Business

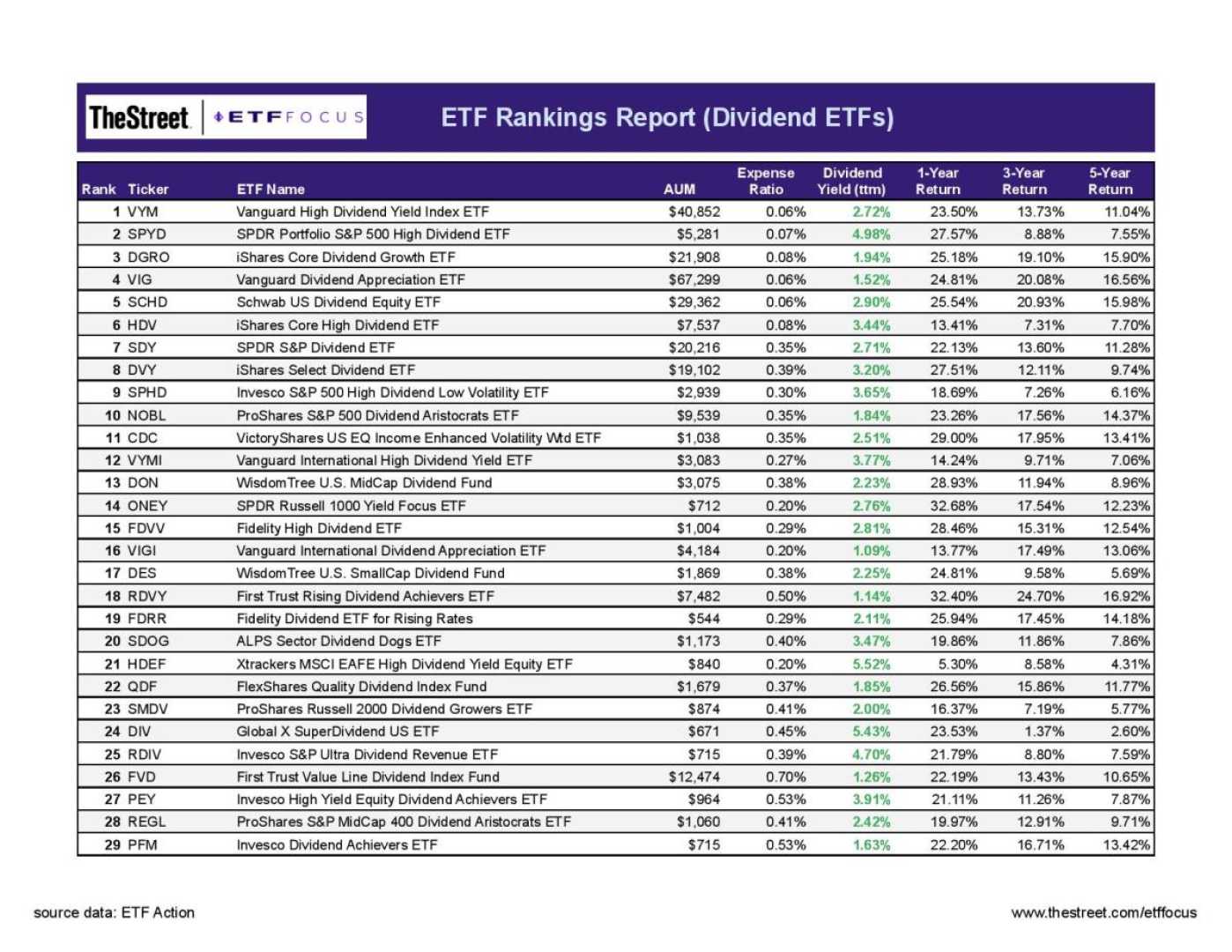

Explore the Best Dividend ETFs for Smart Investing

New York, NY — For public companies, issuing cash dividends is a fundamental way to demonstrate financial stability to shareholders. Established companies often share profits with investors, effectively rewarding them for their support. For investors, dividends serve as a promising income source, particularly appealing when combined with well-selected investments.

Exchange-Traded Funds (ETFs) that focus exclusively on dividend-paying stocks offer an efficient investment strategy. Fund managers choose companies based on key criteria, including size, industry, and dividend history. This means every stock within the ETF shares similar characteristics, making it a convenient choice for retail investors eager for instant diversification at a minimal cost.

As of July 24, 2025, many dividend ETFs offer unique benefits. For instance, VIG tracks the NASDAQ U.S. Dividend Achievers Select Index, focusing on companies that have boosted dividends consistently for a decade. VYM, another popular ETF, focuses on high-yield dividend payers excluding Real Estate Investment Trusts (REITs). Moreover, SCHD, which tracks the Dow Jones U.S. Dividend 100 Index, emphasizes the quality and sustainability of dividend payments.

SDY, DVY, and NOBL are additional ETFs that focus on companies with long-term dividend growth. SDY screens for companies that have increased dividends for at least 20 consecutive years, while NOBL targets those with a history of 25-year increases. According to Hartford Funds, dividends have contributed approximately 34 percent to total returns in the market.

Investing in dividend stocks is often less risky. Well-established companies tend to be cash-rich, allowing them to sustain regular payments, unlike those focusing solely on rapid growth. When considering dividend ETFs, it’s essential to evaluate factors such as investment goals and the risk profile associated with specific funds.

Moreover, dividend payments typically occur quarterly, and to qualify, shareholders must own stocks by the ex-dividend date. Investors closely monitor dividend yields, calculated as the annual payment divided by the stock price, expressed as a percentage. For example, if a company pays an annual dividend of $4 and has a share price of $100, the yield is 4 percent, equating to a $1 quarterly distribution.

However, high yields can signal potential issues. A significant yield may indicate a company’s stock has dropped, warranting careful analysis of the financial health behind the yield. Regardless, dividends can enhance investment returns but should not be the sole reason to invest.

In conclusion, dividend ETFs offer a pathway to diversify investments and secure more stable income. With strategic selection, they can enrich investment portfolios by tapping into reliable income streams from well-established companies.