News

Education Department Halts Key Student Loan Forgiveness Applications Amid Court Ruling

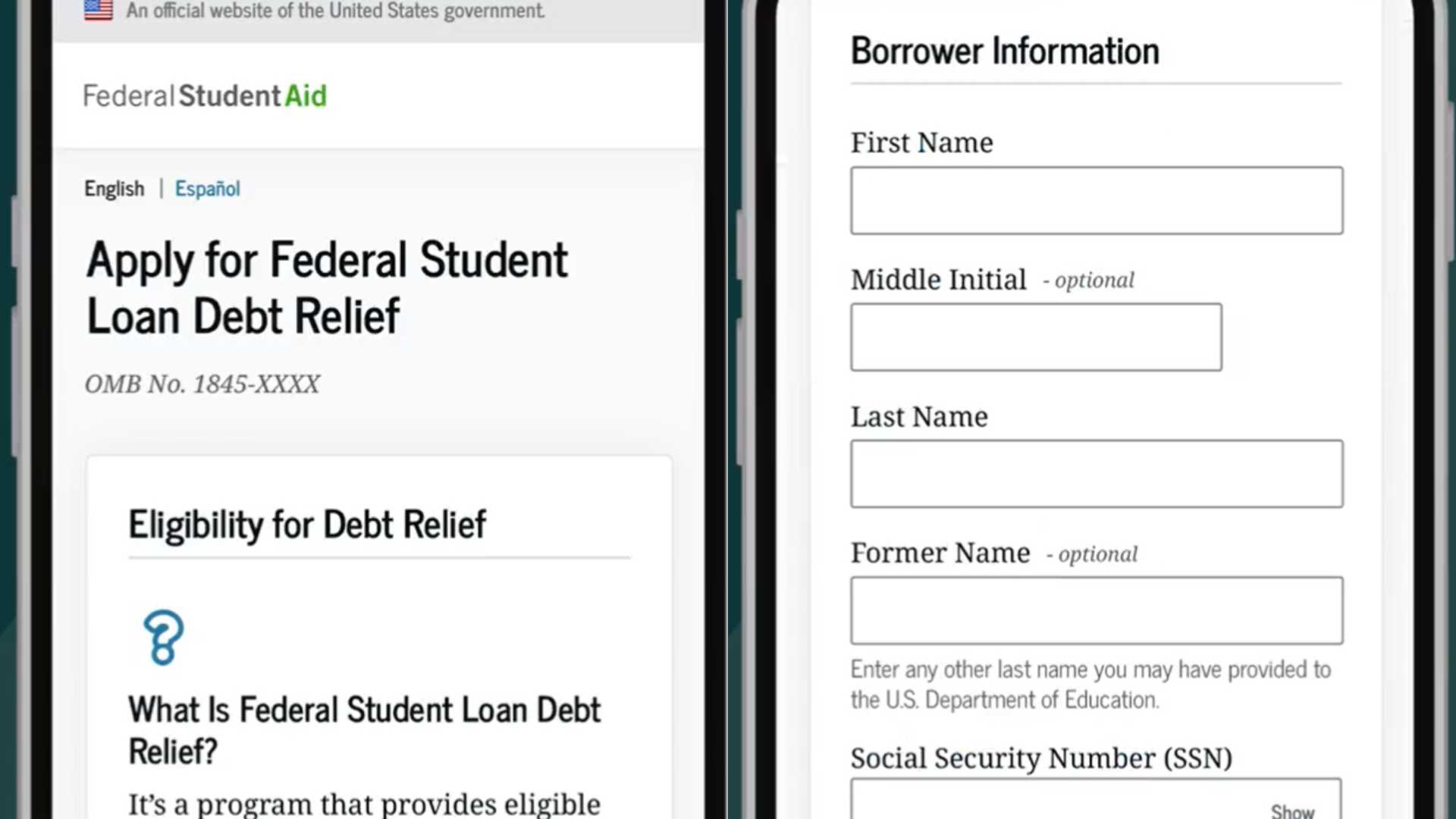

WASHINGTON, D.C. — The U.S. Department of Education has temporarily removed vital online applications for income-driven repayment (IDR) plans and federal Direct loan consolidation, following a significant ruling by the 8th Circuit Court of Appeals that blocks key components of these programs. The decision has left millions of borrowers seeking relief from their student loan debts in a state of confusion and urgency.

The removal, announced on February 24, 2025, impacts applications critical for borrowers looking to reduce their payment amounts and achieve loan forgiveness after 20 or 25 years of consistent payments. The affected IDR plans include Income-Contingent Repayment (ICR), Income-Based Repayment (IBR), Pay As You Earn (PAYE), and Saving on a Valuable Education (SAVE), allowing borrowers to make payments based on income and family size. The Department of Education had not issued a formal announcement regarding the shutdown.

A notice on the Department’s IDR application portal reads, “A federal court issued an injunction preventing the U.S. Department of Education from implementing the Saving on a Valuable Education (SAVE) Plan and other income-driven repayment (IDR) plans. As a result, the IDR and loan consolidation applications are currently unavailable.” The decision is a direct result of litigation involving the SAVE plan filed by several Republican-led states.

The 8th Circuit’s ruling extended an existing injunction against the SAVE plan, originally enacted by the Biden administration in 2023. The lawsuit challenged the federal government’s authority to offer extensive loan forgiveness under various IDR programs. With the online application removed, borrowers have been left with limited options for seeking lower payments or consolidating their loans, which is crucial for eligibility under the Public Service Loan Forgiveness (PSLF) program.

“This was a decision by the Trump administration, and it will inflict massive pain on millions of working families,” said Persis Yu, deputy executive director and managing counsel of the Student Borrower Protection Center. “Millions are already in forbearance or struggling to understand the implications of these sudden changes.”

For many borrowers, the online IDR application was essential for entering new repayment plans or recertifying their income annually, a requirement that directly affects their monthly payments. Borrowers who fail to recertify may experience significant increases in their payment amounts. The consolidation application also plays a vital role for borrowers looking to exit from default status or transition into PSLF eligibility.

While the online applications are down, borrowers can still submit paper applications; however, this process may prolong existing delays in processing. If the recent removal of the applications indicates another suspension in processing, it could lead to a substantial backlog similar to what occurred during prior court interventions.

“There’s a real fear that returning to a phase of processing delays could wreak havoc on borrowers trying to navigate their repayment plans,” said Mark Kantrowitz, an expert on student financial aid. “The Department of Education’s guidance on IDR plans is already unclear, and many borrowers are in a precarious position.”

The situation is further complicated by ongoing litigation. The 8th Circuit’s ruling not only affects the SAVE plan but also raises doubts about the persistence of forgiveness avenues under related programs like ICR and PAYE. The court indicated that Congress did not authorize forgiveness under several IDR plans, despite decades of operational guidance suggesting otherwise.

The Department of Education had initially removed the online applications in August 2024 when the court issued a preliminary injunction but later resumed processing after backlogs mounted. Current borrowers are encouraged to explore their options under the other IDR plans available on paper until further developments occur.

As of now, it remains unclear whether the Department of Education will provide clarity or updates regarding the status of these applications, leaving borrowers in uncertainty about their repayment options. As the political landscape shifts and further challenges develop within the student loan repayment system, advocates for borrowers are urging clarity and responsiveness from the Department.