Business

Millennials Surge Ahead Financially in the 2020s

WASHINGTON, D.C. — A new wave of financial prosperity is sweeping through the millennial generation, with recent reports indicating that those born between 1981 and 1996 have outpaced both Generation X and baby boomers in wealth accumulation during the 2020s. A report from the Center for American Progress (CAP) highlights a remarkable 49% increase in the average wealth of Americans under 40 from the end of 2019 to the end of 2023, raising their inflation-adjusted average net worth to $259,000.

The CAP analysis shows that millennials, specifically, have doubled their wealth during this period. This stands in stark contrast to Generation X, whose wealth declined by 7%, and baby boomers, who saw a modest increase of just 4%.

“They’re doing better than we did,” remarked a senior fellow at CAP. “It’s every single category that has gone up,” referring to home equity, retirement savings, and investments in privately held businesses.

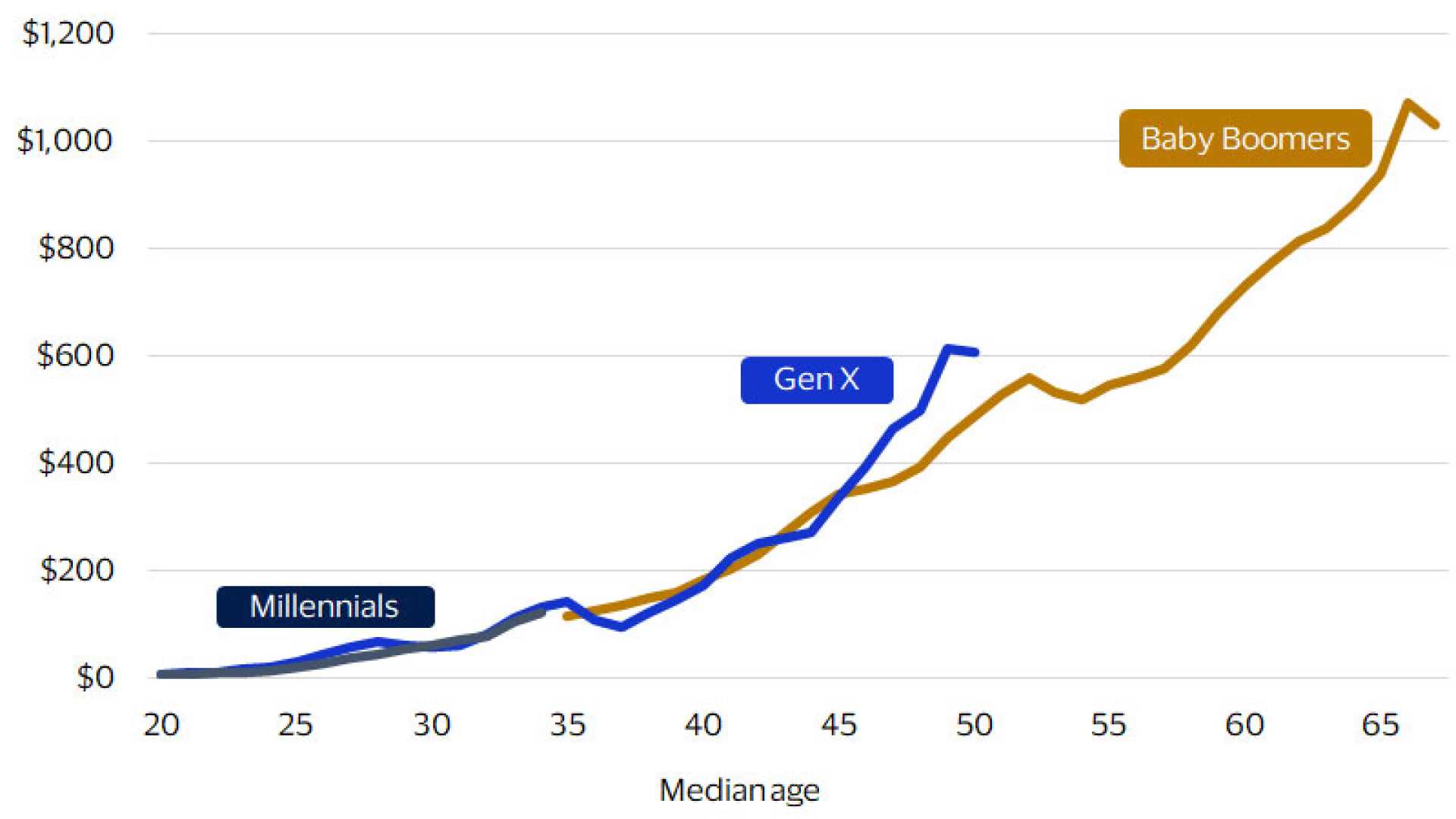

According to LendingTree, a personal finance site, millennials had a median net worth of $84,941 in 2022. This is notably higher than the median net worth of Generation X and baby boomers at the same ages, who had $78,333 and $58,101, respectively.

Millennials and Generation Z have demonstrated significant growth in several financial categories since 2019. The average housing wealth for households led by individuals under 40 increased by $22,000, while liquid assets saw an uptick of $9,000, and other financial assets such as stocks grew by $31,000.

Weller emphasized that it’s a broad spectrum of wealth that is increasing. “Homeownership has risen faster; wages have grown faster,” he noted, illustrating significant economic recovery moving on from the Great Recession.

Despite the positive trends, the financial story of millennials isn’t entirely rosy. Data from Money Management International reveals that millennials now represent 43% of new debt counseling clients, leading all generations. The average millennial client is burdened with approximately $30,000 in unsecured debt.

Federal Reserve data indicates that the debt among thirty-somethings has climbed to $4 trillion by the close of 2024, making them the second-highest indebted age group, following consumers in their 40s, who hold $4.7 trillion collectively.

While millennial financial landscapes have improved, wealth distribution reveals significant disparities. Over half of millennials are homeowners; however, rising property prices have made it challenging for many to enter the housing market. “Older millennials who bought into the housing market before everything got out of control are probably driving a fair amount of this overall net worth growth,” said Schulz from LendingTree.

Additionally, a report from Inequality.org shows that nearly 70% of millennial wealth is concentrated among the top 10% of the generation, leading to the characterization of millennials as the “most unequal generation” in U.S. history.

In summary, while millennials are breaking through previous financial barriers, the wealth gap continues to pose challenges, indicating that not all are thriving in the current economic climate.