Business

Mortgage Rates Expected to Decline in Coming Years

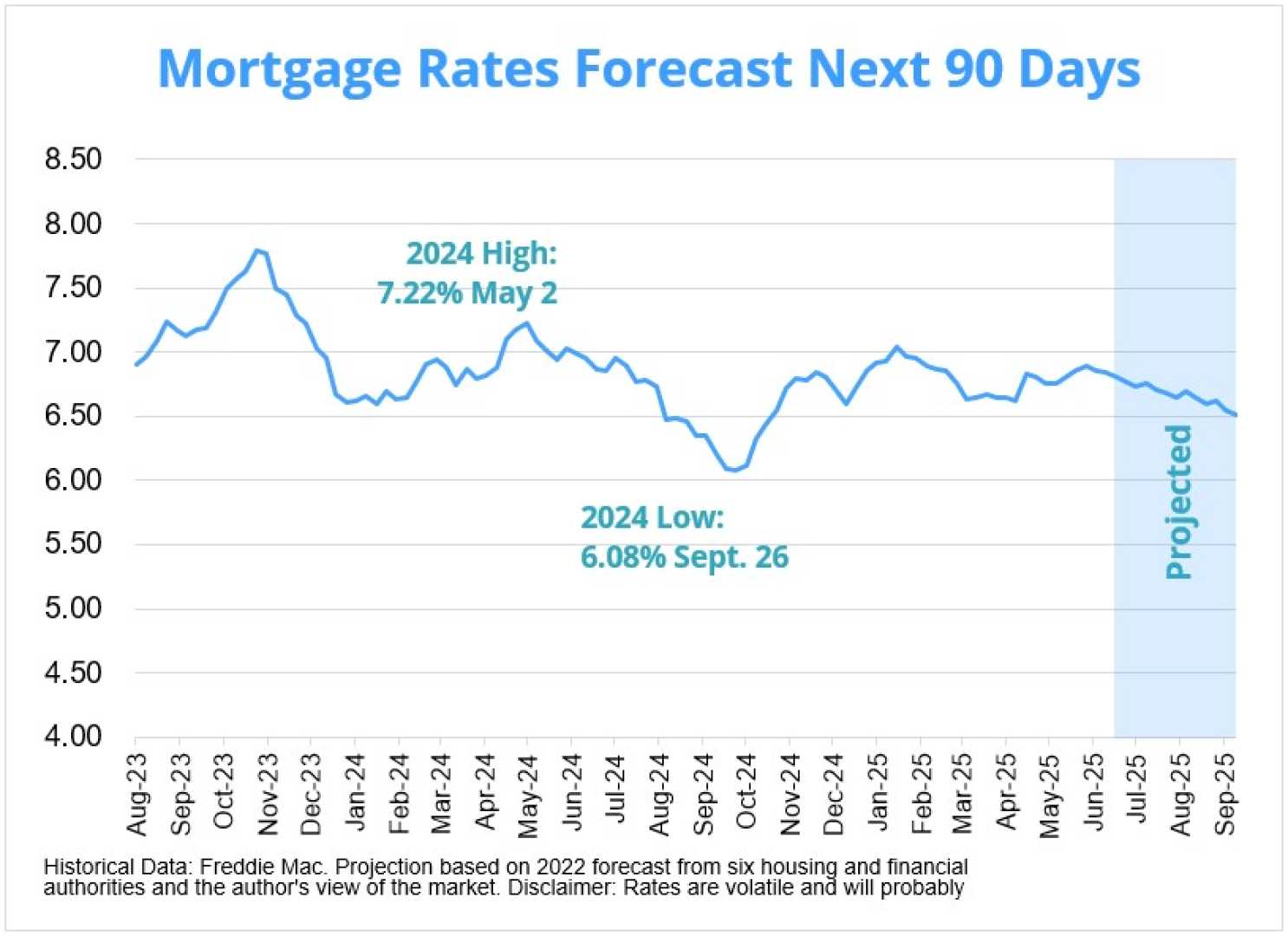

Laguna Niguel, CA – Mortgage rates are expected to decline in the coming years, according to a recent analysis. From August to December 2025, experts predict that rates will range between 6.3% and 6.5%, a welcome change following a period of high rates earlier this year.

As of July 10, 2025, the current 30-year fixed-rate mortgage (FRM) stands at 6.72%, while the 15-year FRM is at 5.86%. Despite a slight increase over the previous week, rates remain below the 52-week high of 7.04%.

Market experts are optimistic about the drop in rates. For example, forecasts from Long Forecast suggest a rate of 6.29% by December 2025, while the National Association of REALTORS expects rates to average around 6.4% during the second half of the year.

According to Freddie Mac, the monthly average mortgage rates have shown some fluctuations but have stabilized after last year’s volatility. The overall sentiment among market analysts is that while rates could remain elevated, significant drops below 6% are unlikely.

Factors such as inflation, the health of the economy, and housing market trends will play a crucial role in shaping these rates. As homeowners with low fixed rates may hesitate to sell, available housing inventory is expected to affect buyers in the market.

Last year, Freddie Mac reported a 56% increase in mortgage refinance applications, indicating that if rates do fall towards the predicted range, many homeowners may consider refinancing.

In recent weeks, economic conditions and emerging inflation concerns have kept interest rates elevated. The June consumer price index increased significantly, hinting that the impact of rising costs is still being felt in the mortgage sector.

With loan rates remaining high, it is essential for potential homebuyers to focus on cash-flowing investment properties, especially in strong rental markets.

In conclusion, while the outlook appears brighter for mortgage rates in the next few years, potential homebuyers and investors are encouraged to monitor the market closely and seek advice from mortgage experts to navigate these changes.