Business

Regions Financial Reports Mixed Earnings Amid Market Challenges

BIRMINGHAM, Alabama – Regions Financial Corporation, a financial holding company, reported mixed earnings results for the first quarter of 2025 amid ongoing market challenges.

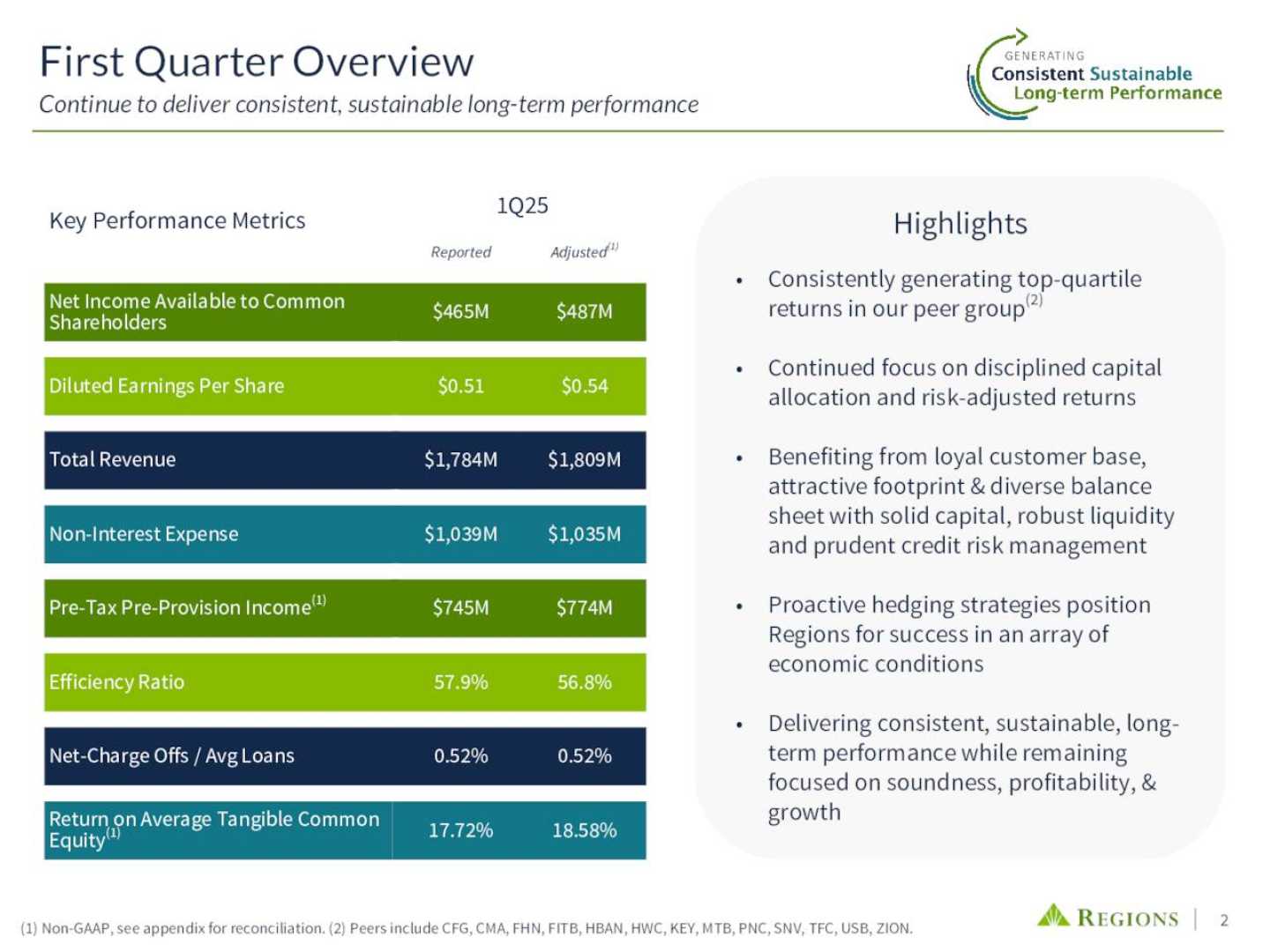

On April 17, the company announced an adjusted total revenue of $1.8 billion, which remained relatively stable compared to the same period last year. However, the net interest income rose slightly to $1.2 billion, while the total net interest margin declined by 3 basis points to 3.52%. This decrease was attributed to lower lending activity and loan spread compression.

Despite these challenges, Regions Financial’s adjusted earnings per share (EPS) increased by 22.7% year-over-year to $0.54, surpassing analyst expectations by 5.9%. For fiscal year 2025, analysts forecast a 5.2% growth in adjusted earnings, projecting EPS of $2.23.

Regions Financial’s stock has underperformed the broader market, declining 11.7% year-to-date, compared to a 4.3% drop in the S&P 500 Index. However, over the past year, the company has marginally outperformed the iShares U.S. Regional Banks ETF.

According to a report from Truist Securities on April 22, analyst Brian Foran lowered the price target on Regions Financial from $24 to $21. The mean price target stands at $24.38, suggesting a potential 17.3% upside. The highest target among analysts is $31, indicating a remarkable 49.2% potential increase.

Regions Financial continues to receive mixed reviews from analysts, with nine “Strong Buys,” two “Moderate Buys,” 11 “Holds,” and one “Strong Sell” among the 23 analysts covering the stock.