Business

Federal Reserve Faces Tough Decisions Amid Rising Inflation and Tariff Effects

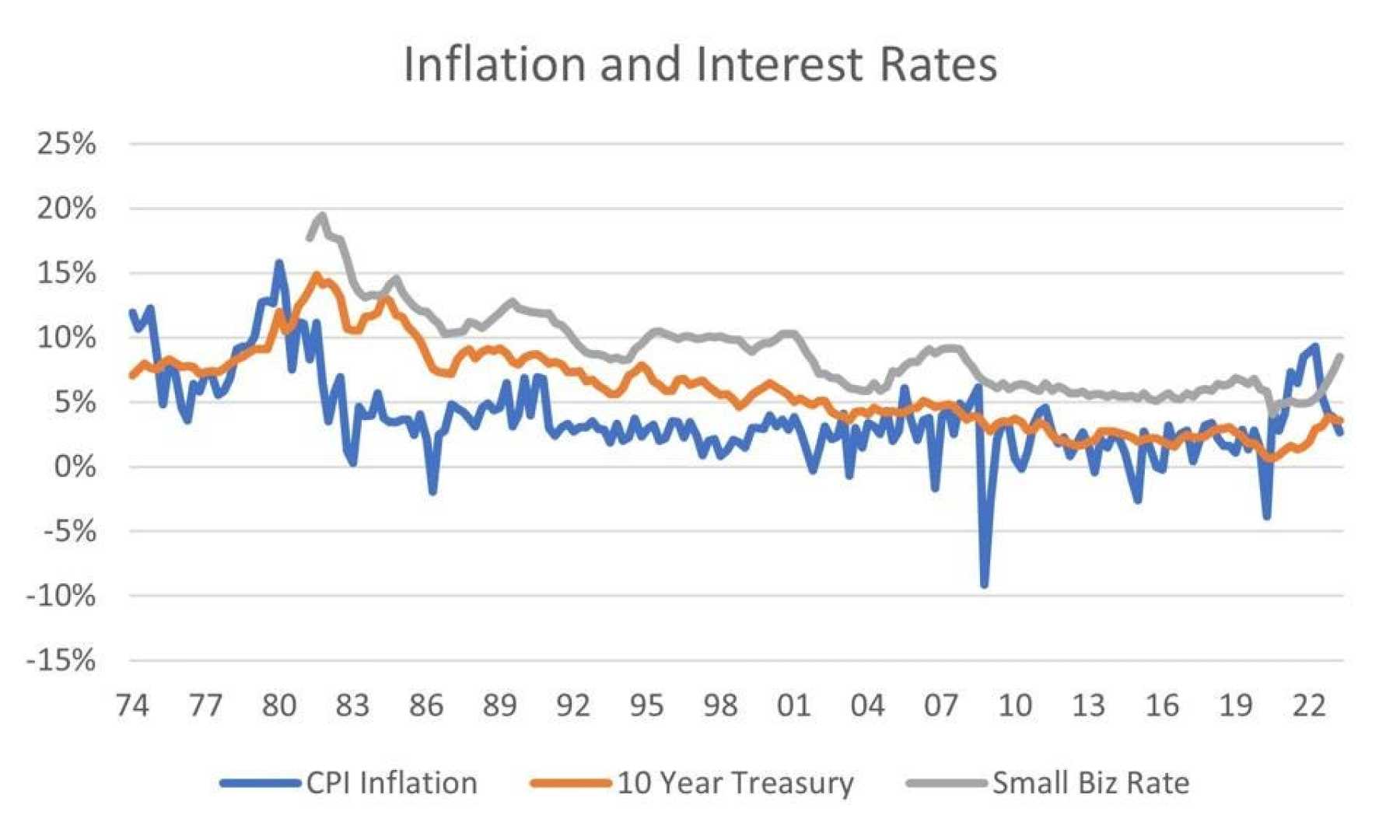

WASHINGTON, D.C. — The Federal Reserve is preparing for critical decisions next week as inflation data indicates rising prices for August. Economists predict the Consumer Price Index (CPI) will show a 2.9% annual increase, up from 2.7% in July, largely attributed to tariffs imposed by the Trump administration.

The Bureau of Labor Statistics is set to release the CPI report on Wednesday, with expectations of a 0.3% month-to-month rise. Core CPI, which excludes food and energy prices, is also predicted to rise by 0.3%, putting further pressure on the Fed’s target inflation rate of 2%.

James Knightley, chief international economist at ING, noted, “In aggregate, it’s still hotter than the Fed would like to see. They’ll be looking at the broader picture.” Knightley highlighted that the U.S. economy is primarily service-based, indicating underlying inflation pressures may be from goods influenced by tariffs rather than long-term price increases.

Goldman Sachs economists indicated that while tariff-driven price increases are expected, they predict that core inflation could decline due to weakening trends in housing and labor markets. “Aside from tariff effects, we expect underlying trend inflation to fall further,” stated the economists in a commentary.

Concerns are also growing regarding the economic impact of rising prices, especially as household budgets are squeezed due to inflation. Knightley warned, “When you get that combination, concerns about prices, incomes, and wealth are pretty toxic for growth.”

Additionally, stock markets reacted positively amid speculation that the Fed might cut interest rates. The Nasdaq Composite gained 0.5%, while the S&P 500 and Dow Jones experienced modest increases. Market analysts cite weakening labor market data as fueling a shift towards potential rate cuts.

As businesses prepare for continued inflationary pressures, the upcoming CPI report is poised to inform the Fed’s approach to monetary policy. The Fed’s meeting next week is set against a backdrop of uncertainty with inflation making significant strides away from its target.

“If CPI comes in above 3%, it would reaffirm that inflation has moved farther from the Fed’s target,” highlighted Katie Klingensmith, chief investment strategist at Edelman Financial Engines. The outcomes of these economic signals will be closely monitored by investors and policymakers alike.