Business

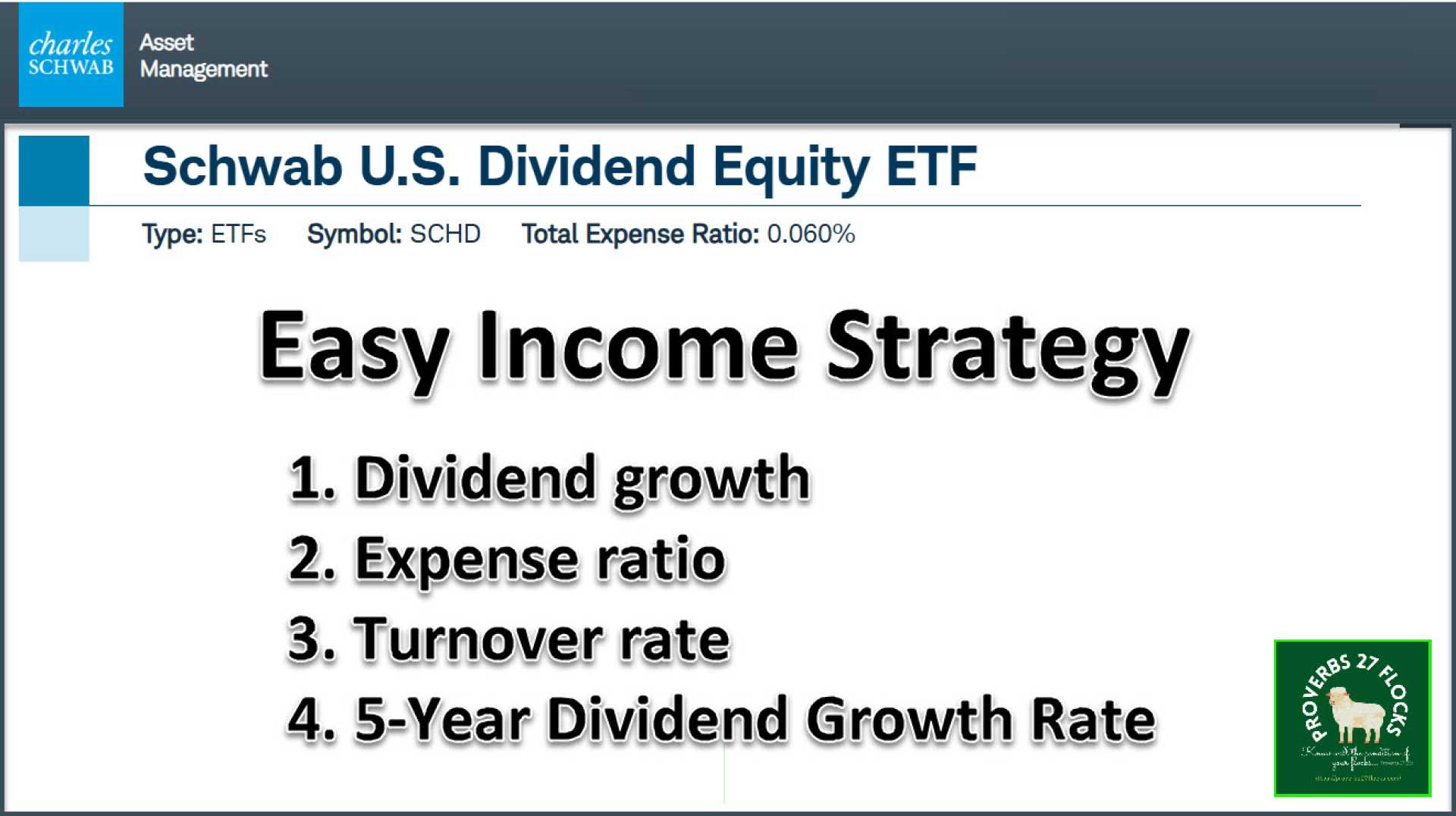

Schwab U.S. Dividend Equity ETF Shows Defensive Strength Amid Market Uncertainty

CHICAGO, IL — The Schwab U.S. Dividend Equity ETF (SCHD) is gaining traction among investors for its risk-conscious investment strategy. As of June 2025, the fund has attracted about $68 billion in assets, signaling its popularity in the market.

This ETF aims to provide long-term risk-adjusted returns through its focus on 100 dividend-paying stocks, selected from the Dow Jones U.S. Dividend 100 Index. To qualify, companies must have a history of paying dividends for at least a decade, ensuring only financially healthy firms like Pepsi and Verizon make the cut.

According to Morningstar, the fund has consistently outperformed the Russell 1000 Value Index, particularly in its profitability metrics, such as return on invested capital. Nearly 65% of the portfolio comprises stocks with strong Morningstar Economic Moat Ratings, indicating a competitive edge in the market.

In terms of strategy, the Schwab U.S. Dividend Equity ETF prioritizes quality stocks with good balance sheets, which often prove to be more resilient in times of market volatility. For example, the fund registered only 88% of the Russell 1000 Value Index’s downside since inception, a notable achievement during market downturns.

Despite facing challenges in 2023 and 2024, when it ranked in the bottom quartile of its peer group, analysts emphasize the fund’s overall track record is still impressive. Its risk-adjusted and absolute returns remain within the top 10% of its category.

Recently, some stocks contributed negatively to its performance, including United Parcel Service and Pepsi. However, the ETF’s structure, which limits individual stock weightings to 4% and sector weightings to 25%, helps maintain diversification and mitigate risk.

As investment in dividend-oriented strategies continues to rise, the Schwab U.S. Dividend Equity ETF could be an attractive option for income-focused investors. The methodology behind the ETF focuses on identifying high-quality dividend growth stocks while maintaining a low expense ratio of just 0.06%.