Business

Markets Strengthen as Q4 Earnings Season Approaches

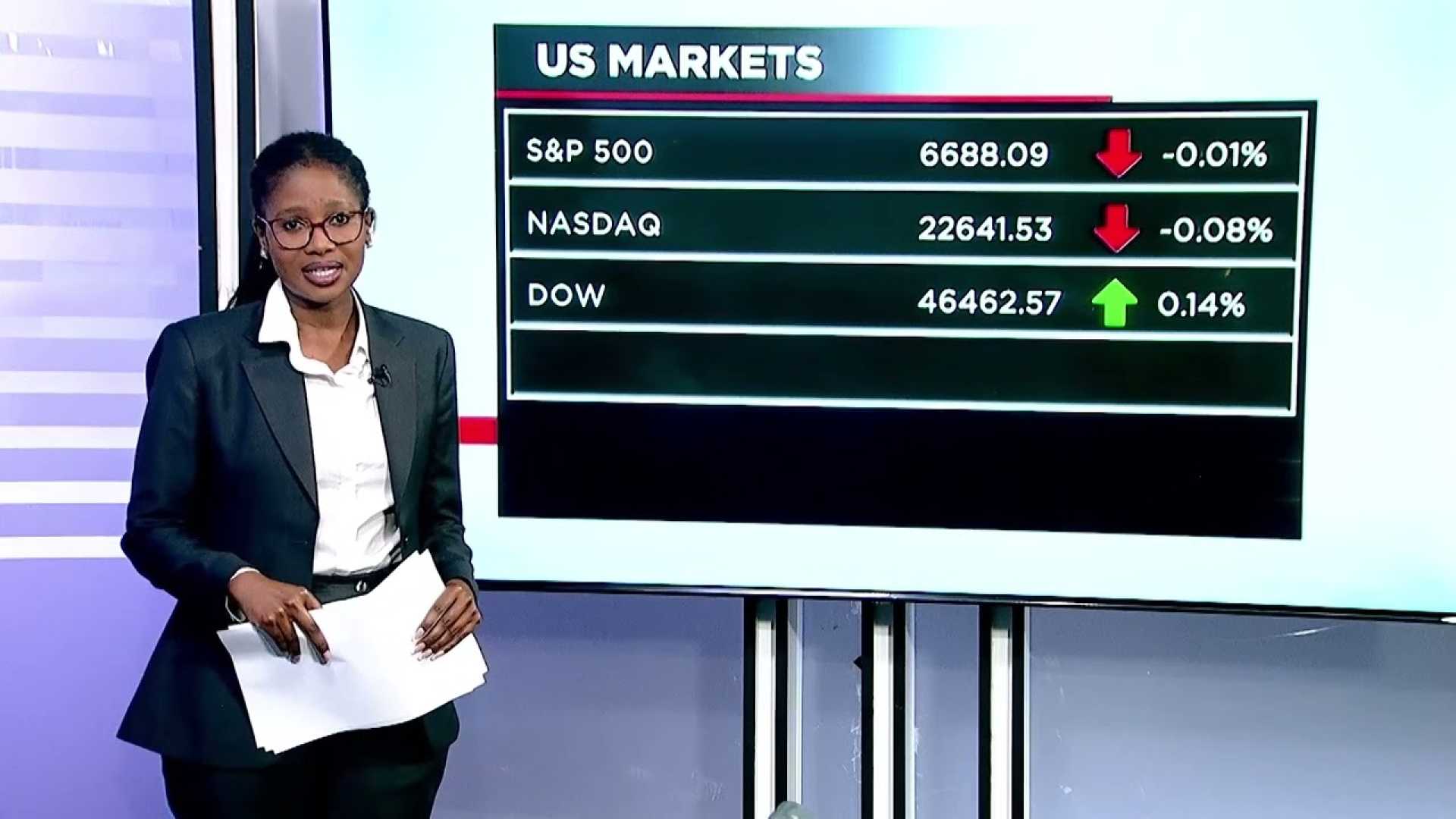

CHICAGO, IL — U.S. markets ended the week on a positive note, closing out the third quarter with gains in technology, healthcare, and small-cap stocks. Investor sentiment remained strong leading into the fourth-quarter earnings season, which kicks off shortly.

Key growth segments, including gold investments, showed impressive performance over the first three quarters of 2025. The SPDR Gold MiniShares Trust (GLDM) led the way, up 47%, outperforming both global equities and bonds. The increase in gold prices reflects ongoing concerns about geopolitical uncertainty and a shift in investor strategies for diversification and hedging.

Among equities, the iShares MSCI Emerging Markets ETF (EEM) surged 27.8% year-to-date, while the iShares MSCI EAFE ETF (EFA) rose 23.5%. This trend indicates stronger performance in non-U.S. markets, as discussed by global strategists in light of ongoing de-dollarization narratives.

Small-cap stocks, represented by the iShares Russell 2000 ETF (IWM), saw a rebound with a gain of 12.1% in the third quarter, although they still lag behind large-cap benchmarks for the year. Following this pattern, growth stocks continue to outshine value stocks, as indicated by the performance of the Vanguard Growth ETF (VUG) compared to the Vanguard Value ETF (VTV).

In sector performance, healthcare (XLV) was the top performer this past week, with a strong 6.6% gain driven by investments in defensive growth areas. Utilities (XLU) also saw gains above 2%, while Communication Services (XLC) and Consumer Discretionary (XLY) struggled to keep pace.

Looking forward, attention will shift to the upcoming Q4 earnings releases from companies such as Constellation Brands (STZ), McCormick & Company (MKC), AZZ Inc. (AZZ), Applied Digital (APLD), and Apogee Industries (APOG). ValuEngine predicts a 13.2% gain for APLD over the next 12 months, while the S&P 500 ETF (SPLG) is expected to rise only 3.2%. APLD carries a VE Rating of 5 (Strong Buy), but it is important to note its high volatility and potential overvaluation risks.

For larger companies, UBS and Disney (DIS) are also projected as Strong Buys and are considered undervalued according to ValuEngine’s analysis. As the fourth quarter progresses, market focus will remain on earnings guidance, interest rate expectations, and ongoing rotations into defensive and international assets.