Business

SoundHound Stocks Could Double Despite Recent Decline

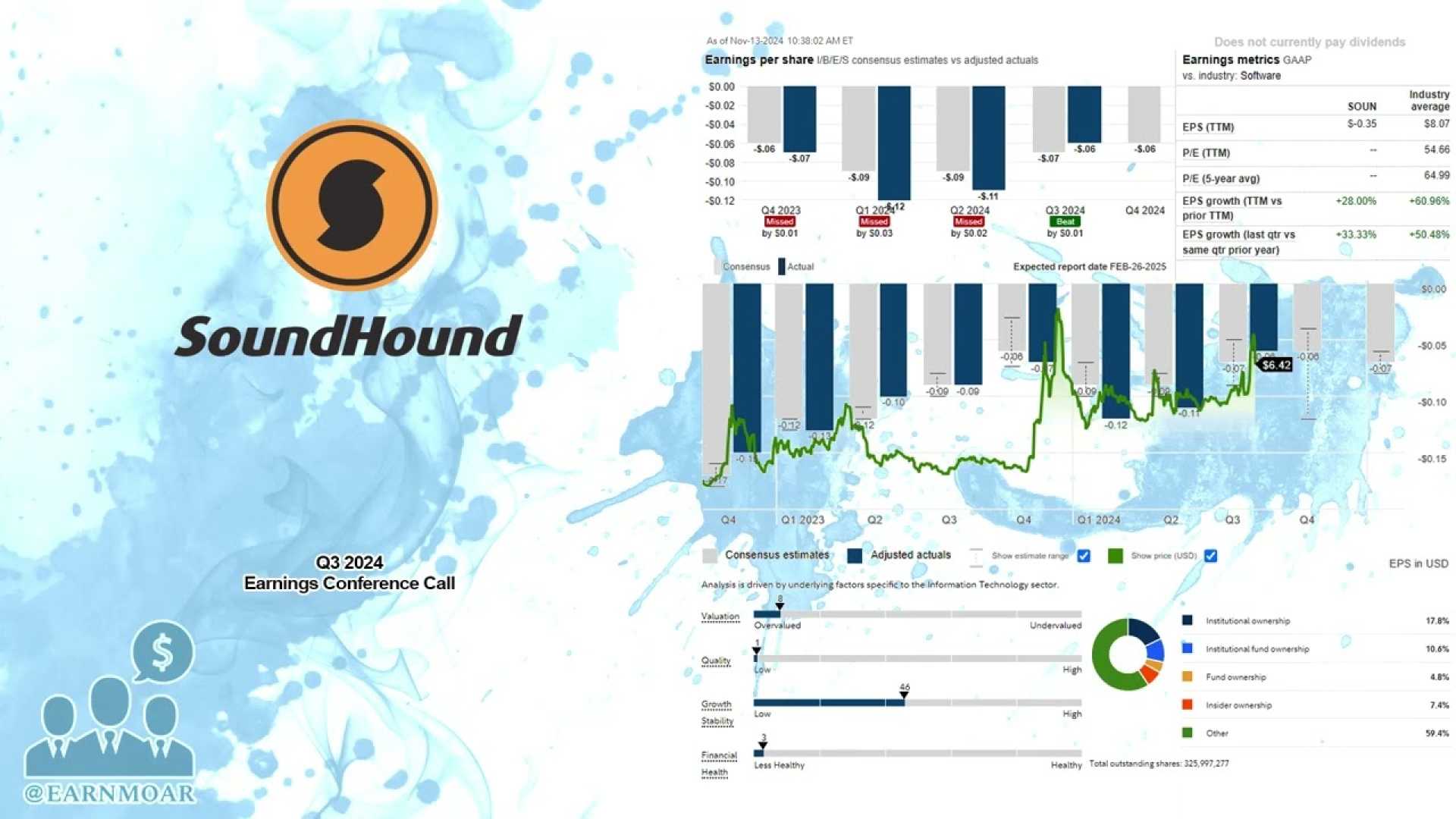

SAN JOSE, California — SoundHound AI (NASDAQ: SOUN) experienced a significant surge in its stock price, climbing from $2 to $24 in 2024, which represents a twelvefold increase. However, in early 2025, the stock has seen a pullback, trading approximately 55% lower than its 52-week high of $25. Despite this decline, several market catalysts could drive its value back to previous highs, indicating a potential for a doubling from current levels.

The company’s financial trajectory has shown clear acceleration, with substantial revenue growth in recent years. Over the last three years, SoundHound’s average growth rate reached 69%. In the past 12 months alone, its revenue doubled from $51 million to $102 million.

Recently, SoundHound reported quarterly revenues surged by 151.2% year-over-year to $29 million, up from $12 million. The management anticipates revenue to range between $157 million and $177 million for 2025, signifying around 100% growth year-over-year, which reflects strong confidence in the demand for voice AI solutions.

Key growth opportunities are evident in the automotive sector, where SoundHound has formed partnerships with prominent manufacturers, including Mercedes-Benz, Hyundai, and Kia. The rollout of its Chat AI to additional Stellantis brands, such as Alfa Romeo, marks a strategic expansion in 2025 across various European markets.

February 2025 saw the introduction of ‘Brand Personalities,’ a feature enabling car manufacturers to customize their voice assistants. A partnership with Tencent Intelligent Mobility announced in April involves the integration of SoundHound’s AI into Tencent’s cloud solutions for global auto brands, further tapping into the expanding automotive voice AI market.

Research has recently highlighted a potential $35 billion annual opportunity for automakers through in-car voice commerce, allowing users to order services directly from their vehicles. With increasing competition and a need for differentiation, SoundHound’s integration capabilities may allow it to capture substantial market share.

SoundHound also boosted its enterprise presence in August 2024 by acquiring Amelia, known for its customer service expertise across finance, insurance, and retail sectors. This has led to immediate revenue diversification, with Amelia AI agents managing over 100,000 customer calls and reducing query volumes significantly.

Currently trading around $11, SoundHound holds a price-to-sales (P/S) ratio of 40x based on its trailing 12-month revenue. Should revenues grow to an estimated $250 million by 2027, there may be significant compression in its P/S multiple. A reduction from 40x to around 30x would position the stock price to reach approximately $20.

While SoundHound faces several risks, including lofty valuations and market volatility, its strategic positioning in high-growth voice AI markets and solid revenue momentum create a compelling case for potential significant upside over the next two to three years. The company’s consistently exceeding guidance underscores its strong operational execution during this growth phase.