Business

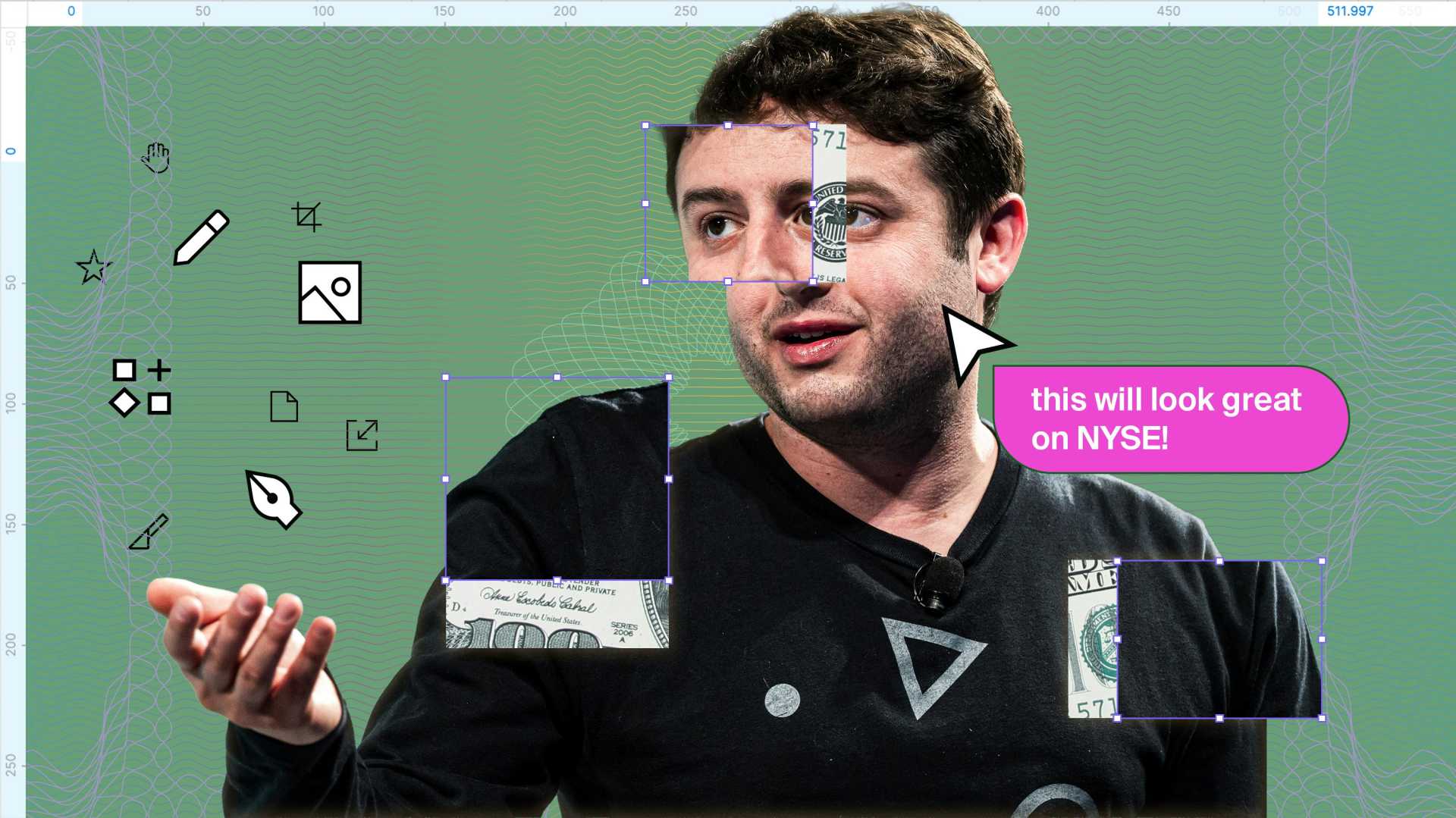

Figma Prices IPO at $33, Set to Trade as ‘FIG’

San Francisco, CA — Figma Inc., known for its design software, announced its initial public offering (IPO) priced at $33 per share on July 30, 2025, exceeding earlier expectations. The San Francisco-based company raised over $1.2 billion from the sale of 36.9 million shares, indicating strong investor demand.

The IPO values Figma at around $19.3 billion, bringing it close to the $20 billion acquisition deal it had agreed upon with Adobe before regulatory issues halted the merger in 2023. Adobe had provided Figma with a $1 billion breakup fee after the deal fell apart.

Figma was founded in 2012 by CEO Dylan Field and Evan Wallace and has grown its user base to approximately 13 million, including 95% of Fortune 500 companies. This growth is attributed to its real-time collaboration features, which allow multiple users to work on designs simultaneously.

In its latest financial report, Figma recorded a 40% increase in revenue for the quarter ending June, rising from $177.2 million to an expected range of $247 million to $250 million year-over-year. The company’s operating profits also showed improvement, with estimates predicting a range between a loss of $500,000 to a profit of $2.5 million.

Figma’s revenue for the first quarter of 2025 rose by 46% to $228.2 million, and its net income tripled to $44.9 million. The company has been expanding its product offerings, launching six new cloud-based tools since 2021.

Field, who holds 56.6 million shares and controls an additional 26.7 million in voting rights, remains the largest investor, while Index Ventures holds 17% of shares outstanding. Other prominent investors include Greylock, Kleiner Perkins, and Sequoia Capital.

Figma’s IPO is set to begin trading on the New York Stock Exchange under the ticker symbol “FIG” on July 31, 2025, with underwriting led by Morgan Stanley, Goldman Sachs, Allen & Company, and J.P. Morgan.