Business

U.S. Stock Market Hits New Highs Amid Earnings Surge, Trade Talks

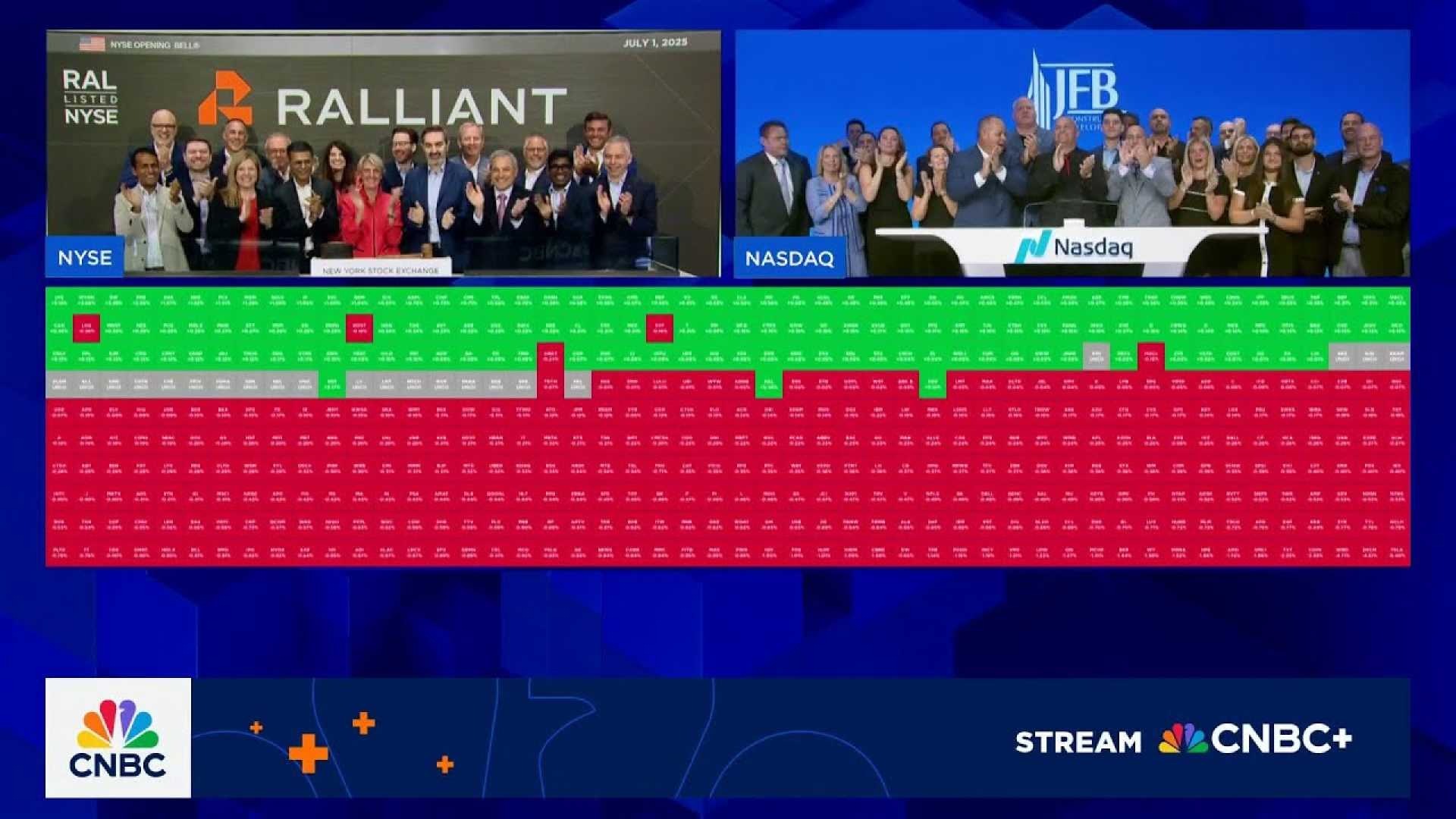

NEW YORK CITY, U.S. — The U.S. stock market closed at new highs on Friday, completing a week of gains driven by strong earnings and encouraging trade developments. The S&P 500 rose 0.40% to reach its 14th record close of the year at 6,388.64.

The Nasdaq Composite climbed 0.24% to end at 21,108.32, marking its 15th record close in 2025. Additionally, the Dow Jones Industrial Average increased by 208.01 points, or 0.47%, finishing at 44,901.92, slightly below its record high of 45,014.04 from December 4, 2024.

All three major indexes reported gains for the week, with the Dow up approximately 1.3%, the Nasdaq gaining 1%, and the S&P 500 rising about 1.5%. This marks the S&P 500’s fifth day of consecutive record closings.

The positive momentum was attributed to a robust earnings season, with over 82% of companies in the S&P 500 exceeding analysts’ expectations, according to FactSet data. “The bull market continues, supported largely by favorable fundamentals,” said Terry Sandven, chief equity strategist at U.S. Bank Wealth Management, in an interview.

Recent agreements between the U.S. and its trade partners have also bolstered market confidence. Earlier this week, President Donald Trump announced a deal that includes 15% “reciprocal” tariffs, and he expressed optimism about finalizing additional agreements, including discussions with European Union officials.

Trump mentioned on Friday that he envisions a 50-50 chance of striking a trade deal with the EU, emphasizing the need for tariff reductions on European goods.

Looking ahead, investors are preparing for a busy week with more than 150 S&P 500 companies scheduled to announce quarterly results, including major players in the tech sector.

As earnings season progresses, experts like Ulrike Hoffmann-Burchardi, chief investment officer for the Americas at UBS Global Wealth Management, caution investors about possible market volatility. “Trade tensions and their economic repercussions could lead to fluctuations in the market,” she noted.

In the backdrop of positive earnings, the Federal Reserve’s upcoming meeting is also closely monitored, as policymakers are widely expected to maintain current interest rates.

This week’s markets demonstrate a complex interplay of earnings success, trade negotiations, and economic indicators, potentially setting the stage for continued market fluctuations as the year progresses.