Business

Comcast Beats Estimates Amid Broadband Subscriber Losses

PHILADELPHIA, Pa. — Comcast beat Wall Street estimates on Thursday for its second-quarter earnings and revenue. Despite this positive financial news, the company reported a loss of broadband customers as it shifted its market strategy.

The broadband industry has been witnessing a slowdown in growth, which has affected company stocks. Comcast shares rose about 3% in early trading, as the losses in broadband subscriptions were fewer than expected, according to StreetAccount estimates.

“While it’s still early days, we like what we are seeing in our broadband business. It’s giving us confidence in the change that we’ve made and what’s still ahead,” said Mike Cavanagh, Comcast president, during an earnings call.

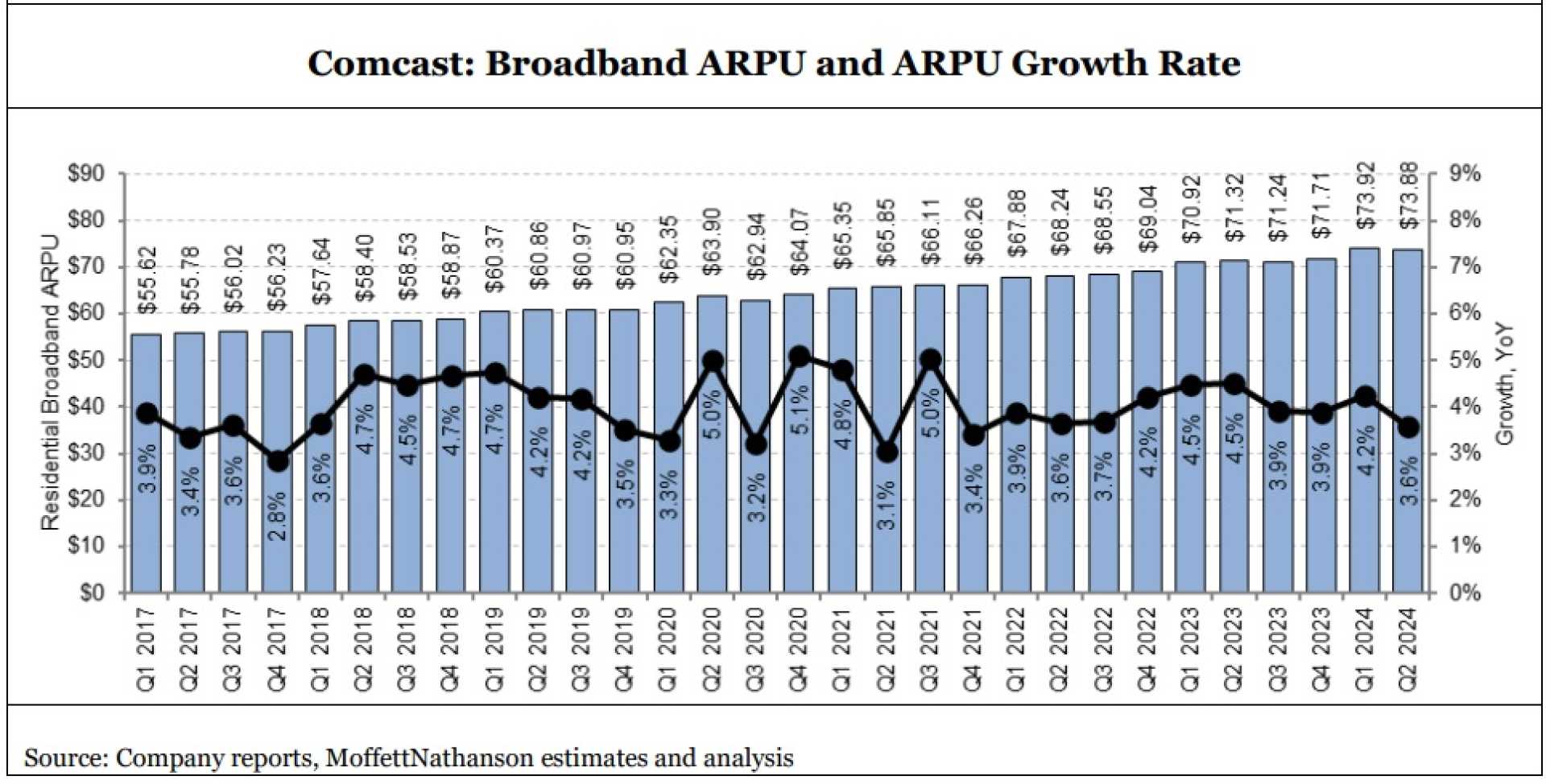

For the second quarter, Comcast’s connectivity and platforms business, which includes its Xfinity broadband, mobile, and pay TV services, generated $20.39 billion in revenue, marking a nearly 1% increase from last year.

The company reported a loss of 226,000 broadband customers during the quarter, mainly from residential users. Wall Street had anticipated losses of nearly 257,000. Comcast’s CFO Jason Armstrong noted, “The competitive environment remains intense, as we had previewed,” highlighting ongoing challenges for the company.

To combat these challenges, Comcast introduced new pricing plans and simplified its broadband offerings. Additionally, the company began providing a free mobile line for one year for new and existing customers. Notably, Comcast added a record 378,000 mobile customers in the second quarter, increasing total lines to 8.5 million, or 14% of its broadband customer base.

In contrast, Comcast continued to lose pay TV customers, with 325,000 dropping their subscriptions during the quarter. Overall, the company’s revenue was $30.31 billion, reflecting a 2% year-over-year increase.

Comcast’s net income significantly rose to $11.12 billion, primarily due to the sale of its stake in streaming service Hulu. This equated to earnings of $2.98 per share, a notable increase from $1 per share the prior year. Adjusted for one-time items, Comcast reported earnings of $1.25 per share.

The company’s content and experiences division, which covers NBCUniversal, observed a 5.6% revenue growth, totaling $10.63 billion. Revenue from the film studios increased by 8% to $2.43 billion, bolstered by the successful release of “How to Train Your Dragon” in June, which grossed over $600 million globally.

Universal theme parks revenue surged past $2 billion, up 19%, due to positive attendance resulting from the new “Epic” attraction at Universal Orlando Resort.

Despite domestic advertising revenue for NBCUniversal decreasing by 7% to $1.85 billion, the company remains hopeful, as advertisers lean towards live sports programming in the upcoming months.

Peacock, NBCUniversal’s streaming platform, reported subscriber numbers unchanged at 41 million, while revenue grew by 18% to $1.2 billion. However, the service still recorded losses of $101 million, although this was an improvement from losses of $348 million from the same quarter last year.

Cavanagh pointed out that Peacock constitutes over a third of NBCUniversal’s total value, emphasizing efforts for profitability in the platform. A recent $3 price rise was implemented to boost revenue.

As NBCUniversal prepares for higher sports programming costs in the fourth quarter due to a new NBA deal set to begin, Cavanagh remarked, “It’s a big investment,” indicating confidence in future growth prospects.