Business

Gold Prices Surge Amid Challenges to the US Dollar

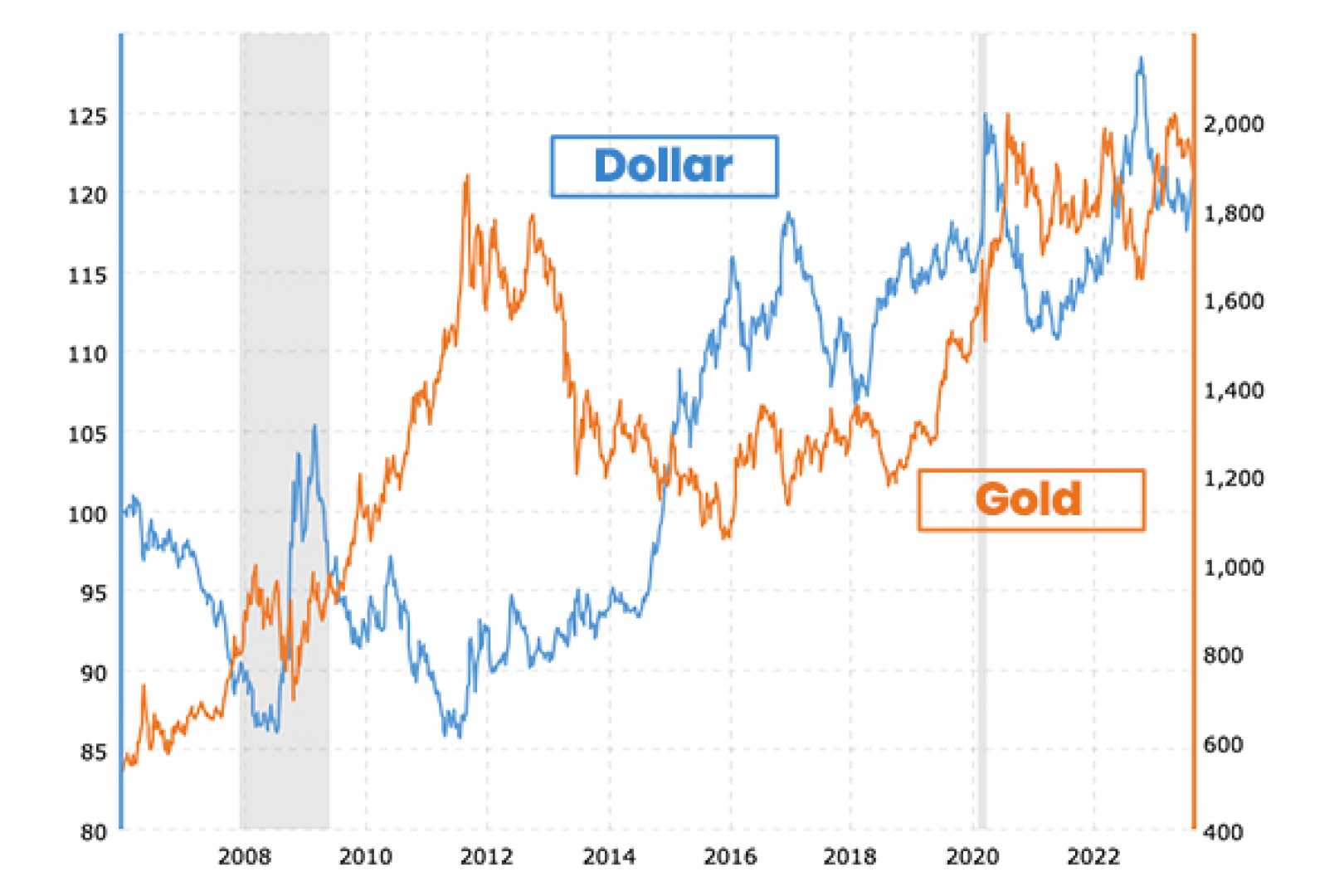

ROME, Italy — Gold prices are on the rise, signaling potential shifts in the international monetary system. This change comes as geopolitical tensions affect trust in the U.S. dollar (USD) and its role as the world’s leading currency.

Historically, countries have relied on the currency of the world’s dominant power for global payments. The USD, since it was untethered from gold in 1971, has remained the primary global currency, supported by the strength of U.S. capital markets and military power.

However, the recent surge in gold prices may indicate a growing sentiment that the international monetary system is moving from a U.S.-centric model to a more multi-polar one. This trend was evident following the Russian invasion of Ukraine, which led to sanctions that limited Russia‘s access to its U.S. and European currencies.

As nations like Russia pivot to gold and other currencies, there is discussion about alternatives like a BRICS currency, although it has faced challenges and lack of consensus among member states. “Russia has started diversifying its reserves into gold and other currencies,” said a finance analyst.

Additionally, the European Central Bank (ECB) is considering using the Euro as a global currency, but it encounters issues of fragmentation in financial markets. Central banks globally are buying gold to hedge against currency risks.

The political landscape in the U.S. has also changed, as the current administration’s policies have shifted the country’s traditional approach to a stable international trading system. This environment has increased private investment in gold as a safe asset.

Investor interest has surged, particularly after significant tariff announcements that suggest a possible economic slowdown, known as stagflation. Demand for gold Exchange Traded Funds (ETFs) has increased significantly, reflecting investor uncertainty.

Despite these changes, experts believe that the USD is likely to maintain its status for the foreseeable future, as no single currency has the capacity to replace it entirely.

As gold prices continue to climb, this could mark the beginning of a gradual transition in how global currencies operate.