News

AI-Driven Phantom Hacker Scam Targets Seniors, Costs Over $1 Billion

Los Angeles, CA – An alarming new scam targeting senior citizens has emerged, utilizing artificial intelligence (AI) to exploit vulnerable individuals. The FBI‘s Los Angeles division issued a warning on July 15 about the Phantom Hacker Scam, which has reportedly drained over $1 billion from Americans since 2024.

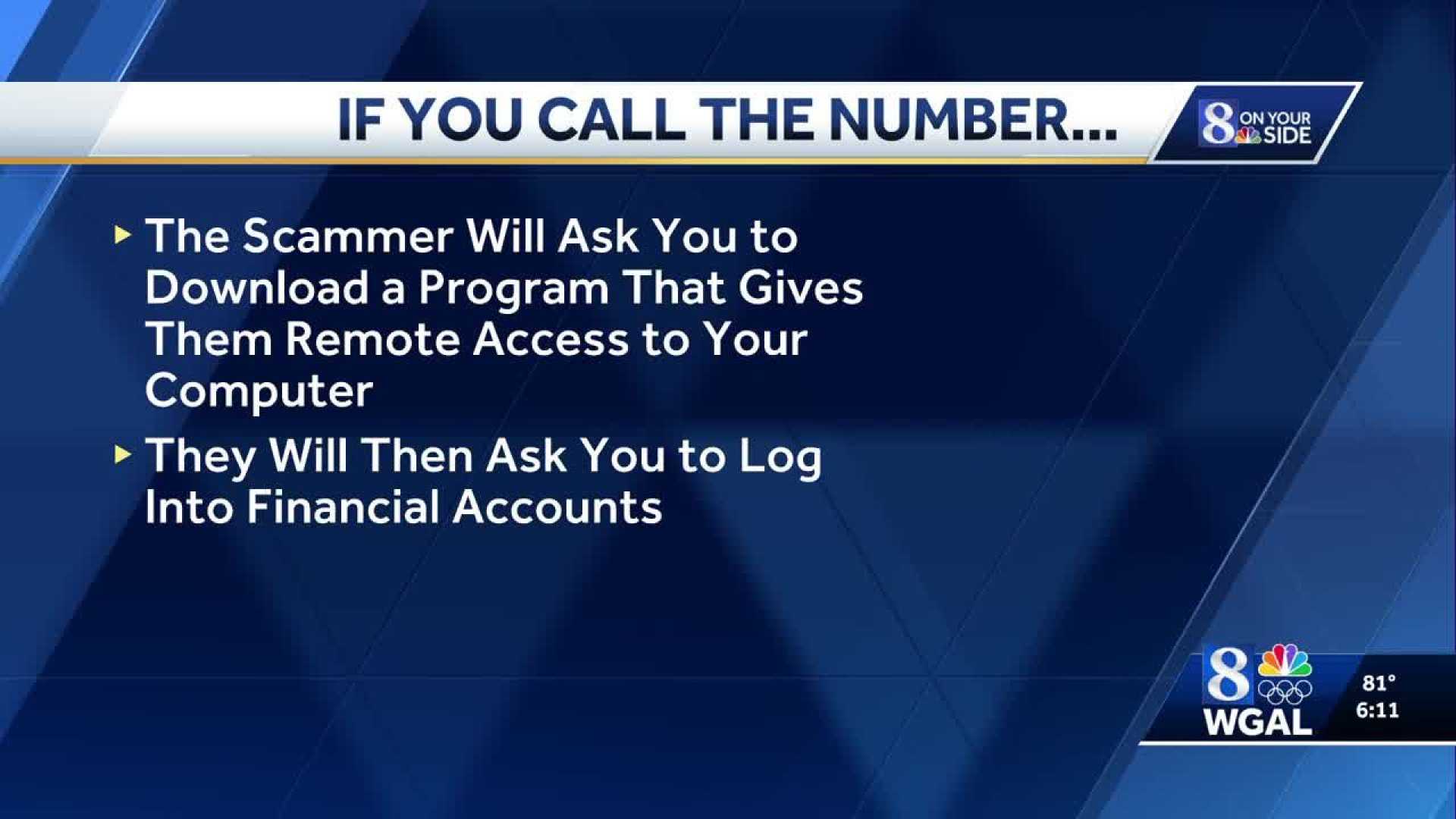

Pete Nicoletti, the chief information security officer at Check Point, described the scam as ‘devastating’ for seniors, who face the risk of losing their life savings. The scam operates in three distinct phases: the first involves a ‘tech support impostor’ who reaches out via text, phone call, or email and manipulates victims into granting remote access to their computers.

Once access is granted, the scammer asks the victim to check for unauthorized transactions in their financial accounts, a step deemed especially lucrative for fraudsters. Following this, the scammer suggests that further instructions will come from a ‘fraud department’ of the victim’s bank.

In the second phase, an impostor posing as a financial institution representative contacts the victim to inform them that a foreign hacker has accessed their funds and urges them to transfer their money to a ‘safe’ third-party account.

The victim is misled into sending money through wire transfers, cash, or even cryptocurrency, often in multiple transactions over several days or months. The final phase involves a person pretending to be a U.S. government employee, who convinces the victim to move their funds to an ‘alias’ account for security.

Nicoletti emphasized the need for families to have open discussions about such scams to better protect their elderly relatives. He pointed out that scammers are increasingly personalizing their tactics, using AI to mine personal information from social media.

‘Family discussions about these threats are crucial,’ Nicoletti said. ‘Seniors often share personal details online, which fraudsters exploit. Discussions over dinner can help keep them informed and safe.’

Despite the rising prevalence of these scams, Nicoletti noted that victims rarely recover their lost money. He found that if victims report theft immediately, the chances of recovery are slim, at only around 10 to 15 percent.

As AI capabilities grow, so does the sophistication of online scams, posing a significant challenge for consumers and law enforcement alike.