Grill.

Cava Group operates a chain of Mediterranean fast-casual restaurants. It aims to capitalize on the growing demand for healthy fast food. The chain has expanded to 382 locations across 26 states and the District of Columbia. Plans are in place to open between 64 and 68 new restaurants in the current fiscal year, contributing to a long-term goal of reaching 1,000 locations by 2032.

In fiscal Q1 2025, which ended April 25, Cava reported revenues of $329 million, marking a 28% increase compared to the same period last year. The number of restaurant openings has played a significant role in this growth, with an 18% increase in locations. Analysts note that this trend showcases rising consumer interest, further indicated by a 33% revenue increase in fiscal 2024.

Cava’s profitability is also noteworthy; the company generated nearly $26 million in the first quarter of fiscal 2025, nearly double its earnings from the previous year. Analysts predict that Cava could surpass $130 million in earnings for the entire fiscal year 2024.

However, despite these positive indicators, Cava’s current market capitalization of $10 billion is significantly less than Chipotle’s $72 billion and McDonald's $213 billion. If an investor were to purchase $10,000 in Cava stock now, its value could grow to $72,000 if it matched Chipotle’s market cap, or $213,000 if it ever reached McDonald’s level, still falling short of the $1 million milestone.

Cava’s price-to-earnings (P/E) ratio is currently at 72, outpacing Chipotle’s 48 and McDonald’s 26. This may limit its growth potential unless they manage to lower their P/E ratio closer to that of the S&P 500’s average of 30.

While growth is evident, analysts caution investors about unrealistic expectations for becoming millionaires through Cava Group stocks alone. The projected trajectory remains promising, yet achieving substantial profit might require considerable investment and ongoing successful growth.