Health

States Brace for Federal Cuts Amid Healthcare and Budget Crisis

WASHINGTON, D.C. — As the new presidential administration embarks on sweeping budgetary changes, states across the nation are poised to face significant fiscal challenges. Under President Trump‘s leadership, proposed reductions in federal funding for health care, education, and food assistance could transfer the responsibility of providing these essential services to the states.

The move comes at a time when many states are already grappling with economic uncertainties stemming from a potential trade war, aggressive immigration policies, and rising unemployment due to federal layoffs. According to a recent analysis by the Urban Institute, these factors threaten to depress state tax revenues and leave many states ill-equipped to meet their growing obligations.

“States should prepare to pause or roll back their recent tax cuts and begin planning for tax increases,” said Elizabeth McNichol of the Center on Budget and Policy Priorities. “The anticipated federal retreat in funding will force states to decide how to cover the costs of essential services.”

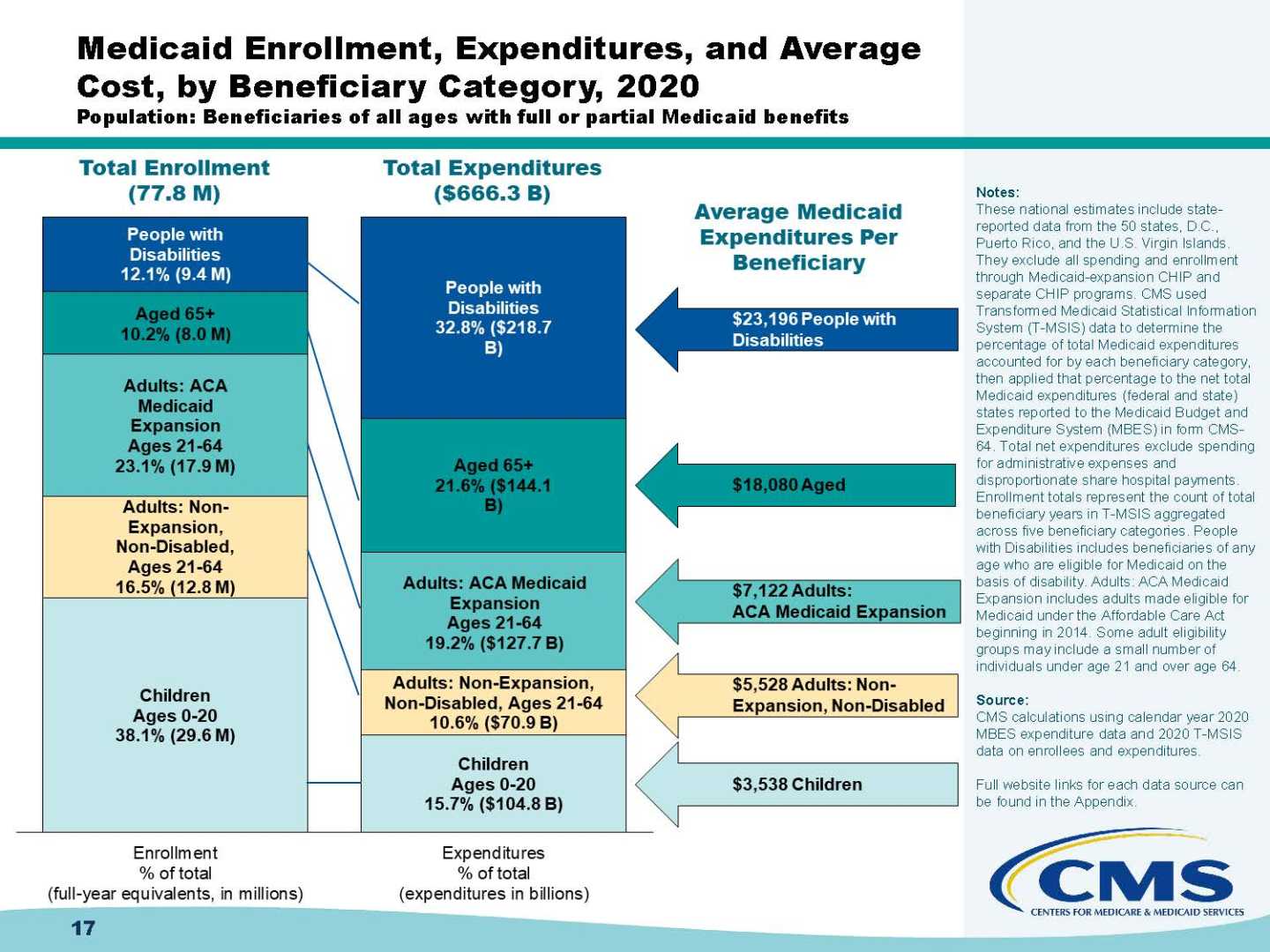

Medicaid, which covers over 70 million Americans, is one of the most significantly impacted programs. Proposed cuts to intergovernmental grants could severely limit states’ ability to fund critical services. The repercussions are particularly grave for women, who make up a majority of Medicaid recipients and rely on it for prenatal care and health services.

Reports indicate that approximately 4.6 million to 5.2 million adults aged 19 to 55 might lose their coverage if the federal government implements work requirements. Many of these individuals are already working; however, hurdles such as lack of transportation and broadband access could lead to unintentional disenrollment.

“Most adults who would lose eligibility are engaged in work-related activities or could qualify for exemptions that are not easy to identify,” said Michael Karpman of the Urban Institute. “These administrative barriers would hurt a population that needs assistance the most.”

Compounding state budget concerns, Congress is also considering policies to tax municipal bond interest, which could result in hundreds of billions of dollars in additional expenses for state and local governments. Higher borrowing costs will pose additional challenges to states already struggling with budget deficits.

The Federal Reserve recently warned of potential stagflation, predicting a mix of rising inflation and sluggish economic growth, which could have dire consequences for tax revenues if the economy heads into recession. History shows that during past economic downturns, state tax revenues fell substantially—the 2001 recession saw a 4.5 percent decline, while the 2007-09 recession led to an 11 percent drop.

“Economic slowdowns dramatically impact state finances,” said Howard Lutnick, Commerce Secretary. “We could see tax revenues decline severely if these predictions come to fruition.”

In addition to economic challenges, the administration’s immigration policies also bring revenue risks. The Institute on Taxation and Economic Policy reports that undocumented immigrants contribute nearly $96.7 billion in taxes, with about $37.3 billion going to state and localities. Large-scale deportations could lead to a drastic reduction in these revenues.

“Every million undocumented individuals who exit the country could reduce annual revenue by $7.9 billion, with state and local budgets absorbing $2.5 billion of that impact,” said Carl Davis, research director at ITEP. “This suggests larger-scale deportations could be financially disastrous for states.”

Federal layoffs and contract cancellations will also affect state economies, especially in areas with a high concentration of federal employment. States like Maryland and Virginia, where federal jobs make up a considerable portion of the workforce, face an uphill battle as the looming layoffs threaten income and business profits.

“The District of Columbia is entering a recession due to federal budget cuts, projecting over $1 billion in lost tax revenue in the next three years,” said a representative from the D.C. Chief Financial Officer’s office. Similarly, Maryland estimates its federal contracts could equate to about 10 percent of the state’s economy, with drastic cuts looming.

As discussions unfold in Congress and the administration advances its fiscal agenda, the implications for state budgets grow increasingly clear—states could either make up for the lost funding through tax increases or drastically cut services.