Health

ACA Insurers Propose 15% Premium Hike Amid Subsidy Uncertainty

WASHINGTON, D.C. — Health insurers participating in the Affordable Care Act (ACA) are proposing a median premium increase of 15% for 2026, the highest rise since 2018. This increase comes as many grapple with rising healthcare costs and uncertainty surrounding federal subsidies.

The proposed hikes are attributed to an expected surge in medical expenses and policy changes. Insurers are particularly concerned about the expiration of enhanced premium tax credits at the end of 2025, which they claim will further burden consumers. Insurers also indicated that tariffs on pharmaceuticals and medical supplies could lead to additional cost increases.

Each spring and summer, insurers submit rate filings to regulators to justify their premium adjustments. The cost of care, including hospitalizations and prescription drugs, typically drives most premium changes. However, upcoming policy decisions are adding to the potential rate increases.

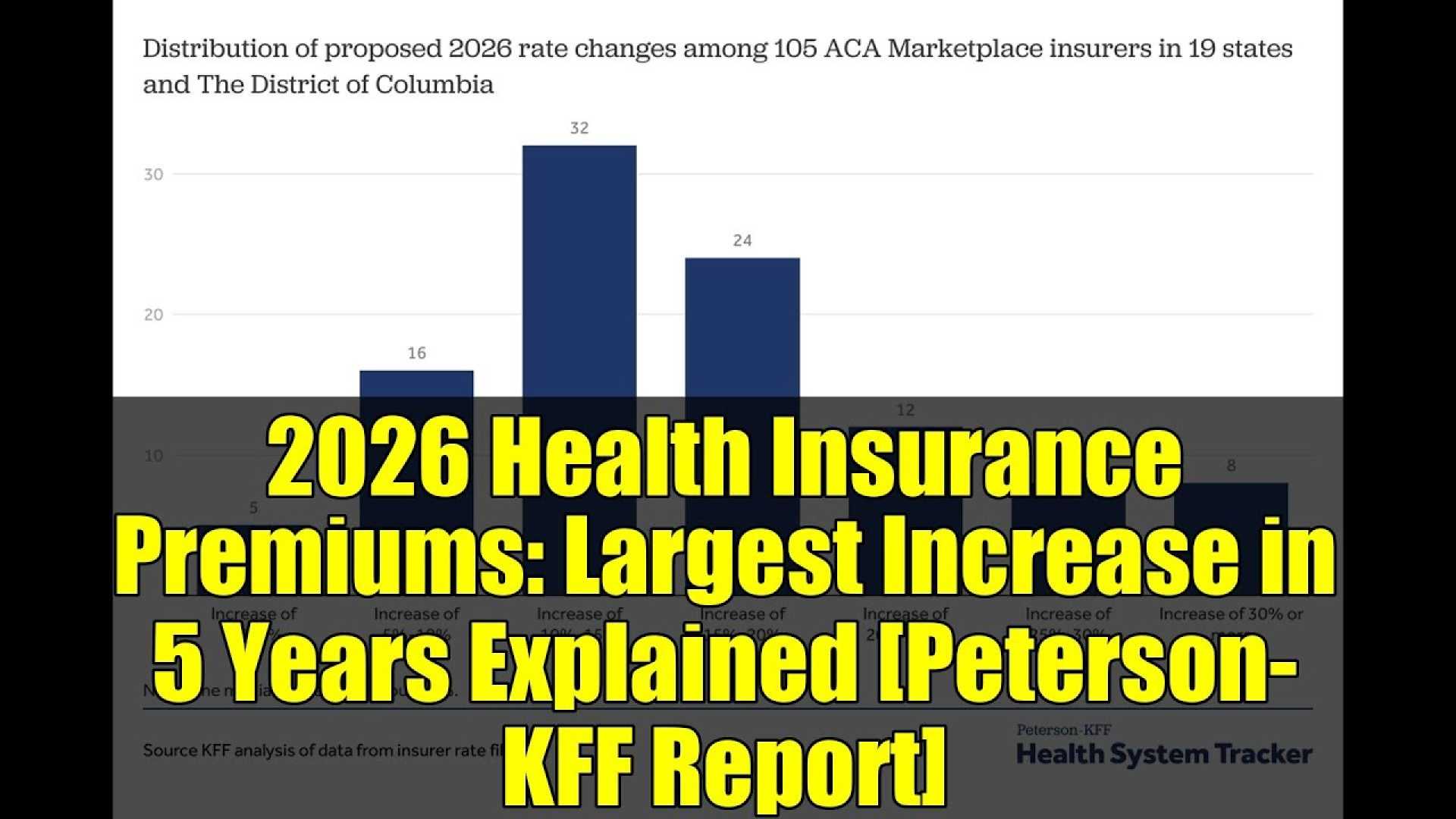

This year, 105 ACA Marketplace insurers across 19 states and the District of Columbia have submitted their proposed rate changes. With low enrollment expected due to rising costs, many insurers predict that healthier individuals might leave the marketplace, worsening the risk pool.

Average premium increases are expected to vary by state, but many insurers are estimating hikes within the 10% to 20% range. In some regions, like New York, proposed increases are significantly larger, with one insurer seeking a 66% raise.

“The out-of-pocket change for individuals will be immense, and many won’t be able to afford to pay premiums,” said JoAnn Volk from Georgetown University. “This could lead to many going uninsured.”

Should Congress fail to renew enhanced tax credits from pandemic relief measures, millions could face steep premium hikes in January 2026. The impact of these potential changes on enrollment and overall premium costs will become clearer as finalized rates are announced later this summer.

In Colorado, for instance, insurers have proposed an average increase of 28.4% for 2026. State officials attribute this rise to a combination of federal changes that do not extend enhanced subsidies which benefited many consumers in recent years.

As consumers await more information on premiums, many advocates and observers worry about the potential drop in enrollment, which could further destabilize the market.

The final premium rates for 2026 are expected to be published in late summer, just before the open enrollment period starts on November 1.