Business

Super Micro Faces Challenges Despite Strong AI Server Demand

San Jose, California — The AI revolution has ignited a surge in demand for server infrastructure, with Super Micro Computer Inc. making a significant mark as a leading player. In its third-quarter financial results released Monday, Super Micro reported impressive revenue growth driven by rising AI adoption.

For fiscal Q3 2024, Super Micro’s revenue reached $3.85 billion, a 16% increase from the previous quarter and a remarkable 200% year-over-year growth. Despite these strong numbers, the company’s gross margins faced pressure, remaining at 15.5%, a decline from 17.6% in Q3 2023.

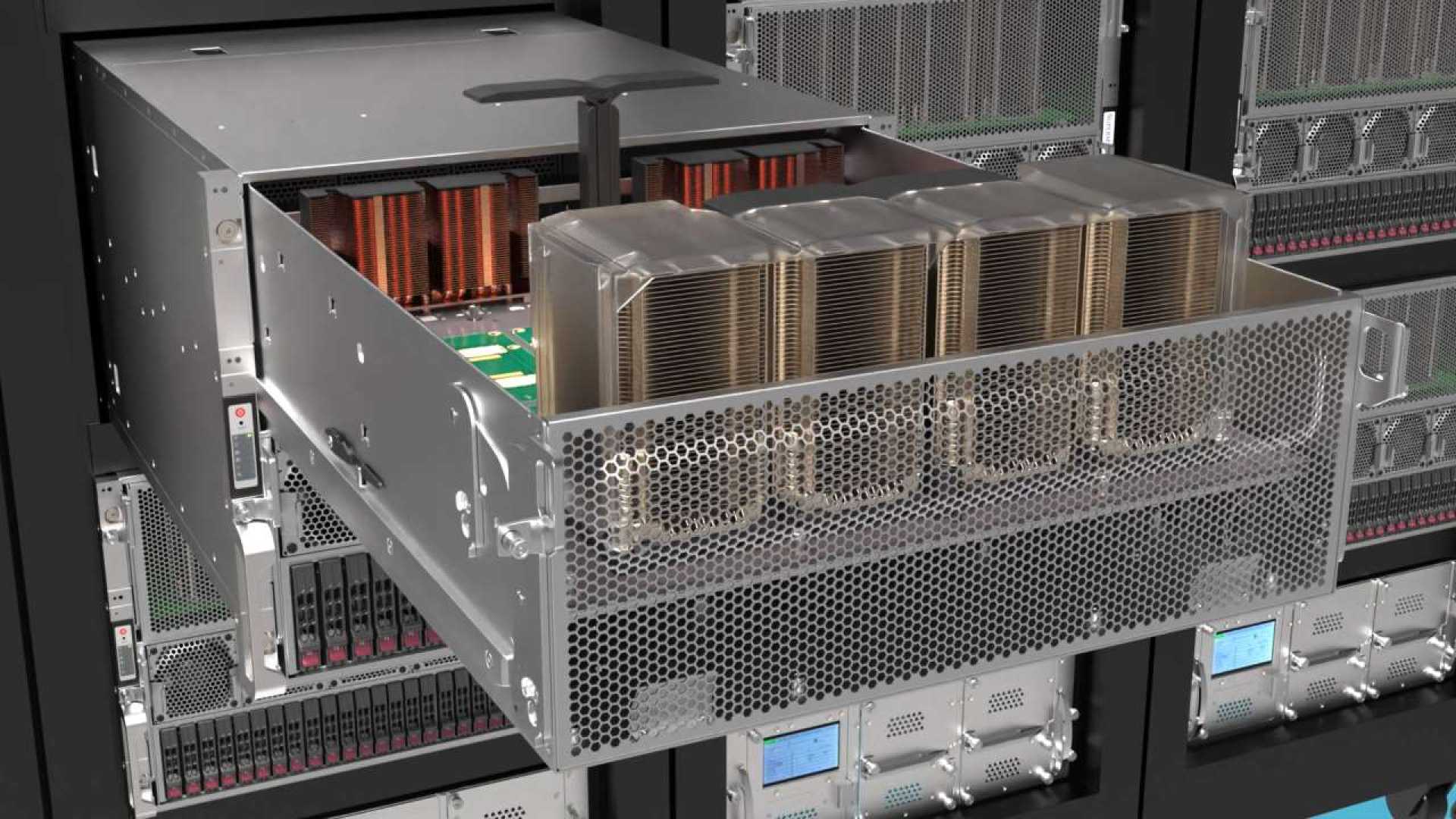

The company attributed this margin dip to strategic inventory builds and the introduction of lower-margin liquid-cooled systems. Yet, management projects confidence in its AI leadership, highlighting successes with its GB200/300 server lines and partnerships with Blackwell GPU.

However, inventory levels nearly tripled year-over-year, reaching $4.12 billion. This increase raises concerns about both supply chain preparedness and potential overstock risks. Although the net income jumped to $402 million, it was significantly influenced by one-off tax benefits.

Analysts from Citi recently raised their price target for Super Micro shares to $52 from $37, reflecting optimism about long-term AI trends. Nonetheless, they also warned about challenges in near-term profitability. Two major risks are emerging:

-

Competitive Pricing Pressure: Large competitors are enhancing their AI server offerings, which could threaten Super Micro’s margins.

-

Supply Chain Volatility: Ongoing component shortages and tariff issues add complexity to cost management.

Market insights from analysts at KeyBank echo these challenges, pointing out signs of margin declines that could limit potential gains. The general market consensus suggests a cautious approach as investors assess Super Micro’s ability to maintain its pricing power amid growing competition.

The company’s new DLC servers, crucial for next-gen AI applications, currently command minimal price premiums compared to previous air-cooled systems. This reality, coupled with heightened inventory, could pressure margins even further. Competitors like Dell and HPE are also leveraging their extensive networks to compete more effectively against Super Micro.

Despite the undeniable growth driven by AI, Super Micro’s stock valuation remains a topic of debate. Currently trading at about 15 times Citi’s estimates for fiscal year 2027, the stock’s worth presumes a stabilization in margins that has yet to manifest. Super Micro forecasted Q4 revenues between $5.1 billion and $5.5 billion, but earnings per share estimates remain subdued at $0.45.

Until Super Micro proves it can consistently maintain margins above 15% amidst rising competition, analysts recommend a cautious approach to investment. Investors seeking AI investments may want to consider options like NVIDIA or AMD, which have the advantage of established hardware and software ecosystems.

In the competitive landscape of AI infrastructure, execution remains crucial. Super Micro’s success in converting AI demand into sustainable profits will be essential for its long-term growth story.