Business

J.P. Morgan Launches Historic $2 Billion Active ETF

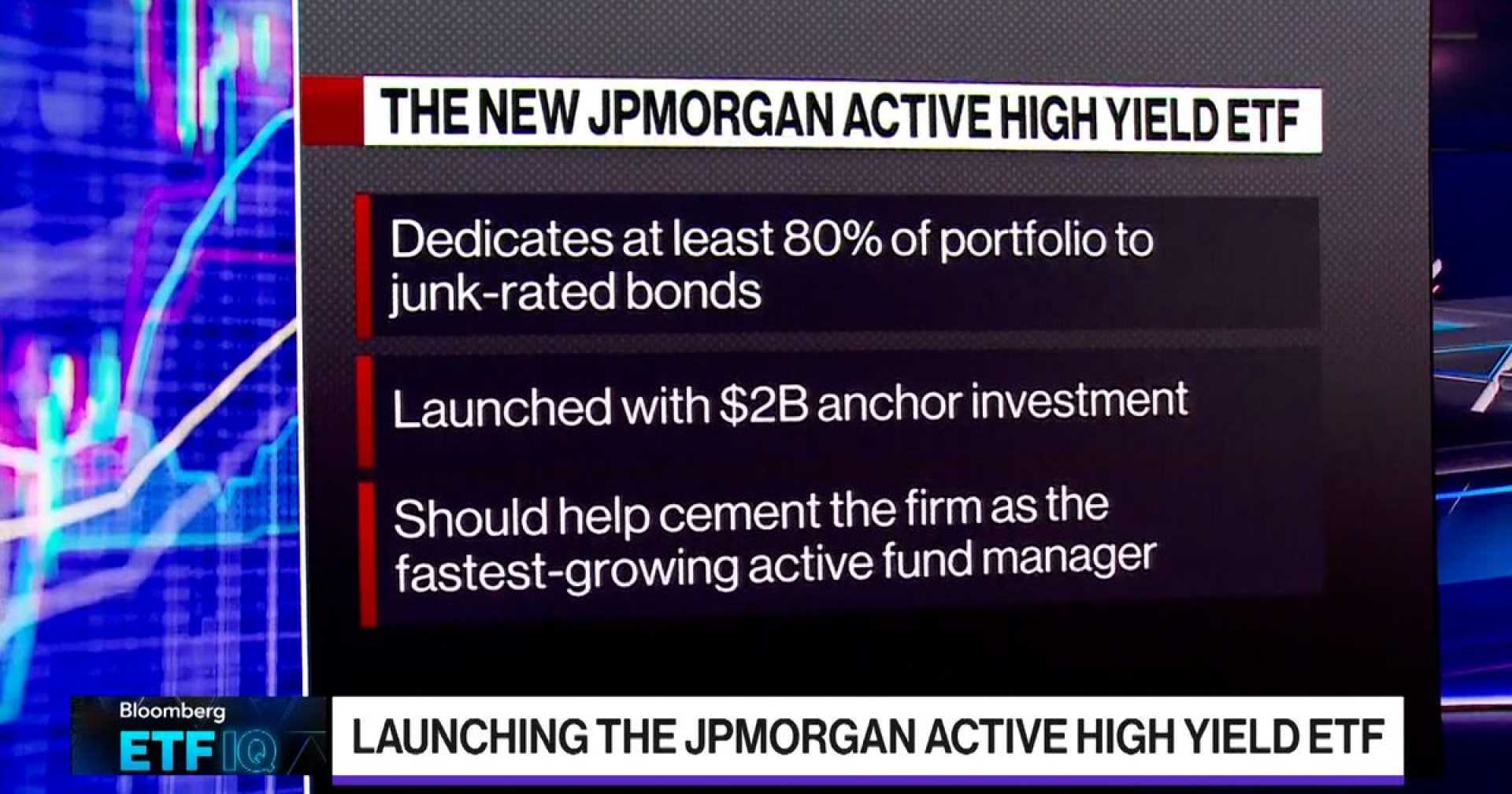

NEW YORK, June 25, 2025 /PRNewswire/ — J.P. Morgan Asset Management has launched the JPMorgan Active High Yield ETF (JPHY), marking the largest active ETF launch in history with a $2 billion investment from a major institutional client. This new fund is set to trade on the Cboe BZX Exchange.

The JPHY aims to invest at least 80% of its assets in below investment-grade debt securities, targeting high current income. The ETF is priced at 45 basis points and is benchmarked against the ICE BofA US High Yield Constrained Index.

This launch positions J.P. Morgan as the largest U.S. active fixed income ETF provider, boasting $55 billion in assets under management (AUM) and attracting $10 billion in flows year-to-date in 2025. It is managed by a team of seasoned professionals, including Robert Cook, Thomas Hauser, Jeffrey Lovell, John Lux, and Edward Gibbons.

George Gatch, CEO of J.P. Morgan Asset Management, expressed excitement regarding the launch, emphasizing its significance within the active fixed income market. “This is just the beginning of a trend that should see active fixed ETF AUM quadruple in the next five years,” he said.

The design of JPHY allows it to leverage the advantages of scale, providing immediate benefits such as enhanced liquidity and tighter bid-ask spreads. The fund aims to fully invest shortly after its launch, which is expected to improve trading costs for investors.

Robert Michele, Global Head of Fixed Income for J.P. Morgan Asset Management, stated, “JPHY reinforces our commitment to delivering incremental return opportunities in fixed income, a market segment that has been dominated by passive strategies.” With significant backing and an experienced management team, the JPHY is anticipated to attract a wide range of investors.