Business

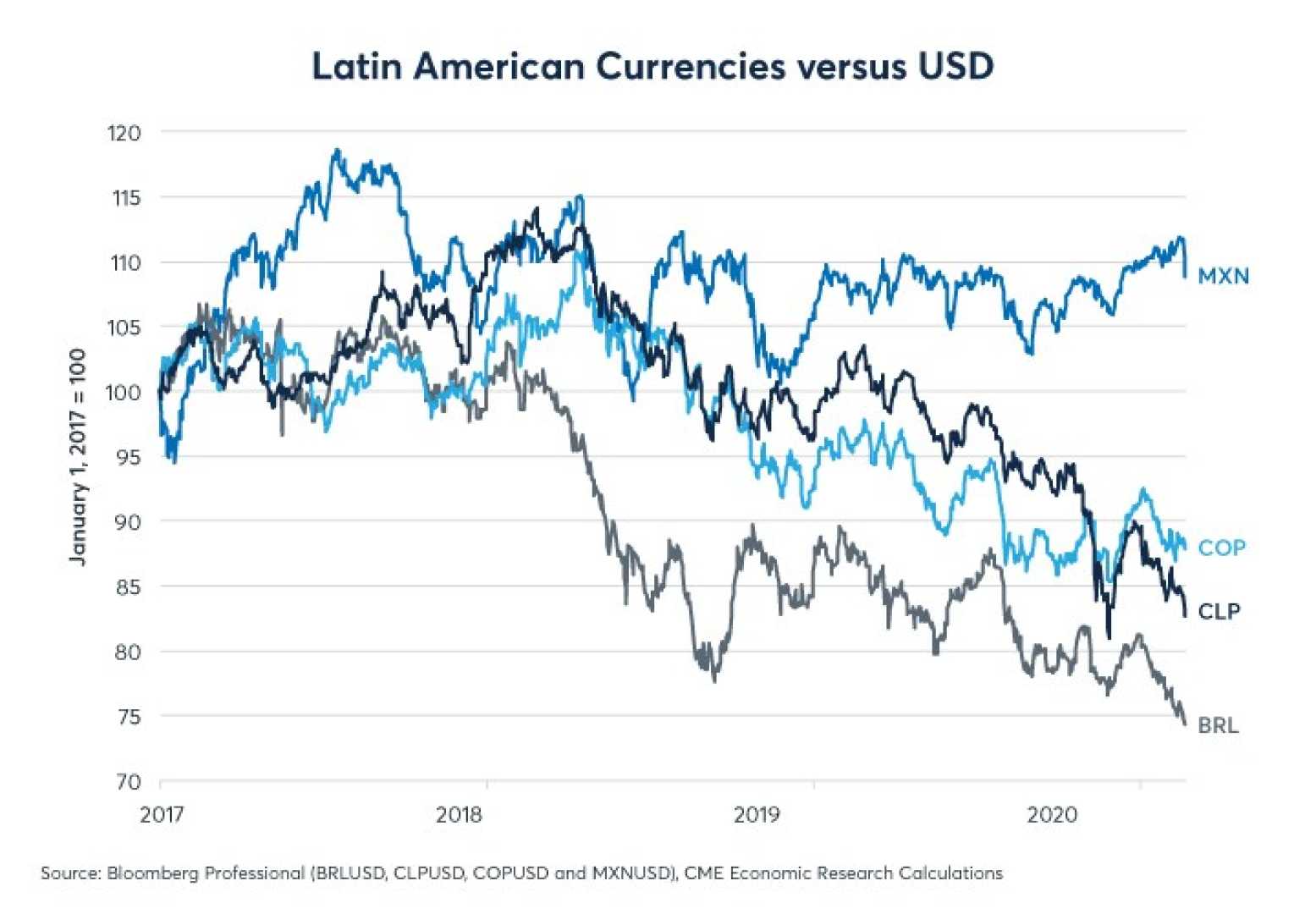

Latin American Currencies React to U.S. Economic Data and Trump Rumors

SANTIAGO, Chile — Major currencies in Latin America closed mixed on Wednesday amid high volatility triggered by U.S. producer price data and reports that President Donald Trump may soon dismiss Federal Reserve Chairman Jerome Powell.

U.S. producer prices were unchanged in June, unexpectedly stalling as increases in import costs due to tariffs were balanced by weak service costs. However, markets continue to anticipate that the Federal Reserve will maintain interest rates at its upcoming July meeting.

Consumer prices in the U.S. rose in June, likely marking the beginning of a long-expected acceleration in inflation due to tariffs. This has made the Fed cautious about resuming interest rate cuts.

The Fed is now expected to keep its benchmark interest rate at 4.25%-4.5% during its meeting this month. Volatility also erupted in the markets on rumors that Trump might fire Powell, prompting significant reactions. However, the President denied these reports, which cited anonymous sources, while not ruling out any future changes.

The Mexican peso closed at 18.7274 per dollar, gaining 0.49% from the previous reference price of 18.8200. In the last three sessions, the peso accumulated a decline of 1.15%. “We believe the recovery will continue,” said Grupo Financiero Banorte in a note. “We suggest maintaining positions,” they added.

The S&P/BMV IPC index, which includes the 35 most liquid companies in the Mexican market, rose by a marginal 0.04% to 56,503.04 points. Attention is now focused on the release of early corporate results for the second quarter.

Retail giant Wal-Mart de México is set to release its quarterly report after market close. Its shares fell 0.17% to 57.54 pesos in anticipation of the data.

The Brazilian real depreciated by 0.03% to 5.5611 units per dollar, while the Bovespa index in São Paulo dropped 0.65% to 135,304.66 points.

In Argentina, the peso fell by 0.16% to 1,263 units per dollar, maintaining medium levels since the floating exchange rate was set in April. Just a day prior, it reached values as high as 1,295 units, the lowest since lifting currency restrictions three months ago.

“Beyond the recent adjustment of the dollar, bringing it closer to the wholesale level of 1,300 pesos amidst future balance projections, the calm market sentiment remains intact as investors view the new level as more favorable for the economy,” said economist Gustavo Ber.

Meanwhile, the Merval index dropped by 2.3%, with shares of oil company YPF falling by 2.7% following gains the previous day. A U.S. appeals court temporarily suspended a court order on Tuesday that obliged Argentina to concede its 51% stake in YPF to partially comply with a judgment for $16.1 billion.

The Colombian peso erased initial losses, closing up by 0.35% at 4,014 units per dollar. The MSCI COLCAP index also rose by 0.13% to 1,701.62 points. Colombia‘s government is considering presenting a tax reform to Congress to secure 26 trillion pesos ($6.475 billion) aimed at financing the 2026 budget.

The Peruvian sol appreciated by 0.28% to 3.548/3.550 units per dollar, while the Lima Stock Exchange dipped by 0.12% to 871.95 points. The Chilean markets remained closed on Wednesday due to a religious holiday.